Belgium Issues a Draft 7 Page QDMTT Return for Consultation

On October 18, 2024, Belgium issued a draft 7-page QDMTT Return for consultation. The consultation lasts until November 8, 2024.

On October 18, 2024, Belgium issued a draft 7-page QDMTT Return for consultation. The consultation lasts until November 8, 2024.

On October 10, 2024, Ireland published its 2024 Finance Bill. In the Bill, a number of amendments are made to the Global Minimum Tax provisions. Our Ireland GloBE Country Guide has been updated for relevant changes.

On October 18, 2024, Portugal introduced the EU Minimum Tax Directive into domestic legislation, whilst on October 16, 2024 and October 18, 2024 (respectively), the Bahamas and Cyprus tabled legislation in Parliament to implement Pillar Two.

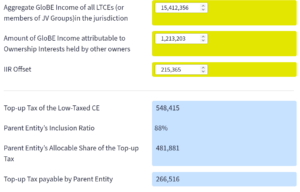

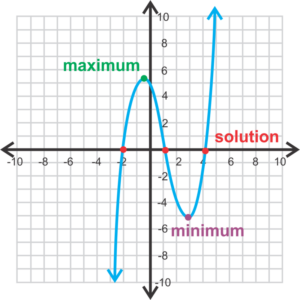

The Pillar Two effective tax rate (ETR) calculation for investment entities is similar to the standard ETR calculation, however, there is an important twist in that the top-up tax is adjusted for minority interests. There is no adjustment for minority interests under the standard ETR calculation. In this article we look at the impact of this.

On October 10, 2024, Ireland published its 2024 Finance Bill. In the Bill, a number of amendments are made to the Global Minimum Tax provisions.

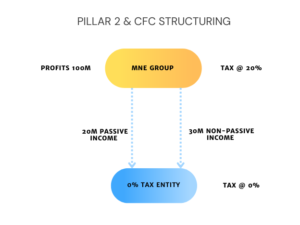

Top-up taxes under a QDMTT are added to covered taxes of a CFC but only for the purposes of calculating the allocation of Blended CFC Taxes. The way the rules operate is aimed at minimising unrelievable CFC taxes under Blended CFC Regimes. Read more.

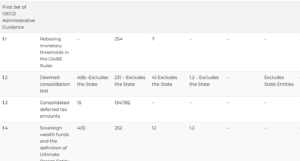

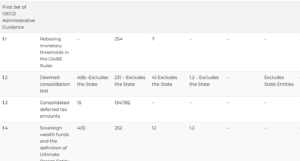

Updates to our ‘OECD Administrative Guidance: Domestic Implementation Matrix’ to reflect the latest Pillar 2 updates for Brazil.

On October 4, 2024, Singapore issued a Consultation document on the GloBE Safe Harbours (Transitional Country-by-Country Reporting (“CbCR”) Safe Harbour, QDMTT Safe Harbour and the Simplified Calculations Safe Harbour), as well as other aspects of the OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Brazil for accounting periods beginning on or after January 1, 2025. Updated for Provisional Measure No. 1,262, and Normative Instruction No. 2,228 of October 3, 2024.

Yesterday, Brazil issued Provisional Measure No. 1,262, of October 3, 2024 and a supporting Regulation to introduce a Domestic Minimum Tax (intended to be a QDMTT) from January 1, 2025. It now needs to be ratified by Congress.

Our Lithuania GloBE Guide has been updated for the Order on Information Notices in relation to Pillar Two.

On September 18, 2024, the Bulgarian Ministry of Finance published draft legislation for public consultation to amend the Bulgarian minimum taxation rules, including the introduction of the Transitional UTPR Safe Harbour.

On September 24, 2024, the Puerto Rico Treasury Department launched a public consultation on the implementation of the GloBE rules, including a QDMTT.

On September 11, 2024, the government of Slovakia approved a draft bill on amendments to the law to reflect various aspects of the OECD Administrative Guidance. See our updated GloBE Guide.

On September 17, 2024, a draft law to amend the Minimum Tax Act was published. This includes a number of amendments to implement the OECD Administrative Guidance. Read our updated GloBE Country Guide.

On September 19, 2024, the OECD held the signing ceremony for the Multilateral Convention to Facilitate the Implementation of the Pillar Two Subject to Tax Rule. 9 jurisdictions have signed with a further 10 stating an intention to sign.

On April 3, 2024, Regulations for the implementation of the GloBE law were issued which implement a number of aspects of the First, Second and Third Set of OECD Administrative Guidance. The Regulations were amended in August 2024.

On September 12, 2024, the UK issued further draft guidance on the Multinational Top-up Tax and Domestic Top-up Tax. The issued draft guidance now runs to over 300 pages.

On September 9, 2024, Singapore introduced its Multinational Enterprise (Minimum Tax) Bill, 2024 into Parliament. Read our updated analysis.

On August 28, 2024, the Czech Republic issued amendments to draft law no. 595/24 (originally issued in April 2024) to amend Act No. 416/2023 implementing the EU Minimum Tax Directive in the Czech Republic.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Bahrain for accounting periods beginning on or after January 1, 2025. Updated for Decree-Law No. (11) of 2024 issued on September 1, 2024.

On September 4, 2024, the Swiss Federal Council announced that the Income Inclusion Rule (IIR) will apply from January 1, 2025.

The substance-based income exclusion favours capital intensive and certain low profit margin companies. These companies stand to benefit the most.

Whilst the treatment of investment property for financial accounting purposes is important when determining the GloBE treatment, of even more importance are any differences between the financial accounting treatment and the domestic tax treatment.

On August 20, 2024, the German Ministry of Finance issued a Discussion Draft of a Draft Law to implement most aspects of the Third Set of OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in The Bahamas for accounting periods beginning on or after January 1, 2025. Updated for the draft legislation issued by The Bahamas Government on August 12, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Jersey for accounting periods beginning on or after January 1, 2025. Updated for the draft legislation issued on August 14, 2024.

Updated Pillar 2 GloBE guide for Austria following OECD Administrative Guidance, including currency provisions and extending the Transitional CbCR Safe Harbour to cases where an MNE is not required to prepare CbC

On August 12, 2024, the Finnish government issued draft legislation to amend the Minimum Tax Act to reflect numerous aspects of the OECD Administrative Guidance. The draft law is subject to a consultation until September 6, 2024, and once enacted will apply from January 1, 2024.

MNE groups should pay careful attention to any group financing companies in light of the Pillar Two Rules. In this analysis we look at the impact of Pillar Two under for both general GloBE and QDMTT purposes.

On August 8, 2024, the Bermuda Ministry of Finance issued a consultation on the administrative provisions for the new corporate income tax that is to apply from 2025

The clarifications and additions to the Commentary to the Pillar Two GloBE Rules provided by the OECDs Administrative and Safe Harbours Guidance, means that there are now up to four jurisdictional effective tax rates (ETRs) that may need to be calculated to determine the impact of the GloBE Rules.

The “Law on the Amendment of Tax Laws and Certain Laws” was published in the Turkish Official Gazette on August 2, 2024. Articles 37 – 50 of the Law include provisions to implement the GloBE rules in domestic law from January 1, 2024. This includes the IIR, UTPR and a domestic minimum top-up tax.

On July 25, 2024, the Ministry of Economy and Finance issued the 2024 Tax Law Amendment Bill. This includes a number of amendments to the South Korean global minimum tax law to reflect aspects of the OECD Administrative Guidance.

On July 29, 2024, the UK government issued draft legislation for the implementation of the Pillar Two anti-avoidance rules targeting Hybrid Arbitrage Arrangements.

On July 29, 2024, the Israeli Ministry of Finance announced it will implement a QDMTT from January 1, 2026. The IIR and UTPR will not be introduced at that point and further consideration will be given to their implementation after a review of the effectiveness of the QDMTT.

On June 11, 2024, Law No. 684 was published in the Danish Official Gazette. This implements additional aspects of the OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Turkey for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation submitted to the Turkish Parliament on July 16, 2024.

Updates to our QDMTT Legislative Tracker to include domestic QDMTT legislation released up to July 19, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Portugal for accounting periods beginning on or after January 1, 2024. Updated for the draft law issued on July 10, 2024.

Permanent Establishments (PEs) are subject to a number of specific rules under Pillar Two in order to apply the general provisions to them. Key issues are what is a PE under Pillar Two? where is it located? and how are income and taxes allocated to it?

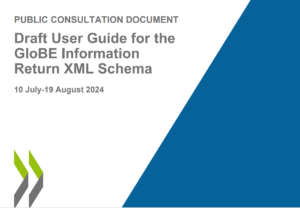

On July 10, 2024, the OECD released the draft XML schema for the GloBE Information Return (GIR). This provides a method of structuring the data reporting for the GIR.

