Denmark GloBE Country Guide: Updated for June 2024 Amending Law

On June 11, 2024, Law No. 684 was published in the Danish Official Gazette. This implements additional aspects of the OECD Administrative Guidance.

English Translation of Turkey’s Global Minimum Tax Law

English Translation Turkey’s draft Global Minimum Tax Law

GloBE Country Guide: Turkey

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Turkey for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation submitted to the Turkish Parliament on July 16, 2024.

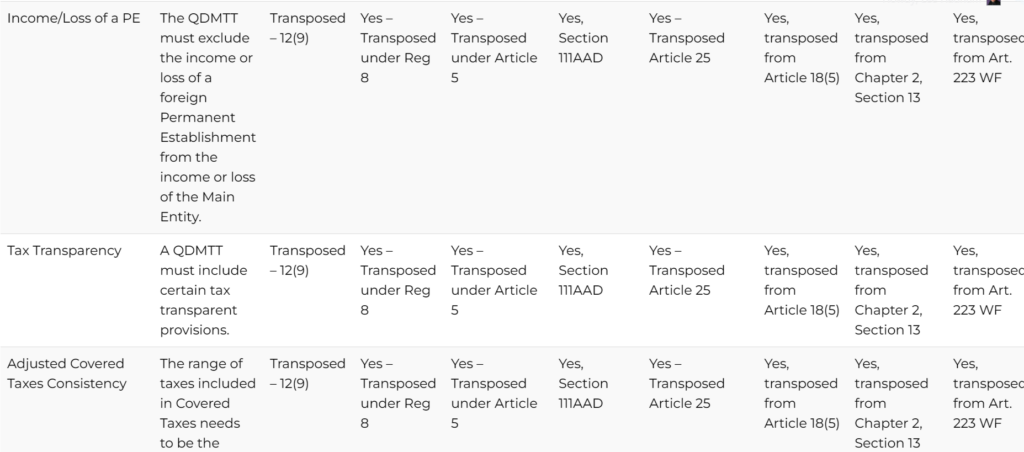

QDMTT Legislative Tracker: Updated to July 19, 2024

Updates to our QDMTT Legislative Tracker to include domestic QDMTT legislation released up to July 19, 2024.

GloBE Country Guide: Portugal

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Portugal for accounting periods beginning on or after January 1, 2024. Updated for the draft law issued on July 10, 2024.

OECD Issues Draft XML Schema for GloBE Information Return

On July 10, 2024, the OECD released the draft XML schema for the GloBE Information Return (GIR). This provides a method of structuring the data reporting for the GIR.

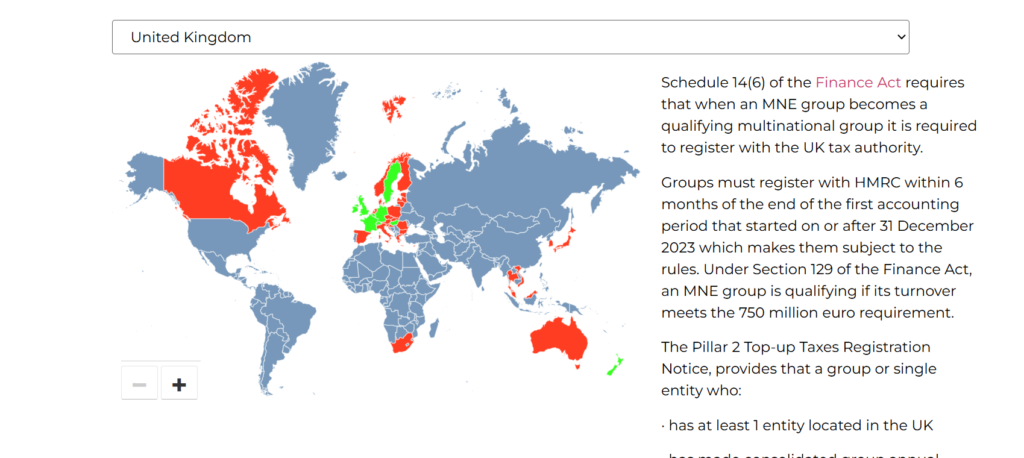

GloBE Implementation: Domestic Registration Requirements

Many jurisdictions will require GloBE registration for administrative purposes, however, the law issued to date has been inconsistent. We outline the GloBE registration obligations from the domestic legislation (enacted and draft) issued to date, with citations and links to relevant laws.

Detailed Analysis of the Italian QDMTT Implementing Decree

On July 3, 2024, the Italian Ministry of Economy & Finance issued a Decree which contains the procedures for the implementation of the Qualified Domestic Minimum Top-up Tax (QDMTT).

Gibraltar 2024 Budget Confirms QDMTT Introduction

In the 2024 Budget address, the Gibraltar government confirmed that draft legislation for the introduction of a QDMTT is expected in September 2024.

Australia Submits Pillar 2 Laws to Parliament

On July 4, 2024, the Australian Government introduced legislation to implement the Pillar 2 GloBE rules into Parliament. This includes a domestic minimum tax, IIR and UTPR.