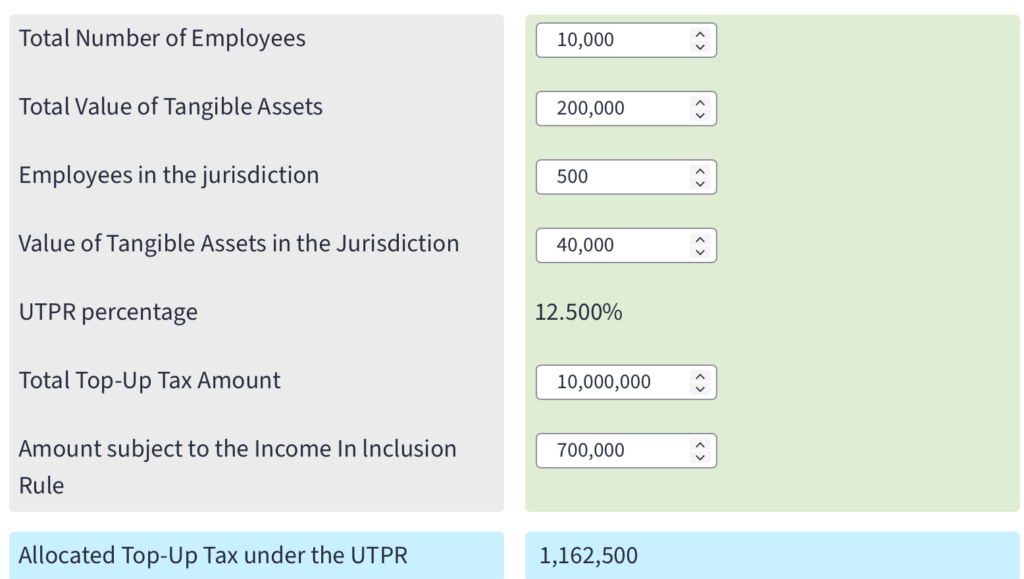

UTPR Calculator

This Pillar Two under-taxed payments rule (UTPR) calculator gives an indication of the broad operation of how the top-up tax is allocated to UTPR jurisdictions.

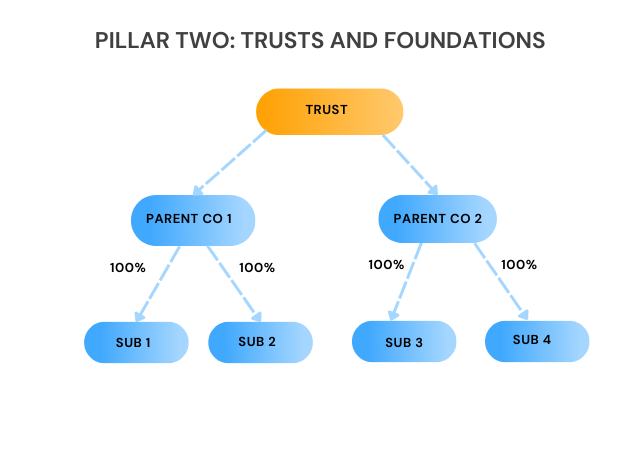

How does Pillar Two Impact Trusts and Foundations?

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’ which can include Trusts and Foundations. The application of the Pillar Two rules to Trusts and Foundations can give rise to a number of issues. Read our member article on some of the practical issues to consider.