Many jurisdictions will require GloBE registration for administrative purposes, however, the law issued to date has been inconsistent. We outline the GloBE registration obligations from the domestic legislation (enacted and draft) issued to date, with citations and links to relevant laws.

On July 3, 2024, the Italian Ministry of Economy & Finance issued a Decree which contains the procedures for the implementation of the Qualified Domestic Minimum Top-up Tax (QDMTT).

In the 2024 Budget address, the Gibraltar government confirmed that draft legislation for the introduction of a QDMTT is expected in September 2024.

On July 4, 2024, the Australian Government introduced legislation to implement the Pillar 2 GloBE rules into Parliament. This includes a domestic minimum tax, IIR and UTPR.

On July 2, 2024, the Belgian Tax Authority extended the notification deadline to September 16, 2024 (from July 13, 2024) for groups that are not subject to advance payments in 2024 for the QDMTT or the IIR.

On June 5, 2024, the German Federal Ministry of Finance published the government draft for an Annual Tax Act 2024. Article 32 includes an amendment to the minimum tax act to implement a provision from the July 2023 OECD Administrative Guidance.

Our OECD Administrative Guidance Tracker has been updated for the latest amendments in the June 2024 Administrative Guidance.

On June 20, 2024, the Global Minimum Tax Act (included in the Budget Implementation Act 2024, No. 1) received royal assent. This includes provisions to implement an IIR and a QDMTT from December 31, 2023:

Our QDMTT Legislative Tracker has been updated for the amendments to the design of QDMTTs, as provided in the June 2024 OECD Administrative Guidance.

Updates to the GloBE Country Guides for Latvia and Lithuania following the publication of their laws to implement Art 50 of the EU Minimum Tax Directive in the Official Gazette.

The Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) includes guidance on the treatment of Securitization Entities.

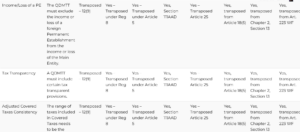

Section 5 of the Fourth Set of OECD Administrative Guidance (published on June 17, 2024) provides clarifications on the allocation of both profits and taxes of Flow-through Entities (including both hybrid entities and reverse hybrid entities). Most of these changes are to ensure the consistent matching of income and taxes in the same entity.

On June 17, 2024, the OECD provided more information on the Transitional Qualification Mechanism for determining the qualified status of IIRs and Domestic Minimum Taxes

Section 2 of the Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) provides details of the use of GloBE carrying values and the impact that these will have on the GloBE ETR calculation.

Section 1 of the Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) provides further details on the deferred tax liability recapture rule. Read our detailed analysis.

On June 17, 2024 the Fourth set of OECD Administrative Guidance was issued. This includes guidance related to the recapture rule applicable to deferred tax liabilities, cross-border allocation of current and deferred taxes, flow-through entities and securitisation vehicles.

On June 14, 2024, the Official Gazette of the Spanish Parliament published the draft law to implement the EU Minimum Tax Directive. The draft law includes minor changes from the version published in December 2023.

Jurisdictions that apply a territorial basis do not tax foreign source income. This raises some interesting issues in the application of the Pillar 2 rules.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Singapore for accounting periods beginning on or after January 1, 2025.

On June 5, 2024, the Luxembourg Government adopted the draft law amending the law of 22 December 2023 on the minimum effective taxation for multinational enterprise groups and large domestic groups. The draft law provides for a number of amendments in the December 2023 OECD Administrative Guidance.

On June 6, 2024 the Latvian Parliament adopted in its final reading the “Law on ensuring the global minimum tax level of large groups of companies”, which implements the EU Global Minimum Tax Directive, with an Article 50 postponement.

Insurance Investment Entities are subject to special treatment under the Pillar Two GloBE Rules. Read our analysis of the key provisions.

On June 4, 2024, the Spanish Council of Ministers approved the second Draft Law to transpose the EU Global Minimum Tax Directive into domestic law. It will now be sent to the Spanish Parliament.

We keep track of all domestic Pillar Two forms issued to date, including links to domestic forms and notices for each relevant jurisdiction.

On May 17, 2024, the Germany Finance Ministry issued a draft Global Minimum Tax Return to specialist publishers, software providers and associations for feedback. This includes draft explanatory guidance.

On May 24, 2024, the Canadian government issued detailed explanatory notes on the application of the Global Minimum Tax.

On May 29, 2024, the Royal Decree of 15 May 2024 was published in the Belgian Official Gazette. This sets July 13, 2024 at the latest, as the deadline for the first GloBE Notification Form.

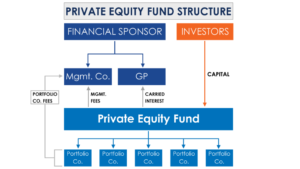

In this article we look at some of the most significant issues to consider including the determination of when and how deals can bring groups within the scope of Pillar Two, specific considerations for private equity funds, differences in GloBE and domestic tax treatment and potential restrictions on post-acquisition transfers.

On May 23, 2024, the EU Commission issued a reasoned opinion to Spain, Cyprus, Latvia, Lithuania, Poland and Portugal as result of them not yet enacting domestic Pillar Two legislation.

On May 21, 2024, the Italian Ministry of Economy and Finance issued a Decree providing further details on the application of the Transitional Safe Harbours.

On May 21, 2024, the Belgian Tax Authority issued further details on the notification requirements for in-scope MNE groups. This includes significant information on the group structure.

Analysis of the Pillar Two GloBE rules in the Czech republic, updated for the April 26, 2024, draft law to reflect various aspects of the OECD Administrative Guidance (particularly the December 2023 amendments).

On May 22, 2024, Jersey announced it will be implementing an Income Inclusion Rule (IIR) and a new standalone multinational corporate income tax for accounting periods beginning on or after January 1, 2025.

On April 30, 2024, a Draft Law to amend the Danish Minimum Taxation Act was submitted to the Danish Parliament. This implements additional aspects of the OECD Administrative Guidance.

On May 20, 2024, the Isle of Man Government issued a press release stating it intends to introduce a Qualified Domestic Minimum Top-Up Tax (QDMTT) with effect from January 1, 2025.

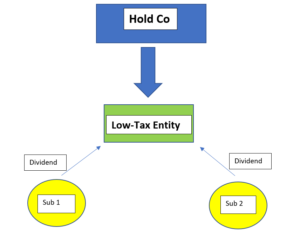

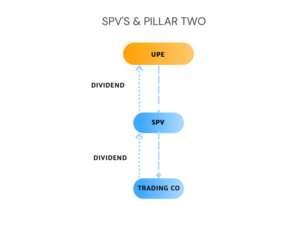

The specific treatment of dividends and other distributions under the Pillar Two GloBE Rules raises some interesting issues and opportunities in blending such payments between otherwise low-taxed entities and holding companies to reduce any potential top-up tax liability.

On May 13, 2024, the Finance Bill, 2024 was sent to the Kenyan Parliament. It includes provisions to introduce a 15% domestic minimum top-up tax from January 1, 2025.

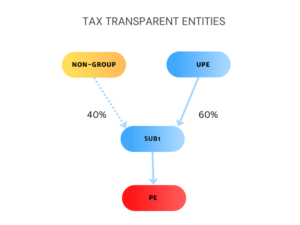

The Pillar Two Rules include specific provisions for tax transparent entities to avoid artificially low effective tax rates and significant top-up tax, particularly for tax transparent UPEs.

Centralized HR/payroll companies are frequently used by MNE groups but raise specific issues in relation to the Pillar Two GloBE Rules. In particular, the impact of using a centralized function and the nature of recharges could have an impact on the substance-based income exclusion of group entities.

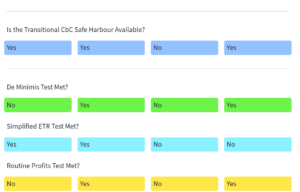

The Transitional CbCR Safe Harbour is a short-term measure that will allow an MNE to avoid undertaking detailed GloBE calculations for a jurisdiction if certain requirements are met. Data will need to be extracted from the CbC Report, financial statements and ERP and EPM systems. Group structure information will also be required.

On May 2, 2024, the Estonian Official Gazette enacted the ‘Act supplementing the Tax Information Exchange Act, the Tax Administration Act and the Income Tax Act’ to implement Article 50 of the EU Minimum Tax Directive.

Analysis of the implementation of the Pillar Two GloBE rules for Canada, updated for the Budget Implementation Bill, 2024, No. 1, issued on April 30, 2024.

Whether multinationals adopt a centralized or decentralized approach to Pillar Two will be one of the key factors in correctly establishing the systems and architecture to collect, manage, analyse and store source data for the Pillar Two effective tax rate and top-up tax calculation.

On April 25, 2024, the Polish Ministry of Finance issued a draft law to implement the EU Minimum Tax Directive into domestic law. Read our review of the draft law.

The tax data mapping assessment is the cornerstone for MNEs looking to implement an effective approach to manage Pillar Two. All systems changes flow from this.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Barbados for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation being considered by the Barbadian Parliament.

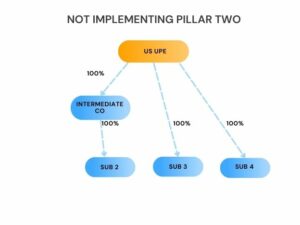

The Pillar Two rules include specific rules for Joint Ventures (JVs) that would otherwise not be within the scope of Pillar Two due to not being consolidated in the financial accounts of the MNE group. However, of more interest is how the amount of top-tax tax (and by implication the amount not collected) varies depending on the JV group structure. Read more in this article.

On March 22, 2024, the Decree of the Ministry of Economy and Finance No. 1048, to amend the Enforcement Regulations of the International Tax Adjustment Act entered into force.

On March 22, 2024, the Enforcement Regulations to the International Tax Adjustment Act were amended. This includes attachments for the GIR (in English and Korean), the GloBE Tax Return and the Notification Form for a Foreign CE to File the GIR.

Whilst the OECD Model Rules require the application of the IIR to Low-Taxed Constituent Entities outside the jurisdiction, the Commentary permits the application of the IIR domestically (a ‘DIIR’). Both New Zealand and the EU apply a DIIR.

Analysis of the Pillar Two GloBE rules in Greece – updated for Law 5100/2024 of April 5, 2024 implementing the EU Minimum tax Directive.

On April 5, 2024, Law 5100/2024 was published in the Official Gazette. This implements the EU Minimum Tax Directive in Greece from December 31, 2023 (with the UTPR applying from December 31, 2024).

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Liechtenstein from 2024. Updated for the GloBE Regulation of March 28, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in New Zealand. Updated for the enacted legislation on March 28, 2024.

On March 28, 2024, the Decree on the minimum taxation of large groups of undertakings (the ‘GloBE Regulation’) was published in the Official Gazette.

On March 28, 2024, the GloBE Regulations were published in the Liechtenstein Official Gazette and New Zealand’s Pillar Two Law received Royal Assent.

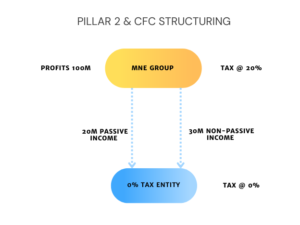

The definition of CFC taxes that are restricted in the GloBE rules is much narrower than under many domestic CFC regimes. In this article we look at this issue.

The GloBE rules include a number of insurance specific adjustments. In this article we look at the nature of these provisions as well as the impact of the GloBE rules on insurance companies generally. Updated for OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Australia for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation issued by the Australian Treasury on March 21, 2024.

On March 19, 2024, the Swedish Ministry of Finance issued a proposal (including Draft Legislation and Explanatory Notes) to amend its Pillar Two law to include relevant provisions of the OECD Administrative Guidance.

On March 21, 2024, the Australian Treasury issued draft GloBE legislation for consultation. The consultation is open until April 16, 2024.

On March 13, 2024, the Lithuanian Parliament updated the draft law to implement the EU Minimum Tax Directive.

On March 11, 2024, the Finance and Expenditure Committee of the New Zealand Parliament made a number of amendments to the Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill (which includes proposed legislation to transpose the OECD GloBE Rules).

On March 15, 2024, the UAE launched a public consultation on the implementation of the GloBE rules in the UAE. The consultation is open until April 10, 2024.

On March 14, 2024, the UK Government confirmed it is to apply an anti-avoidance rule for the purposes of the Transitional CbcR Safe Harbour from March 14, 2024.

We track the implementation of key aspects of the Transitional CbCR Safe Harbour in draft and enacted domestic laws issued to date back to the OECD Safe Harbours Guidance and the OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Belgium for accounting periods beginning on or after December 31, 2023. Updated for the Draft Law to amend the ‘Act on the introduction of a minimum tax for multinational enterprise groups and large domestic groups’ of March 6, 2024.

On March 6, 2024, the Belgian Government submitted a draft law to Parliament which includes provisions to amend the GloBE Law to implement aspects of the OECD Administrative Guidance.

On March 7, 2024, the Australian Taxation Office provided an update on the implementation of Pillar Two.

Analysis of the implementation of the Pillar Two Global Minimum Tax rules in the UK on or after 31 December 2023. Updated for the 2024 Finance Act.

In most cases, a Qualifying Refundable Tax Credit will result in a higher Pillar Two effective tax rate than a non-qualifying tax credit. However, this is not always the case. We look at some examples in this article.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Thailand for accounting periods beginning on or after January 1, 2025. Updated for the Draft Law issued on March 1, 2024.

On March 1, 2024, the Thai Revenue Department published an 18-page consultation paper on the implementation of Pillar Two. This includes draft legislation which includes, an IIR, UTPR and a domestic minimum tax.

In this article, we look at the status of Pillar Two implementation in the EU, as at March 1, 2024, for jurisdictions that have not yet enacted domestic law to implement the EU Minimum Tax Directive.

On February 22, 2024, the UK enacted the 2024 Finance Act to domestically implement amendments provided in the OECD Administrative Guidance.

On February 22, 2024, the Ministry of National Economy and Finance issued a draft law to implement the EU Global Minimum Tax Directive. In this article we review the draft law.

The Pillar Two GloBE treatment of corporate investments will depend to a large extent on the nature of the activities, the accounting treatment and the ownership interest.

On February 21, 2024, the National Treasury and the South African Revenue Service issued the Draft Global Minimum Tax Bill and the Draft Global Minimum Tax Administration Bill.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Malta for accounting periods beginning on or after 31 December, 2023. Updated for Legal Notice 32 of 2024 of February 20, 2024.

On February 20, 2024, the Maltese Government issued Legal Notice 32 of 2024 which enacts the EU Minimum Tax Directive with the Article 50 postponement.

On February 19, 2024, the OECD published its final report on Pillar One Amount B, aimed at providing a simplified and streamlined approach to the application of the arm’s length principle to baseline marketing and distribution activities.

In this article we look at the interaction between deferred tax on bonus depreciation and the substance-based income exclusion on investments in tangible assets.

In this article we look at the impact of Pillar Two on tax stabilization agreements, and the benefits of renegotiating agreements.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Estonia. Updated for the Draft Law of February 8, 2024.

On February 8, 2024, the Government approved the ‘Act supplementing the Tax Information Exchange Act, the Tax Organisation Act and the Income Tax Act’ which includes provisions to implement Article 50 of the EU Minimum Tax Directive.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Lithuania. Updated for the Draft Law of October 27, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Latvia. Updated for the Draft Law of January 30, 2024

Foreign tax credits interact with the Pillar Two GloBE Rules in a number of ways. In this article we assess the key impact.

On January 30, 2024, a draft law to implement the EU Minimum Tax Directive (and delay the application of the GloBE rules until 2030) was approved by the Latvian Cabinet of Ministers.

We have tracked the draft and enacted domestic laws issued to date to the OECD Model Rules. This will be constantly updated as new or amended legislation is issued.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Austria for accounting periods beginning on or after 31 December, 2023. Updated for the Minimum Taxation Reform Act published in Austrian Federal Law Gazette No. 187/2023 on December 30, 2023.

On January 25, 2024, the EU Commission announced infringement decisions against EU member states that have not enacted domestic law to implement Pillar 2.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Spain for accounting periods beginning on or after 31 December, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Slovakia for accounting periods beginning on or after 31 December, 2023. Updated for Act No. 507/2023 of December 23, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Czech Republic for accounting periods beginning on or after 31 December, 2023. Updated for Law 416/2023 published in the Official Gazette on December 29, 2023.

Tax incentives for R&D are a common way for a jurisdiction to attract foreign direct investment (FDI).

In this article we look at the financial accounting, domestic tax and Pillar Two treatment of some of the key incentives offered including a deduction, capitalized treatment, a super deduction, tax credits and patent boxes or other similar arrangements.

The Polish Ministry of Finance has stated that Poland will begin the legislative process to implement Pillar 2 in the first quarter of 2024, with the rules to be effective from January 1, 2025.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Croatia for accounting periods beginning on or after 31 December, 2023. Updated for Law No 155/23, of December 22, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Slovenia for accounting periods beginning on or after 31 December, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Norway for accounting periods beginning on or after 1 January 2024. Updated for Law 2024-01-12-1 of January 12, 2024.

On January 12, 2024, the Norwegian Council of State ratified the Norwegian Parliament’s enactment of the Supplementary Tax Act in Legislative Decision 37 (2023-2024) Act No. 1

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Vietnam for accounting periods beginning on or after January 1, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Ireland from 2024. Updated for the Finance (No. 2) Act 2023 of December 18, 2023.

Yesterday, a Bill to implement the EU Minimum Tax Directive was considered by the Greek Council of Ministers. This includes an IIR and QDMTT from December 31, 2023 and a UTPR from December 31, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Romania for accounting periods beginning on or after 31 December, 2023. Updated for Law No. 431/2023 of December 29, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Netherlands from December 31, 2023. Updated for the Minimum Tax Act of December 27, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Finland for accounting periods beginning on or after 31 December, 2023. Updated for the ‘Law on the Minimum Taxation for Corporations’ of December 28, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in France for accounting periods beginning on or after 31 December, 2023. Updated for the French Finance Act published on December 30, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Bulgaria for accounting periods beginning on or after 31 December, 2023. Updated for the Law Amending the Corporate Income Tax Act on December 22, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Switzerland from January 1, 2024. Updated for the Ordinance on the Minimum Taxation of Large Groups of December 22, 2024.

The Minimum Tax Act (to implement the EU Minimum Tax Directive) was published in the Official Gazette of Liechtenstein, No. 2023/484

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Italy for accounting periods beginning on or after 31 December, 2023. Updated for Legislative Decree No. 209 of December 27, 2023.

On December 29, 2023 and December 30, 2023, Romania and the Czech Republic, and Austria (respectively) gazetted their Pillar 2 Laws.

On December 31, 2023, Law 19928 was issued to amend the International Tax Adjustment Act to take account of a number of OECD amendments issued in the Administrative Guidance.

Bulgaria, Croatia and Slovenia gazetted Pillar 2 laws on December 22, 2023, whilst Slovakia gazetted its Pillar 2 law on December 23, 2023,

On December 28, 2023, Italy, Belgium and Finland gazetted laws to implement the EU Minimum Tax Directive.

Germany, Luxembourg and the Netherlands have all enacted Pillar Two Laws over the last few days.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Luxembourg for accounting periods beginning on or after 31 December, 2023. Updated for the draft law n°8292 approved by Parliament on December 20, 2023.

Today, the UK and EU have issued guidance on the application of the GloBE Rules whilst Switzerland is to introduce a QDMTT from December 31, 2023 and has delayed its IIR/UTPR.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Sweden from January 1, 2024. Updated for Law No. SFS 2023:875 of December 16, 2023.

On December 19, 2023, Gibraltar announced it is bringing forward its QDMTT to apply from December 31, 2023. This was previously intended to apply from December 31, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Malaysia for accounting periods beginning on or after January 1, 2025. Updated for the law approved by Parliament on December 13, 2023.

The December 2023 OECD Administrative Guidance provides additional information on the application of the Blended CFC rules.

The December 2023 OECD Administrative Guidance provides additional information on Year End Mismatches and identifying Consolidated Revenue.

The December 2023 OECD Administrative Guidance provides additional information on the application of the Transitional CbCR Safe Harbour in a number of areas.

The December 2023 OECD Administrative Guidance provides further information on the NMCE Simplified Calculations (for the Simplified Calculations Safe Harbour).

The December 2023 Administrative Guidance provides more guidance on whether purchase accounting adjustments also need to be removed from Qualified Financial Statements for the purposes of the Transitional CbC Safe Harbour.

Today, the OECD issued their Third Set of Administrative Guidance on the Pillar Two GloBE Rules.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Denmark for accounting periods beginning on or after 31 December, 2023. Updated for the final law enacted on December 12, 2023 and the Draft Law of April 30, 2024.

The Austrian GloBE Country Guide has been updated for the Minimum Tax Law approved by Austria’s National Council on December 14, 2023.

Draft laws to implement the Pillar Two Globe rules have been passed by Parliaments in Austria, Bulgaria, Germany and Malaysia this week. Denmark has enacted its Minimum Tax Act.

Today, the EU Commission published the Commission Notice to Elect to delay application of the IIR and UTPR under Article 50 of the Pillar Two Directive.

On November 30, 2023, the Belgian House of Representatives adopted draft law 55K3678/2023 to implement the EU Minimum Tax Directive.

Slovakia draft law was submitted to the National Council on December 4, 2023. It applies the derogation under Article 50(1) of the EU Minimum Tax Directive to postpone the application of the IIR/UTPR.

Act LXXXIV of 2023 on ‘Additional taxes ensuring a global minimum tax level and amending certain tax laws in connection with this’ was published in issue 171/2023 of the Hungarian Gazette.

On December 1, 2023, the Czech Parliament approved the Draft Top-up Tax Act to give effect to the GloBE rules.

There were limited amendments to the draft law during the parliamentary process (including the inclusion of the QDMTT and Transitional UTPR Safe Harbour, and other key aspects of the July 2023 Administrative Guidance, such as the rules for transferable tax credits).

On November 29, 2023, the Vietnamese Parliament passed a Resolution to implement the Pillar Two Global Minimum Tax in Vietnam with effect from January 1, 2024.

On November 24, 2023, a draft law to implement the Pillar Two GloBE rules into domestic law was introduced into the Norwegian Parliament.

Yesterday, the Austrian Government sent the updated Minimum Taxation Reform Bill to Parliament. The Bill implements the EU Minimum Taxation Directive into domestic law.

Members can access our unofficial English translations of domestic Pillar Two laws (both enacted and draft).

On November 21, 2023, the draft law to implement the EU Minimum Tax Directive was approved by the Hungarian Parliament. It was sent to the Hungarian President today for signature.

Analysis of the implementation of the Pillar Two GloBE rules in Luxembourg, updated for amendments to the draft law on November 13, 2023.

On November 13, 2023, draft law No. 55K3678 to implement the EU Minimum Tax Directive was sent to the Belgian Parliament.

On November 13, 2023, the Luxembourg Government issued amendments to update its draft law implementing the EU Minimum Tax Directive (Law 8292 issued on August 4, 2023).

On November 15, 2023, Bermuda issued draft corporate income tax legislation as part of a third consultation on enacting a new 15% corporate income tax from January 1, 2025.

An article by article analysis that sources all of the articles of the South Korean Pillar Two legislation (the original Law, Amended Law and Amended Enforcement Decree) back to the OECD Model Rules.

Analysis of the implementation of the EU Global Minimum Tax Directive in Germany, taking account of the changes made in the recent draft law, approved by the Bundestag on November 10, 2023.

Our South Korea GloBE Country Guide chapter has been updated for the recent amendment to the Enforcement Decree of the International Tax Adjustment Act which provides additional detail for the operation of the GloBE rules.

On November 10, 2023, the Bundestag (lower house) approved the German draft law to implement the EU Minimum Tax Directive.

The Amended Enforcement Decree implements most aspects of the February and July 2023 OECD Administrative Guidance. Read our analysis.

On November 9, 2023, South Korea issued the Preliminary Legislative Notice of Partial Amendment to the Enforcement Decree of the International Tax Mediation Act.

Bermuda and Barbados announced on November 3 and 7, 2023 (respectively) their intention to implement the Pillar 2 GloBE rules (albeit with different approaches).

The Transitional CbCR Safe Harbour is included in the OECD Safe Harbour and Penalty Relief Guidance and where it applies it deems the jurisdictional top-up tax to be zero. Read our detailed analysis.

Today, the Finance (No. 2) Bill, 2023 (the ‘draft law’) had its first reading before the Malaysian Parliament. This inserts a new Part XI into the Income Tax Act, 1967 to implement the GloBE rules.

Qatar’s General Tax Authority closed its three-day regional workshop on the Pillar Two global minimum tax.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Japan from April 1, 2024, as updated by the detailed implementation guidance issued by the Ministry of Finance on October 20, 2023,

On October 27, 2023, Lithuania’s Ministry of Finance issued a draft law to implement the EU Global Minimum Tax Directive (along with a Draft Law on the Amendment of Article 589 of the Code of Administrative Offenses).

On October 27, 2023, it was suggested by an EU official that Estonia, Latvia, Lithuania, Malta, and Slovakia are to delay the implementation of the IIR and UTPR under the Pillar Two rules.

Updated analysis of the treatment of intra-group asset transfers under the GloBE rules, including the step-up denial and examples of the impact of claiming a deferred tax asset under the OECD Administrative Guidance.

It was reported on October 23, 2023, that Kuwait is considering a comprehensive overhaul of its tax laws from January 1, 2025 to apply a 15 percent corporate tax on the profits of all legal persons, including major international companies.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Hungary from 2024.

On October 19, 2023, the Irish Ministry of Finance released the Finance (No. 2) Bill 2023 (‘draft law’). to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

On October 17, 2023, the Hungarian Ministry of Finance issued a draft law to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

On 13 October 2023, the Dutch State-Secretary of Finance issued a Bill to amend the Dutch Draft Minimum Tax Bill.

In the 2024 Budget Speech today, the Malaysian Prime Minister confirmed that the Pillar Two GloBE rules are to apply from 2025.

On October 11, 2023, the OECD published the Multilateral Convention to Implement Amount A of Pillar One (MLC).

On October 4, 2023, the Romanian Ministry of Finance issued a draft law to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Cyprus for accounting periods beginning on or after 31 December, 2023.

On October 3, 2023, the Austrian Federal Ministry of Finance issued the ‘Federal law enacting the Federal Act to Ensure a Global Minimum Taxation for Groups of Companies’ to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

On October 3, 2023, the Cyprus Ministry of Finance issued a draft law to implement the Pillar Two GloBE rules/EU Minimum Tax Directive. It is open for consultation until October 31, 2023.

On September 29, 2023, the National Tax Agency published the “Partial Revision of the Basic Circular on Corporate Tax” which provides some administrative guidance on various aspects of Japan’s GloBE law.

The text of the Pillar 2 STTR Multilateral Instrument has been released by the OECD and the STTR MLI is now open for signature from October 2, 2023.

Article 4 of the French 2024 Finance Bill (published on September 27, 2023) includes provisions to implement the EU Global Minimum Tax Directive.

Both the EU Minimum Tax Directive and the OECD Model Rules leave the determination of GloBE penalties to domestic jurisdictions. See our Global Roadmap.

On September 26, 2023, the Bulgarian Ministry of Finance issued a draft law for the implementation of the EU Global Minimum Tax Directive. Read our detailed review.

Differences in Accounting Standards have a significant impact on the Pillar Two effective tax rate (ETR) and top-up tax calculation. Read this detailed report.

On September 19, 2023, Turkey gazetted the Pillar 2 amendments to IAS 12, as previously announced by the IASB.

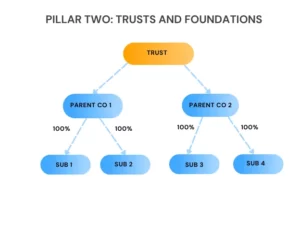

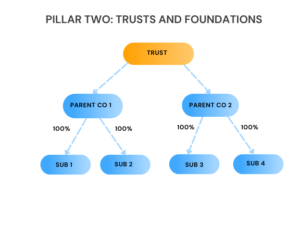

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’. This means that the Pillar Two GloBE rules can apply to both trusts and foundations.

On September 11, 2023, the Italian Ministry of Finance issued a draft law for the implementation of the EU Global Minimum Tax Directive. Read our detailed review.

We have tracked the draft and enacted domestic laws issued to date back to both sets of OECD Administrative Guidance in this matrix for our members. This will be constantly updated as new or amended legislation is issued.

The requirements for a participation exemption under domestic law may not match the exemption requirements in the Pillar Two Rules. Read our analysis.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Germany from 2024. Updated for the August 16, 2023 Draft Law.

Taiwan’s Ministry of Finance confirmed today there is no set schedule for the introduction of the Pillar 2 GloBE rules in Taiwan. Taiwan’s Ministry of Finance has previously stated it will prepare draft legislation for the government to increase Taiwan’s domestic minimum tax rate from 12% to 15%.

However, this creates a number of issues in terms of its interaction with the Pillar Two global minimum tax.

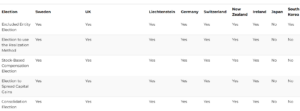

Our Pillar 2 Jurisdictional Elections Matrix has been updated for the latest draft laws issued/amended, including the recent Czech update.

An article by article analysis that sources all of the articles of the Japanese Pillar Two Law, Cabinet Order and Ministerial Ordinance back to the OECD Model Rules, including notes where there are differences from the provisions in the Model Rules.

Japan has issued three pieces of legislation to implement the Pillar Two GloBE Rules. In this article we look at the final piece (to date) in Japan’s GloBE law – the Ministerial Ordinance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Canada for accounting periods beginning on or after 31 December, 2023.

On August 4, 2023, Canada issued the draft Global Minimum Tax Act (the ‘draft law’) for consultation.

On August 15, 2023, the Finnish Ministry of Finance issued a draft law for the implementation of the EU Global Minimum Tax Directive

Our Pillar Two: AI-Powered Research Tool has been updated for the latest Pillar Two developments. Free access for members.

On August 2, 2023, the Vietnamese government issued Draft Resolution No. 122/NQ-CP, the 2023 on the introduction of the GloBE rules in Vietnam.

On 4 August 2023, the Luxembourg government issued Draft Law No. 8292 to implement the EU Global Minimum Tax Directive.

As a result of the international introduction of the Pillar Two GloBE rules, on August 8, 2023, the Government of Bermuda issued a Public Consultation on the Introduction of Corporate Income Tax in Bermuda.

On August 4, 2023, Canada issued the draft Global Minimum Tax Act for consultation. The consultation closes on September 8, 2023.

On August 3, 2023, Slovakia issued a draft Pillar Two law, which includes an IIR, UTPR and a QDMTT.

The GloBE Country Guide for Ireland has been updated for the Irish Second Feedback Statement issued on July 27, 2023.

On July 27, 2023, Ireland issued its Second Feedback Statement on the Pillar Two GloBE Rules. This includes draft legislation for the Transitional CbCR and UTPR Safe Harbours and the QDMTT.

On July 28, 2023, the South Korean government published the Partial Amendment Proposal for the International Tax Adjustment Act, to amend their Pillar Two law to (1) take account of a number of OECD amendments issued in their Administrative Guidance, and (2) delay the implementation of the UTPR until January 1, 2025.

On 28 July 2023, the Government approved the draft law aimed at transposing the EU Minimum Tax Directive into Luxembourg law.

The QDMTT Safe Harbour excludes the application of the GloBE Rules in other jurisdictions by deeming the Top-up Tax payable under the GloBE Rules to be nil where top-up tax is levied under a QDMTT. In this article, we look at how it applies.

On July 17, 2023, the OECD issued the model provision and commentary for the STTR. In this report we analyse the operation of the STTR based on this latest guidance.

We have updated our QDMTT Legislative Tracker to include details of the amendments to the design of QDMTTs in the July 2023 Administrative Guidance.

The UK released draft legislation for the Under-Taxed Profits Rule (UTPR) on July 17, 2023. Read our review.

On July 17, 2023, the OECD issued the standardised GloBE Information Return (GIR) that must be submitted by MNE groups within the scope of the GloBE rules.

The Second Set of OECD Administrative Guidance includes a number of additions to the design features of a QDMTT. Read more in this article.

On July 17, 2023, the OECD issued its second set of Administrative Guidance on the application of the Pillar Two GloBE Rules. This follows the first set of Administrative Guidance that was issued in February 2023.

Today, the OECD issued the model provision for the Subject-to-tax Rule (STTR) and its commentary.

On July 10, 2023, the German Ministry of Finance issued an updated draft Pillar 2 law. This includes a number of provisions not included in the original draft bill.

The Finance (No. 2) Act, 2023 received Royal Assent on July 11, 2023. As such the UK legislation to give effect to the Pillar Two GloBE rules is now enacted.

Cabinet Order No. 208/2023 accompanies the previous GloBE law and provides further detail on many aspects of the GloBE rules.

Yesterday, the OECD issued an Outcome Statement on Pillars 1 & 2 that gives an update on the status and timeline for implementation of Amount A and B of Pillar One, and the Subject-to-Tax Rule (STTR).

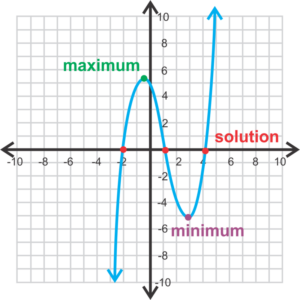

In this article we look at some of the key drivers that can result in Pillar 2 ETR’s being significantly different to the headline domestic tax rate.

A number of the adjustments to the deferred tax expense under Pillar 2 will mean significant changes to ERP systems. See our list of all required adjustments.

On June 30, 2023, Japan’s Ministry of Finance issued Ministry of Finance Ordinance No. 47 of 2023 Amending the Enforcement Regulations of the Corporation Tax Act for Pillar 2 purposes.

Whether Pillar 2 laws are ‘Substantively Enacted’ is of key importance for Pillar 2 tax accounting. This will vary according to a jurisdictions legislative process. We discuss Substantive Enactment globally.

The Dutch Finance Minister expects the Inclusive Framework (IF) to reach agreement on Pillar One during the IF meetings on 10-12 July, 2023.

In this article we look at why the correct determination of which tax credits are classed as Qualified Refundable Tax Credits is so important and the significant risks to the application of the Pillar Two rules they potentially pose if there is a non-harmonized approach.

A key issue with a distribution tax regime such as Estonia’s is that a company may not distribute profits for a number of years. They would have GloBE income but no or limited tax suffered on that income which would lead to a sizeable Pillar Two top-up tax liability. As such a distribution tax regime election is available.

Local media reports state that Israel’s Finance Minister has reaffirmed Israel’s commitment to adopting the Pillar Two rules.

On June 23, 2023, the Danish Ministry of Taxation issued the draft Minimum Tax Act to give effect to the GloBE rules.

On May 15, 2023, the Czech Republic issued the Draft Top-up Tax Act, (along with Explanatory Notes) to give effect to the GloBE rules,

On June 16, 2023, Cabinet Order No. 208 was published in Japan’s Official Gazette. This provides much more detail on various aspects of the Pillar Two GloBE rules in Japan from April 1, 2024.

Members have access to our Pillar Two AI-powered Analysis Tool. This is a custom AI model trained on Pillar Two data from our members-only content including our Pillar Two Navigator and Jurisdictional analysis.

On June 15, 2023, the UK issued draft guidance on the application of the multinational top-up tax which will apply for accounting periods beginning on or after December 31, 2023.

On June 16, 2023, a Cabinet Order to Partially Amend the Enforcement Order of the Corporation Tax Law for Pillar 2 was published in the Official Gazette.

The Swiss referendum on June 18, 2023 approved the introduction of a global minimum tax from January 1, 2024

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’. In this article we look at the application of Pillar Two to trusts and foundations.

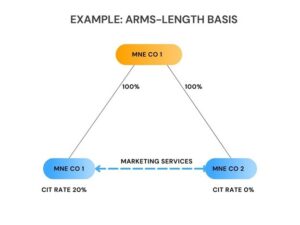

The Pillar Two Rules generally require transactions between entities located in different jurisdictions to be priced at an arms-length basis. However, special rules apply to unilateral transfer pricing adjustments given the risk of income either being taxed twice or not taxed at all.

Use our jurisdictional matrix to track the domestic implementation of Pillar Two elections in the current domestic draft or enacted law.

Yesterday, the Norwegian Ministry of Finance launched a consultation (including draft legislation) on the implementation of the Pillar Two GloBE Rules in Norway.

In yesterdays concluding statement of the IMF 2023 Article IV mission to Kuwait, the IMF recommended that the 15 percent corporate income tax should be expanded to cover domestic firms, to bring Kuwait into line with the GloBE rules.

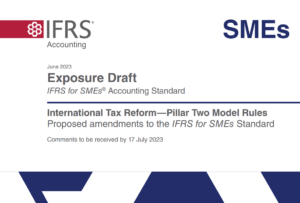

On June 1, 2023, the International Accounting Standards Board issued an Exposure Draft for Proposed Amendments to the IFRS for SMEs Standard to take account of the Pillar Two Rules.

The Netherlands presented the Minimum Tax Bill, 2024 to Parliament yesterday. It implements an Income Inclusion Rule and a Qualified Domestic Minimum Top-Up Tax for financial years commencing on or after December 31, 2023. An Under-Taxed Profits Rule applies for financial years commencing on or after December 31, 2024.

Track the development and application of QDMTTs as they are implemented globally. The OECD Administrative Guidance provides significant flexibility as to their design.

It was reported last week that the Vietnamese Ministry of Planning and Investment is working on designing tax incentives to take account of the upcoming application of Pillar Two.

Last week the Bahamian government released a Green Paper asking for feedback on four proposed strategies for the introduction of corporate income tax in the Bahamas, including a QDMTT.

Yesterday, Switzerland issued an updated Draft Decree for the Pillar Two Global Minimum Tax. This follows the previous Draft Decree that was subject to a public consultation.

Whilst both jurisdictions are opting for direct transposition of the OECD Model Rules, there is a key difference in how they are drafted.

Today, the IASB issued the amendments to IAS 12 to take account of the Pillar Two GloBE Rules.

Yesterday, New Zealand published a draft law (the Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill) to implement the Pillar Two Global Minimum Tax.

On May 13, 2023, the G7 finance ministers reaffirmed their commitment to both Pillars One and Two.

In todays’ Budget speech, the Australian Government confirmed it will introduce an Income Inclusion Rule, Under-Taxed Profits Rule and a Domestic Minimum Tax.

The OECD Administrative Guidance includes a number of specific provisions on the design of a domestic minimum tax to ensure it is a QDMTT. In this article we review the UK’s domestic top-up tax based on the OECD Guidance.

A number of jurisdictions have issued legislation (either draft or enacted) to implement the Pillar Two GloBE Rules, however, the approach taken differs significantly. In this article we look at domestic differences not only from the OECD Model Rules, but differences in the implementation of the rules between jurisdictions.

In this article, we map, on an Article-by-Article basis, the EU Directive to the OECD Model Rules and identify provisions in the EU Directive which have no equivalent in the Model Rules.

The German Federal Ministry of Justice has proposed a Pillar 2 “white list” for countries whose nominal tax rate is sufficiently above the 15% global minimum rate.

Our table sources all of the Articles in the OECD Model Rules to the relevant provision in the UK draft legislation. It also includes notes where there are differences from the provisions in the Model Rules.

In this article we highlight key differences between the UK approach to Excluded Entities in the draft GloBE legislation and the approach taken in the OECD Model Rules.

The UK proposed some minor technical changes to the domestic implementation of the Pillar Two GloBE rules on April 14, 2023.

Nigeria may be reconsidering its approach to Pillar 2 following an April 2023 workshop jointly organised by the OECD and the Federal Inland Revenue Service (FIRS).

Australia issued an Exposure Draft for Multinational Tax Transparency Reporting last week to provide for global public country-by-country reporting for many large multinational enterprises (MNEs) operating in Australia. This includes the GloBE ETR.

Local reports state that the Ministry of Finance is collecting feedback on its proposals to develop the Global Minimum Tax Law and will submit it to the Government in June 2023. Submission to the National Assembly is planned for its 6th Session in October 2023.

Last week, the IASB released five Staff Papers providing an update to tax accounting under IFRS for Pillar Two. The IASB had previously issued an Exposure Draft for proposed amendments to IAS 12 to take account of the Pillar Two Model Rules.

Track enacted and proposed amendments to global accounting standards relating to the Pillar Two Global Minimum Tax.

Yesterday, the UK Financial Reporting Council (FRC) issued Financial Reporting Exposure Draft (FRED) 83 on draft amendments to FRS 102 for Pillar 2 tax accounting.

The Ministry of Taxation and the Ministry of Industry, Business and Financial Affairs have sent a questionnaire to Danish MNEs expected to be within the scope of the Pillar Two GloBE Rules.

On March 31, 2023, the Irish government issued a Feedback Statement on the Pillar Two Global Minimum Tax. This included draft legislation.

Today, the Accounting Standards Board of Japan (ASBJ) issued the Practical Response Report on the ‘Treatment of Deferred Tax in Relation to the Revision of the Corporation Tax Act Corresponding to Global Minimum Taxation’.

The Practical Response Report is applicable from today and until it is repealed by the ASBJ.

It’s been reported that Kenya is to sign up to the Two Pillar Solution. It was not a signatory to the original October 2021 Statement as it was not prepared to remove its digital service tax as required for Pillar One.

The “Act for the Partial Revision of the Income Tax Act” was promulgated in Special Issue No. 25 of the Official Gazette on Friday, March 31, as Act No. 3/2023.

On March 29, 2023, Liechtenstein published draft legislation for the implementation of the Pillar Two Globe Rules.

In yesterday’s 2023 Canadian Budget, the government confirmed that it will introduce legislation implementing the Income Inclusion Rule (IIR) and a domestic minimum top-up tax (QDMTT) applicable to Canadian entities of MNEs with effect for fiscal years of MNEs that begin on or after December 31, 2023.

On March 28, 2023, Japan enacted the second domestic law to give effect to the Pillar Two GloBE rules from April 1, 2024.

The wording for Pillar 2 implementation can vary from ‘ On or after December 31, 2023’, ‘From December 31, 2023’ or ‘After December 30, 2023’ to ‘From January 1, 2024’ or ‘From April 1, 2024’. We look at why.

Analysis of the implementation of the Pillar Two Global Minimum Tax rules in the UK on or after 31 December 2023. Updated for the 2024 Finance Act.

The Spring Finance Bill 2023 (Finance (No. 2) Bill) was published yesterday (March 23, 2023). The Bill includes provisions to implement key aspects of the Pillar Two Global Minimum Tax for accounting periods beginning on or after 31 December 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules.

On March 20, 2023, the German Federal Ministry of Finance published a consultation, including a draft law (the Minimum Taxation Directive Implementation Act) to implement the EU Global Minimum Tax Directive. The consultation is open for comments until April 21, 2023.

Many of the deferred tax data points are not stand-alone data sources but arise as a result of further calculations that are themselves based on underlying data-sources. There is therefore a ‘layering-up’ of data before the GloBE calculations can be effectively made.

In the 2023 Budget on March 14, 2023, the Prime Minister of Barbados confirmed that the Barbados Revenue Authority has already started consultations with impacted entities with a view to implementation of the GloBE rules.

In today’s 2023 Spring Budget, the UK government confirmed that it will include the Pillar Two Global Minimum Tax in the Spring Finance Bill 2023.

