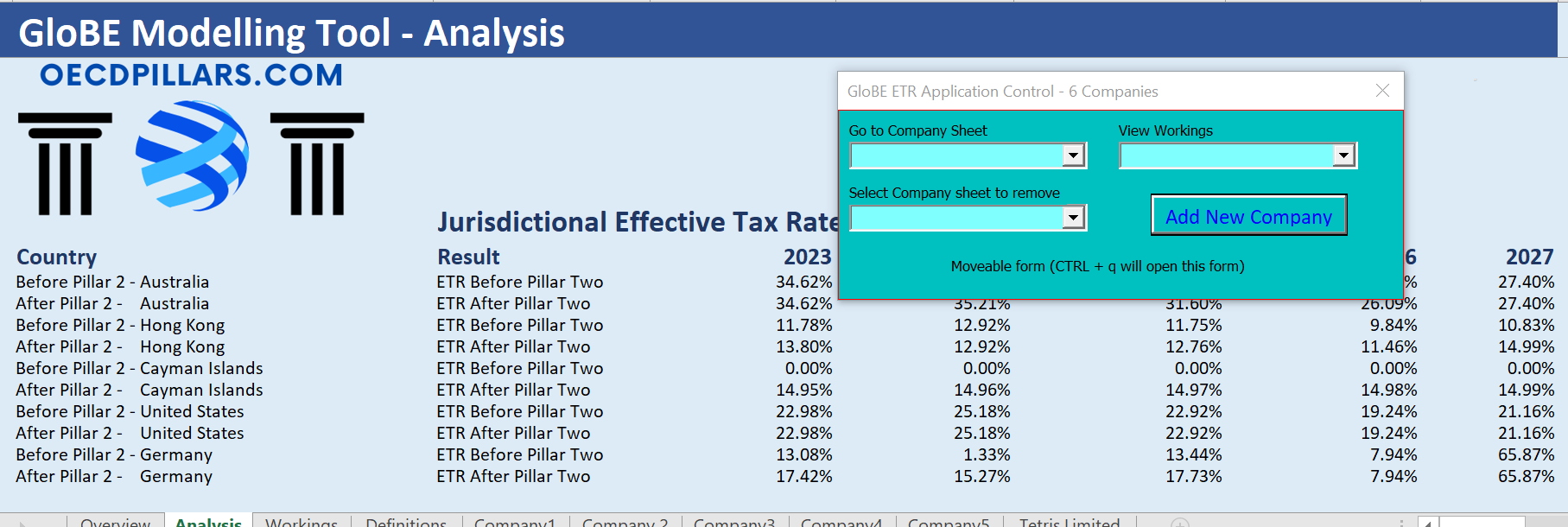

Our Pillar Two Modelling Tool allows you to estimate your jurisdictional top-up tax liability and the impact on your effective tax rate (ETR).

It handles an unlimited number of companies and jurisdictions.

Simply enter entity-level relevant financial details and this tool instantly takes care of all of the jurisdictional blending calculations. You don’t need to complete all of the financial data boxes, however, the more information provided, the more accurate the figures.

The Modelling Tool handles all of the Pillar Two GloBE adjustments including:

If you’re a site member, you can access the Pillar Two Modelling Tool (for free) at:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |