Romania Adopts a Law to Amend its Minimum Tax Act

On August 29, 2025, Ordinance No. 21 of August 28, 2025 was published in the Official Gazette. This amends various aspects of the Minimum Tax Act, including for the filing deadline for the designated filing entity nomination, transferable tax credits and the excess negative tax carry forward election.

Australia Issues a List of Jurisdictions that Have Qualified IIRs and DMTTs for Pillar 2

On August 26, 2025, Australia issued a list of jurisdictions that have qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour).

Australia Issues a Draft Instrument for IIR/UTPR/QDMTT Filing Exemptions

On August 27, 2025, the Australian Taxation Office issued a draft legislative instrument (the ‘Taxation Administration (Exemptions from Requirement to Lodge Australian IIR/UTPR tax return and Australian DMT tax return) Determination 2025’). This outlines situations when entities within the scope of the Pillar 2 GloBE rules do not need to file an Australian DMT Return or an IIR/UTPR Return.

Mauritius Enacts a QDMTT From July 1, 2025

The Finance Act 2025, enacted on August 8, 2025, introduces a new Sub-Part AF to the Income Tax Act to include a domestic minimum top-up tax (intended to be a QDMTT) from July 1, 2025.

GloBE Country Guide: Mauritius

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Czech Republic for accounting periods beginning on or after July 1, 2025. Updated for the Finance Act 2025, enacted on August 8, 2025.

IIRs and DMTTs that don’t yet Qualify Under the OECD August 2025 Update

On January 15, 2025, the OECD issued Administrative Guidance that includes a list of jurisdictions that have transitional qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour). This was subsequently updated on March 31, 2025 and August 18, 2025.

Canada Issues Draft Proposals to Amend its Global Minimum Tax Act

On August 13, 2025, Canada issued draft legislative proposals to amend its Global Minimum Tax Act to provide for aspects of the June 2024 and January 2025 OECD Administrative Guidance.

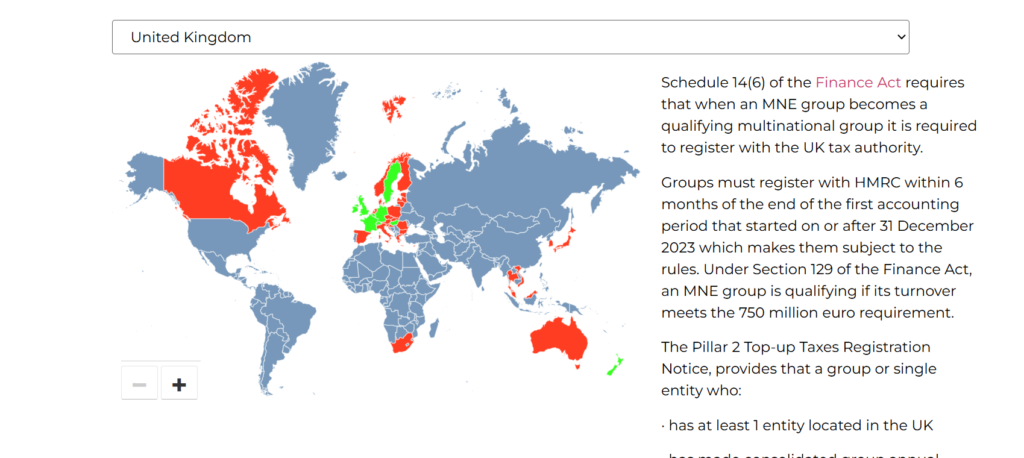

Pillar Two: Domestic Registration Requirements

Many jurisdictions will require GloBE registration for administrative purposes, however, the law issued to date has been inconsistent. We outline the GloBE registration obligations from the domestic legislation (enacted and draft) issued to date, with citations and links to relevant laws.

South Korea to Apply a QDMTT from January 1, 2026

South Koreas 2025 Tax Reform Proposal (announced on July 31, 2025), provides that a QDMTT will be applied from January 1, 2026.

Kuwait opens Electronic Registration for Pillar 2

On July 16, 2025, Kuwait updated its electronic registration portal to include Pillar 2 registration for in-scope groups.