Last week, the Vietnamese Government released Resolution 31/NQ-CP of the February 2023, Regular Government Session to speed-up Global Minimum Tax implementation.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in South Korea from January 1, 2024.

Hungary’s Prime Minister Viktor Orbán reiterated that Hungary has an Official letter from the EU agreeing to the Local Business Tax being a covered tax for the purposes of the Pillar Two Global Minimum Tax.

On March 6, 2023, Spain’s Ministry of Finance and Public Function opened a public consultation on the transposition into Spanish law of the European Directive on the Global Minimum Tax

Yesterday, the Thai Cabinet approved the proposal to implement a Global Minimum Tax (see item 48 of the following Cabinet Resolution:

Yesterday, the Director of the OECD’s Centre for Tax Policy and Administration, stated to Brazil’s Finance Minister that the implementation of the 15% global minimum tax on multinational companies should be part of tax reform in Brazil.

Whilst the British Virgin Islands (BVI) and the Bahamas do not levy corporate income tax, the Director of the BVI International Tax Authority, has confirmed that the BVI is to take a different approach to the Bahamas in relation to the Pillar 2 Global Minimum Tax.

On March 2, 2023, the Belgian Minister of Finance announced the first phase of a broad tax reform that will include the Pillar Two global minimum tax.

Whilst China was a signatory to the October 2021 Statement on a Two-Pillar Solution, domestic implementation has been slow. On February 17, 2023, a consultation issued by the Chinese Ministry of Finance ended.

Yesterday, the Chairman of the Vietnamese National Assembly confirmed that the Vietnamese government is progressing in its proposals for the implementation of the Pillar Two Global Minimum Tax

The Attorney General of the Bahamas, has stated that the government is planning to introduce a Pillar Two Global Minimum Tax.

Malaysia issued its 2023 revised Budget today (4pm Malay time). The original October 2023 Budget included a commitment to introduce the Pillar Two GloBE Rules and a Qualified Domestic Minimum Top-Up Tax. This was reaffirmed in the revised Budget.

In yesterdays 2023 Budget, the South African Treasury confirmed that during the 2023 legislative cycle, the government will publish a draft position on the implementation of the Pillar Two global minimum tax for public comment and draft legislation will be prepared for inclusion in the 2024 Taxation Laws Amendment Bill.

On February 7, 2023, the Special Investigator submitted the Interim Report on the proposal for the implementation of the EU Global Minimum Tax Directive to the government. Read our analysis.

In February, 2023, the Special Investigator submitted the interim report on the proposal for the implementation of the Global Minimum Tax Directive to the government. We have an English translation of the interim report (running to over 400 page) available to all site members.

In Today’s 2023 Budget, Hong Kong’s Financial Secretary confirmed that Hong Kong will implement the Pillar Two Global Minimum Tax from 2025.

In Bermuda’s 2023 Budget last week, the government announced it is actively looking at how to implement the Pillar Two global minimum tax.

Paraguay stands out amongst most South American countries as being the one most at risk of substantial jurisdictional top-up tax for in-scope groups under Pillar Two.

The Director of International Taxation of the Directorate General of Taxes has confirmed Indonesia is planning to implement the Pillar Two GloBE Rules from 2024. This is unlike Singapore which has delayed the implementation until 2025.

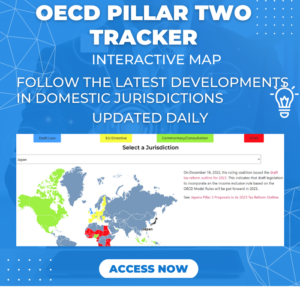

The global implementation of the GloBE rules is staggered with different jurisdictions applying both the Income Inclusion Rule (IIR) and the Under-Taxed Payments Rule (UTPR) from different dates.

In the 2023 Budget Speech, the Singapore government announced it is to implement Pillar Two from 2025.

Under Article 4.3.2(c) of the OECD Model Rules, tax paid under a CFC regime is generally allocated for GloBE purposes to the CFC entity. However, Article 5.1.3 of the OECD Administrative Guidance confirms that this is not the case for Qualified Domestic Minimum Top-Up Taxes (QDMTTs).

The Pillar Two Navigator – GloBE Adjustments chapter has been updated for the OECD Administrative Guidance.

The OECD Administrative Guidance included a number of new elections available to MNEs to simplify or minimise some of the adverse impacts of the GloBE Rules. We have updated our Pillar Two Elections product to include all GloBE Elections.

Article 2.9 of the OECD Administrative Guidance provides for an Equity Investment Inclusion Election. This relates, in part, to the interaction of Articles 3.2.1(c) and 4.1.3(a) of the OECD Model Rules.

As an alternative to incurring additional top-up tax when a domestic tax loss exceeds the GloBE loss, Article 2.7 of the OECD Administrative Guidance provides that an MNE can elect for the Excess Negative Tax Expense administrative procedure.

Article 2.8 of the OECD Administrative Guidance provides for the inclusion of deferred tax in the GloBE deferred tax adjustment amount for ‘Substitute Loss Carry Forwards’.

On February 3 and 6, 2023, the Ministry of Finance published the “Bill for Partial Revision of the Income Tax Act” This includes the proposed implementation of the Pillar Two GloBE rules from April 2024.

Qatar is the first Arab state to introduce a 15% minimum tax in Law 11 of 2022, issued on February 2, 2023.

The OECD Administrative Guidance provides details on which aspects of the GloBE Rules need to be reflected in the QDMTT regime and which aspects don’t.

Article 2.10 of the Administrative Guidance provides more information on the treatment of the US Global Intangible Low-Taxed Income (GILTI) regime.

Today the OECD has issued the Agreed Administrative Guidance for the Pillar Two GloBE Rules. This is the final part of the implementation framework for the GloBE Rules.

Yesterday the Financial Accounting Standards Board (FASB) issued a Tentative Decision on the treatment under US GAAP of deferred taxes for the GloBE minimum tax.

See our infographic for the impact of the proposed IASB Pillar 2 amendments to IAS 12 for MNEs with a December 31 year end.

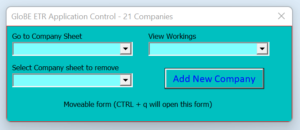

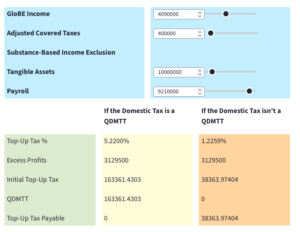

Calculate estimated GloBE top-up tax. Add unlimited companies and jurisdictions via an easy to use control panel to view potential jurisdictional liabilities.

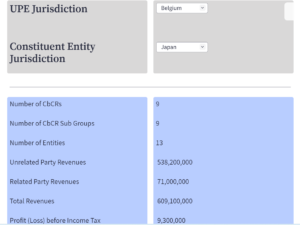

Our Modelling Tool takes the underlying source data from the OECD aggregated CbC source data and subjects it to a data manipulation process to provide a drill down into some of the key metrics and data sources that are relevant for Pillar Two on a jurisdictional basis.

Use our members Income Inclusion Rule Calculator to see how the IIR applies. Enter details of the low-taxed entity including jurisdictional GloBE income and other relevant information to determine top-up tax payable by the parent company.

Liechtenstein has announced it is to issue a consultation on a Pillar Two Global Minimum Tax in March 2023.

In this article we take a comprehensive look at how the substance-based income exclusion applies including the various adjustments for permanent establishments and flow-through entities and the data points required.

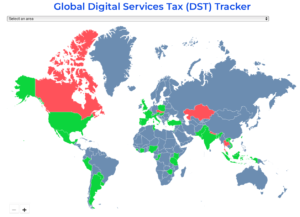

Our Global Digital Services Tax Tracker has been updated to January 23, 2023.

In this article, we look at the potential impact of the Pillar Two GloBE Rules for MNEs operating in the Philippines.

On December 20, 2022, Indonesia issued Government Regulation No. 55/2022 on the Adjustment of Regulations in the Field of Income Tax. This included reference to the implementation of a global minimum tax in Indonesia as well a a desire to implement Pillar One.

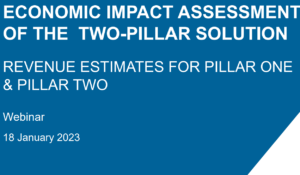

Today’s OECD webinar on Tax challenges of digitalisation: Economic impact assessment of the Two-Pillar Solution reported that revenue gains from both Pillar One and Pillar Two is expected to increase from the previous economic impact assessment.

Just because the statutory rate of corporate income tax is significantly below 15% does not necessarily mean that top-up tax would apply under the Pillar Two global minimum tax rules. We look at why in this article.

With the enactment of the Pillar Two GloBE Rules in South Korea from January 1, 2024, the costs of an unintentional permanent establishment (PE) in South Korea may be significantly greater.

Our members-only modelling tool carries out the calculations based on the required inputted information to determine whether the Transitional CbCR Safe Harbour applies.

