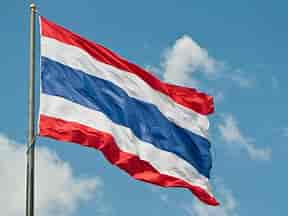

GloBE Country Guide: Thailand

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Thailand for accounting periods beginning on or after January 1, 2025. Updated for the Draft Law issued on March 1, 2024.

Thailand Issues Draft Pillar Two Legislation

On March 1, 2024, the Thai Revenue Department published an 18-page consultation paper on the implementation of Pillar Two. This includes draft legislation which includes, an IIR, UTPR and a domestic minimum tax.

Status of Pillar Two Implementation in the EU as at March 1, 2024

In this article, we look at the status of Pillar Two implementation in the EU, as at March 1, 2024, for jurisdictions that have not yet enacted domestic law to implement the EU Minimum Tax Directive.

English Translation of Greece’s Global Minimum Tax Law

English Translation of Greece’s Global Minimum Tax Law

UK Enacts 2024 Finance Act to Implement the OECD Administrative Guidance

On February 22, 2024, the UK enacted the 2024 Finance Act to domestically implement amendments provided in the OECD Administrative Guidance.

GloBE Country Guide: Greece

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Greece for accounting periods beginning on or after 31 December, 2023. Based on the draft law issued on February 22, 2024.

A Review of Greece’s Draft Pillar Two Law

On February 22, 2024, the Ministry of National Economy and Finance issued a draft law to implement the EU Global Minimum Tax Directive. In this article we review the draft law.

GloBE Country Guide: South Africa

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in South Africa for accounting periods beginning on or after January 1, 2024, based on the Draft GMT Bill and the Draft GMT Administration Bill of February 21, 2024.

South Africa Issues a Draft Law to Transpose the OECD GloBE Rules & Adopts an Ambulatory Approach

On February 21, 2024, the National Treasury and the South African Revenue Service issued the Draft Global Minimum Tax Bill and the Draft Global Minimum Tax Administration Bill.

GloBE Country Guide: Malta

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Malta for accounting periods beginning on or after 31 December, 2023. Updated for Legal Notice 32 of 2024 of February 20, 2024.