Belgian Royal Decree Sets July 13, 2024 as the Deadline for the First GloBE Notification Form

On May 29, 2024, the Royal Decree of 15 May 2024 was published in the Belgian Official Gazette. This sets July 13, 2024 at the latest, as the deadline for the first GloBE Notification Form.

EU Gives Spain, Cyprus, Latvia, Lithuania, Poland and Portugal 2 Months to Enact Domestic Pillar 2 Laws

On May 23, 2024, the EU Commission issued a reasoned opinion to Spain, Cyprus, Latvia, Lithuania, Poland and Portugal as result of them not yet enacting domestic Pillar Two legislation.

Italy Issues a Decree for the Transitional CbCR & UTPR Safe Harbours

On May 21, 2024, the Italian Ministry of Economy and Finance issued a Decree providing further details on the application of the Transitional Safe Harbours.

Belgium’s Pillar Two Notification Form Requires Significant Data Input

On May 21, 2024, the Belgian Tax Authority issued further details on the notification requirements for in-scope MNE groups. This includes significant information on the group structure.

Czech Republic GloBE Guide Updated for the April 2024 Draft Law Amendments

Analysis of the Pillar Two GloBE rules in the Czech republic, updated for the April 26, 2024, draft law to reflect various aspects of the OECD Administrative Guidance (particularly the December 2023 amendments).

Jersey to implement an IIR and QDMTT from January 1, 2025

On May 22, 2024, Jersey announced it will be implementing an Income Inclusion Rule (IIR) and a new standalone multinational corporate income tax for accounting periods beginning on or after January 1, 2025.

Denmark GloBE Guide Updated for the Draft Law of April 30, 2024

On April 30, 2024, a Draft Law to amend the Danish Minimum Taxation Act was submitted to the Danish Parliament. This implements additional aspects of the OECD Administrative Guidance.

Isle of Man Announces QDMTT From 2025

On May 20, 2024, the Isle of Man Government issued a press release stating it intends to introduce a Qualified Domestic Minimum Top-Up Tax (QDMTT) with effect from January 1, 2025.

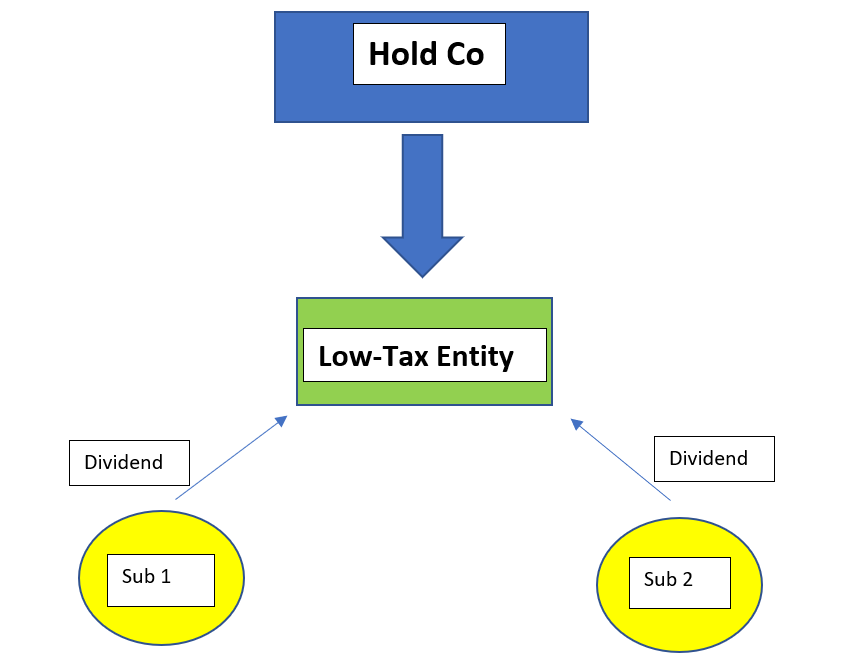

Reviewing MNE Group Structures for Profit Extraction after Pillar Two

The specific treatment of dividends and other distributions under the Pillar Two GloBE Rules raises some interesting issues and opportunities in blending such payments between otherwise low-taxed entities and holding companies to reduce any potential top-up tax liability.

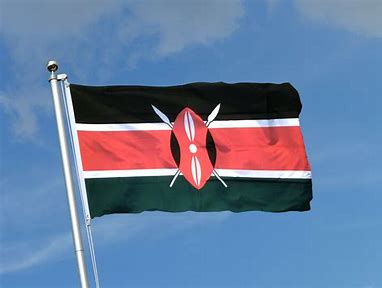

Kenya Includes a Domestic Minimum Tax in its 2024 Finance Bill

On May 13, 2024, the Finance Bill, 2024 was sent to the Kenyan Parliament. It includes provisions to introduce a 15% domestic minimum top-up tax from January 1, 2025.