Deferred tax flows from the financial accounts and can be either a deferred tax liability or a deferred tax asset.

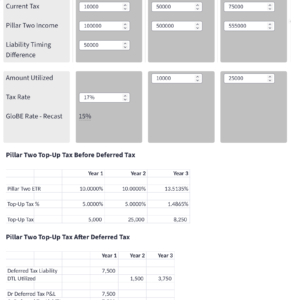

For a detailed analysis of how deferred tax is treated under Pillar Two, see Deferred Tax and Pillar Two. Use our deferred tax liability calculator to simulate the impact of deferred tax liabilities on Pillar Two top-up tax.

We have a separate calculator that looks at deferred tax assets – see Pillar Two Deferred Tax Asset Calculator.

A deferred tax liability arises in the financial accounts when there is an upfront benefit for tax purposes compared to the accounting treatment. A typical example is an immediate tax deduction in a tax year when the accounting treatment grants the deduction over a number of years.

In this case, a deferred tax liability is created. This is a Debit to the P&L in the year of creation and a Credit to the Balance Sheet for the amount of the liability. Note that if the accounts use a tax rate above 15%, the deferred tax liability is recast to the 15% rate for Pillar Two purposes.

The creation of the deferred tax liability increases the tax charge in the accounts in that year. As the Pillar Two effective rate includes deferred tax from the accounts, this would (other things being equal) increase the Pillar Two ETR, and reduce any potential top-up tax liability.

As the deferred tax liability is unwound in the accounts, the opposite treatment applies (ie this would Debit the liability in the Balance Sheet and Credit the P&L reducing any tax charge).

The creation and unwinding of deferred tax liabilities can significantly affect the Pillar Two ETR under Article 4.4 of the OECD Model Rules.

Members can use our deferred tax liability calculator below to see the impact on the Pillar Two ETR.

Note that deferred tax liabilities are also subject to a recapture rule under Pillar Two. See more on this at: Deferred Tax Recapture Rule. We also have an interactive tax tool to model the impact of the recapture rule at Recapture Rule Tax Tool.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |