Pillar Two: AI-Powered Research Tool

Members have access to our Pillar Two AI-powered Analysis Tool. This is a custom AI model trained on Pillar Two data from our members-only content including our Pillar Two Navigator and Jurisdictional analysis.

Our cloud-based Pillar Two software provides access to market-leading analysis and insights to allow you to model the impact of the Pillar Two GloBE Rules on any potential top-up tax liability, determine best and worst case scenarios and simulate the impact of making various Pillar Two elections.

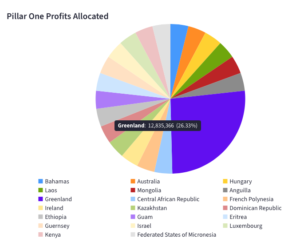

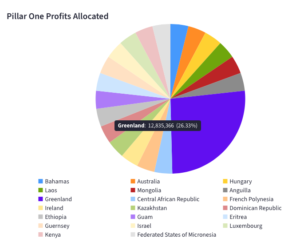

Our Pillar One Modelling Tool provides a calculation of the estimated profits reallocated to jurisdictions under Amount A of Pillar One and the estimated corporate income tax on those reallocated profits.

Given Pillar One feeds directly into Pillar Two, it also estimates the Pillar Two top-up tax liability after the application of Pillar One.

Free access for site members.

Members have access to our Pillar Two AI-powered Analysis Tool. This is a custom AI model trained on Pillar Two data from our members-only content including our Pillar Two Navigator and Jurisdictional analysis.

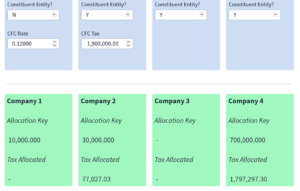

For fiscal years that begin on or before 31 December 2025 but not ending after 30 June 2027, the OECD Administrative Guidance includes a simplified formula to allocate CFC taxes in blended CFC regime. Use our simple calculator.

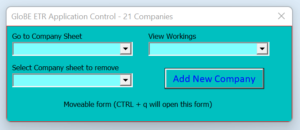

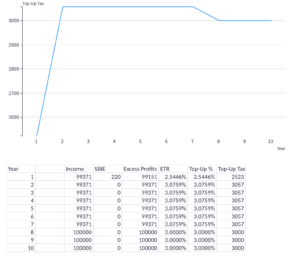

Calculate estimated GloBE top-up tax. Add unlimited companies and jurisdictions via an easy to use control panel to view potential jurisdictional liabilities.

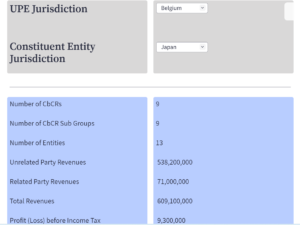

Our Modelling Tool takes the underlying source data from the OECD aggregated CbC source data and subjects it to a data manipulation process to provide a drill down into some of the key metrics and data sources that are relevant for Pillar Two on a jurisdictional basis.

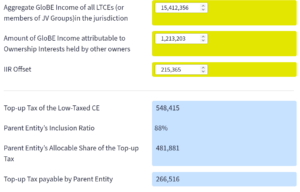

Use our members Income Inclusion Rule Calculator to see how the IIR applies. Enter details of the low-taxed entity including jurisdictional GloBE income and other relevant information to determine top-up tax payable by the parent company.

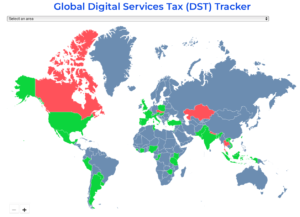

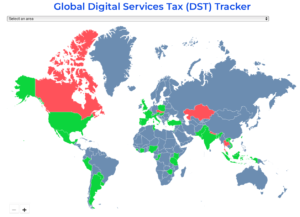

Our Global Digital Services Tax Tracker has been updated to January 23, 2023.

Our members-only modelling tool carries out the calculations based on the required inputted information to determine whether the Transitional CbCR Safe Harbour applies.

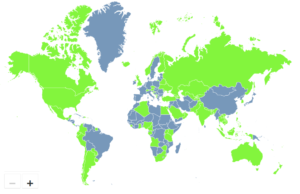

Our Global VAT on Digital Services Tracker has been updated and now covers over 80 jurisdictions.

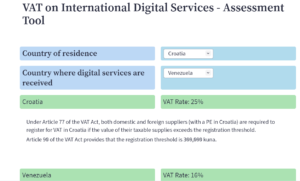

Use our global assessment tool to determine the VAT position on the provision of international digital services. The tool is fully cited to the relevant domestic law.

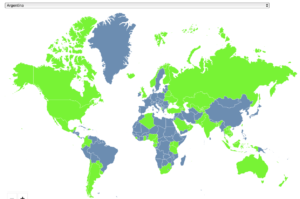

Use our Global map to determine the effective tax rate for R&D expenditure globally. Including the average R&D ETR per jurisdiction and the impact of incentives.

Global intellectual property (IP) incentives have grown in recent years. Use our tool to compare different regimes.

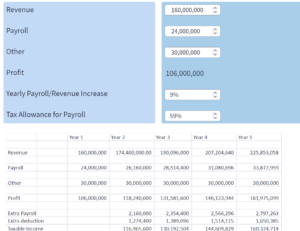

This Modelling Tool accompanies our analysis Modelling the Impact of Payroll Tax Incentives Post Pillar 2. Members use this tool to adjust key variables.

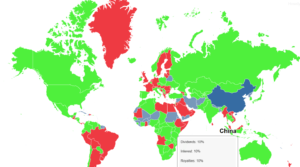

The Subject-to-Tax Rule is a key component of Pillar Two, and unlike the GloBE Rules focuses on source jurisdictions. Our members-only global map highlights domestic withholding taxes at less than the 9% rate under the Subject-to-Tax Rule.

For Pillar Two purposes, investments in fixed assets can involve an interaction between deferred tax impacts and the the substance-based income exclusion.

Our interactive map covers the current global treatment of VAT on digital services. Fully cited with links to relevant laws.

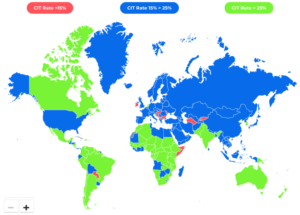

Our interactive map breaks down worldwide corporate income tax rates to identify jurisdictions with a headline CIT rate below the Pillar Two 15% rate.

Our Global Digital Services Tax Tracker allows you to stay up to date with international digital service taxes. Cited and with links to domestic legislation.

Our OECD Pillar One Modelling Tool is designed to provide an analysis of the high-level impact of Amount A of Pillar One.

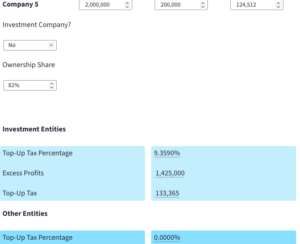

Our Investment Companies Top-Up Tax Calculator models the impact of Pillar Two in a jurisdiction where there are a mix of investment and non-investment companies.

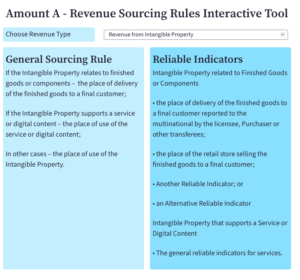

The Revenue Sourcing Rules for Amount A are used to determine where an in-scope multinational group derives its revenues. This is then used in the profit reallocation calculation.

Use our interactive tool to quickly determine the relevant sourcing rule for each revenue type.

Our GloBE Loss Election interactive tool allows you simulate the impact on your top-up tax liability depending on whether a GloBE Loss Election is made or not.

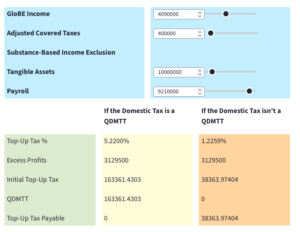

Our Qualified Domestic Minimum Top-Up Tax (QDMTT) interactive tool allows you simulate the impact on your top-up tax liability depending on whether the domestic top-up tax is a QDMTT or is non-qualifying.

The UK published draft legislation on July 20, 2022, to implement a ‘multinational top-up tax’ in line with Pillar Two of the OECDs Two-Pillar Solution. We have produced a calculator to illustrate the key aspects to the calculation of the multinational top-up tax.

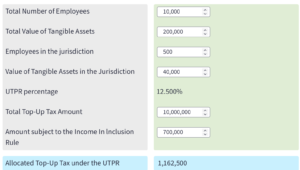

This Pillar Two under-taxed payments rule (UTPR) calculator gives an indication of the broad operation of how the top-up tax is allocated to UTPR jurisdictions.

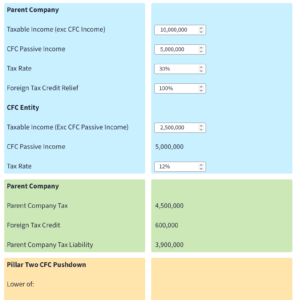

When allocating taxes to group entities for the purpose of the Pillar Two rules, tax paid by a parent entity under a controlled foreign company (CFC) regime is usually allocated to the CFC entity. However, under Pillar Two, this is subject to a limitation. Use our interactive tool to see the impact of the CFC pushdown limitation.

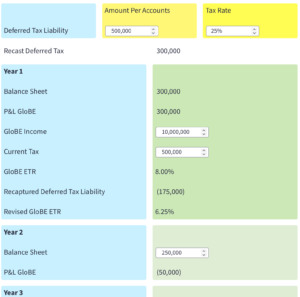

Our deferred tax recapture tool simulates the impact of the Pillar Two rule that recaptures deferred tax liabilities that are not paid within five years.

Deferred Tax has a significant impact on the Pillar Two effective tax rate (ETR) and therefore on any top-up tax that may be levied. Use our Pillar Two Deferred Tax Liability Calculator to model the impact on the Pillar Two top-up tax.

On July 11, 2022, the OECD released a progress report on its Two Pillar Solution. This included draft rules on Pillar One. Whilst these draft rules are subject to a consultation, they nevertheless make interesting reading, particularly as there has, to date, been very little detailed information on the marketing and distribution profits safe harbour. Use our Pillar One profit allocation calculator to see the impact of the profit reallocation and marketing and distribution profits safe harbour.

Our capital gains carry back tool models the impact of making a Pillar Two election to spread capital gains. View different scenarios by changing gains and losses.

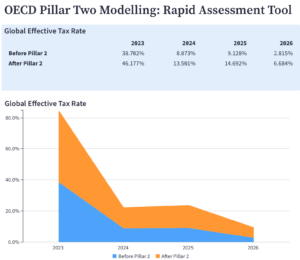

Our Pillar Two Rapid Assessment Tool, simulates the impact of the Pillar Two GloBE Rules. It is a slimmed-down version of our Pillar Two Tax

Deferred Tax is a key element of the Pillar Two Rules, aimed at smoothing out the effective tax rate to address timing differences. This simple Pillar Two deferred tax calculator shows the broad operation of a deferred tax asset and its impact on the effective tax rate and top-up tax.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |