English Translation of the Swedish Global Minimum Tax Law

In February, 2023, the Special Investigator submitted the interim report on the proposal for the implementation of the Global Minimum Tax Directive to the government. We have an English translation of the interim report (running to over 400 page) available to all site members.

Hong Kong to Implement Global Minimum Tax in 2025

In Today’s 2023 Budget, Hong Kong’s Financial Secretary confirmed that Hong Kong will implement the Pillar Two Global Minimum Tax from 2025.

Bermuda’s Plans For a Global Minimum Tax

In Bermuda’s 2023 Budget last week, the government announced it is actively looking at how to implement the Pillar Two global minimum tax.

Paraguay’s Significant Pillar Two Risk

Paraguay stands out amongst most South American countries as being the one most at risk of substantial jurisdictional top-up tax for in-scope groups under Pillar Two.

Director of Indonesian Tax Authority Confirms Planned 2024 GloBE Implementation

The Director of International Taxation of the Directorate General of Taxes has confirmed Indonesia is planning to implement the Pillar Two GloBE Rules from 2024. This is unlike Singapore which has delayed the implementation until 2025.

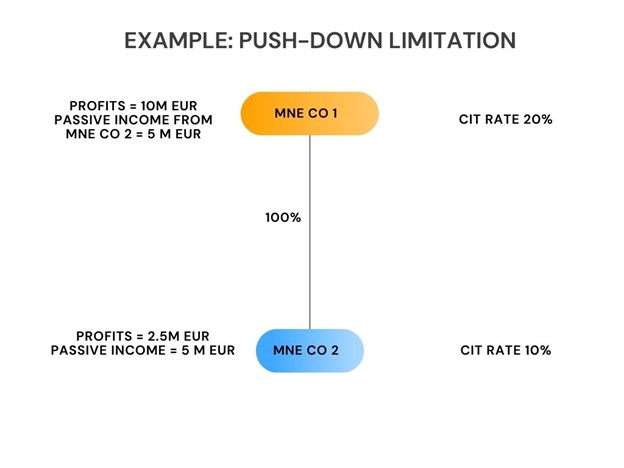

Impact of the Staggered Implementation of the GloBE Rules

The global implementation of the GloBE rules is staggered with different jurisdictions applying both the Income Inclusion Rule (IIR) and the Under-Taxed Payments Rule (UTPR) from different dates.

Malaysia: Pillar Two Implementation Expected in February 24 Budget

It is expected that the Pillar Two global minimum tax may be among the measures implemented in Budget 2023 on February 24, 2023.

Singapore To Implement Pillar Two From 2025

In the 2023 Budget Speech, the Singapore government announced it is to implement Pillar Two from 2025.

Treatment of CFC Taxes: QDMTTs vs GloBE Rules

Under Article 4.3.2(c) of the OECD Model Rules, tax paid under a CFC regime is generally allocated for GloBE purposes to the CFC entity. However, Article 5.1.3 of the OECD Administrative Guidance confirms that this is not the case for Qualified Domestic Minimum Top-Up Taxes (QDMTTs).

Pillar 2 Navigator Update for OECD Administrative Guidance: GloBE Adjustments

The Pillar Two Navigator – GloBE Adjustments chapter has been updated for the OECD Administrative Guidance.