The GloBE Information Return will require information on an MNEs corporate structure in so far as it impacts the application of the Pillar Two GloBE rules. In this article we look at the data points that are required to comply with this.

As a members only resource, we include an unofficial English translation of the South Korean Global Minimum Tax Law (Law 19191 of December 31, 2022).

Today, the International Accounting Standards Board (IASB) issued an Exposure Draft for proposed amendments to IAS 12 to take account of the Pillar Two Model Rules.

On December 31, 2022 the first domestic law was enacted to give effect to the Pillar Two GloBE rules from January 1, 2024. Read more.

In this first of a series of articles that will break down all of the data points for the purposes of the Pillar Two GloBE rules (and in particular the expected reporting in the GloBE information return), we look at the UPE data points in the corporate structure.

The International Accounting Standards Board (IASB) has stated it expects to publish its Exposure Draft on the Pillar Two Model Rules on January 9, 2023. Read more.

The African Tax Administration Forum (ATAF) has released a Suggested Approach to Drafting Domestic Minimum Top-Up Tax Legislation under the Pillar Two GloBE Rules.

We can expect to see a substantial number of countries releasing and enacting legislation to implement Pillar Two in 2023.

On December 16, 2022, the ruling coalition issued the draft tax reform outline for 2023. This indicates that draft legislation to incorporate an income inclusion rule based on the OECD Model Rules will be put forward in 2023.

On December 21, 2022, the Congressional Research Service updated its policy document: The Pillar 2 Global Minimum Tax: Implications for U.S. Tax Policy following the EU adoption of the Global Minimum Tax Directive.

On December 20, 2022, the OECD published a consultation document on the Pillar Two GloBE Information Return which includes 268 data points for MNEs to collect.

On December 20, 2022, the OECD published a consultation document on Tax Certainty for the GloBE Rules. We look at the key highlights.

On December 20, 2022, the OECD opened a consultation on the draft Multilateral Convention provisions for the removal of Digital Services Taxes and other similar measures under Pillar One.

Today the OECD announced details of two safe harbours and a penalty relief provision for the Pillar Two GloBE rules.

The Irish Finance Bill 2022 was published in October 2022 and includes some key changes to the corporation tax system to take account of the Pillar 2 rules.

December 16, 2022 saw more developments on the international implementation of Pillar Two. The Swiss parliament approved the draft constitutional amendment for enacting the GloBE rules and Azerbaijan joins the 2-Pillar solution.

Last night the Council of the European Union formally adopted (among other things) the EU Pillar Two directive as Poland pulled its veto at the last minute.

Following the recent preliminary agreement reached in the EU Council on the implementation of Pillar Two, Poland had asked for further time to consider the implementation of the EU Directive.

On 9 December 2022, the UAE issued the Federal Decree-Law No. (47) of 2022 on the taxation of corporations and businesses. In this article we look at the new UAE CT Law from a Pillar Two perspective.

The EU Council has reached agreement on the implementation of Pillar Two. As Pillar Two gains momentum the critical mass of countries required for effective implementation gets closer.

The OECD published a consultation document on Amount B of Pillar One today. We take an initial look at the key aspects of the Amount B consultation.

In this article, we take a look at Thailand’s tax regime from a Pillar Two perspective, with a particular focus on their tax incentives.

There are features of the NZ regime that raise issues from a Pillar Two perspective. Some of these were addressed in a Pillar Two consultation document issued earlier this year. In this article we look at some of the key issues in the implementation of Pillar Two for New Zealand.

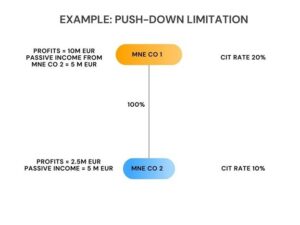

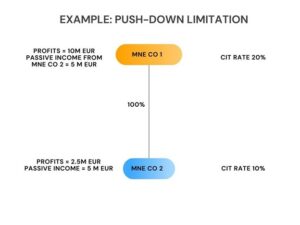

Article 4.3.2(c) of the OECD Model Rules allocates tax paid on CFC income to the CFC entity (subject to a pushdown limitation). However, this leads to a situation where an MNE can reduce potential top-up tax by allocating more income to a CFC entity.

Pension funds are subject to a number of specific provisions under the Pillar Two rules. In this article we look at some of the key aspects of Pillar Two that impact on Pension Funds.

Our Global VAT on Digital Services Tracker has been updated and now covers over 80 jurisdictions.

Whilst a number of the measures follow the proposals in the November Staff Paper, the prospect of certain other additional disclosures not previously suggested, has been put forward. In this article we review the IASB’s announcement and proposed changes.

Luxembourg is home to the second largest funds industry in the world and the largest in Europe. In this article we look at the Pillar 2 impact on Luxembourg private debt funds.

Use our Global map to determine the effective tax rate for R&D expenditure globally. Including the average R&D ETR per jurisdiction and the impact of incentives.

Following draft legislation issued in July 2022, the UK government confirmed in this week’s Autumn Statement that they will legislate to implement Pillar Two from 2024 including the UTPR and a QDMTT.

The OECD issued the Fourth Edition of its Corporate Tax Statistics report yesterday. The Press Release that accompanied the report stated that the report supported the need to press forward with the OECD Two-Pillar Solution to address base erosion issues. In this article we look at some of the key insights and highlights from the report.

In this article we take a detailed look at Taiwan’s tax regime from a Pillar Two perspective. Key aspects covered include tax incentives provided by the Statute for the Establishment and Management of Free Trade Zones, the Statute for Industrial Innovation and the provisions of the Income Tax Act.

The International Accounting Standards Board (IASB) will be discussing the approach to Pillar Two in its November 22, 2022 meeting. As preparation for this, a staff paper has been issued to outline a proposed approach to Pillar Two including a temporary exception and disclosure requirements.

MNEs within the scope of Pillar 2 are well advised to carry out a Pillar 2 Impact Assessment. In this article we look at the approach to a Pillar 2 impact assessment.

In this article we review Oman’s income tax laws from a Pillar Two perspective to highlight key issues to consider for MNEs with Omani subsidiaries or permanent establishments.

Undertaking an early Pillar Two Impact Assessment allows MNE groups to identify potential top-up tax, ascertain and implement changes to processes and systems and provides time to consider restructuring to efficiently plan for Pillar Two.

In this 35-page report we take a systems-based approach to the GloBE rules and look at effective systems implementation to allow the Pillar Two GloBE ETR calculations to be undertaken.

Israel’s incentive regime offers significant tax incentives. In this article we assess the impact this may have on MNEs post Pillar Two.

In this article, we look at Singapore’s tax system and some of the key drivers of low ETRs for Pillar 2, including other factors that can temper any reduction.

On October 24, 2022, the Dutch Government released a consultation, including draft legislation, on the Pillar Two GloBE rules. See the key takeaways.

In this analysis we look at the key corporate tax incentives and assess their potential FDI impact taking into account the Pillar Two GloBE Rules.

The nature of the Pillar Two GloBE Rules means that in some cases, SPVs can lead to top-up tax that would not occur if a subsidiary was directly held.

In this analysis we look at the key features of China’s tax law that would need to be taken into account by MNEs with Chinese subsidiaries for Pillar 2 purposes.

In a post Pillar Two environment, the nature of tax incentives needs to be carefully considered to ensure that both MNEs and tax authorities derive benefits. In this analysis we model the impact of payroll tax incentives.

In this article we look at India’s corporate income tax regime and assess the impact of the Pillar Two GloBE Rules on MNE’s with operations in India.

Vietnam’s broad income-based tax incentives could impact on investment into Vietnam in a post Pillar Two environment. We look at the issues and policy options.

On October 6, 2022, the OECD issued the Progress Report on the Administration and Tax Certainty Aspects of Amount A of Pillar One (the ‘Progress Report’), which includes draft Model Rules on the administration of Amount A.

In this members article we look at key developments last week, including Ireland, Vietnam, Belgium and the OECD.

In today’s 2023 Budget Speech, the Malaysian government joined the growing number of countries that will implement the 15% global minimum tax under Pillar 2.

The OECD issued a report yesterday on tax incentives after Pillar 2. We look at the key takeaways including which tax incentives have the largest impact.

On October 4, 2022, Australia issued a consultation paper on Pillar Two of the OECD Two-Pillar Solution. We look at the key aspects of the consultation.

Nigeria has rejected Pillar 1 and 2 on the basis that the thresholds would result in a loss of tax revenue. We look at the changes to domestic law to tax MNEs.

The Subject-to-Tax Rule is a key element of Pillar Two, and allows source jurisdictions to levy additional tax on certain payments. Read what you need to know.

The Netherlands has issued Parliamentary Paper 22112 (3278) in which it provides comments on the EU’s proposed directive for the implementation of Pillar Two.