OECD Issues Outcome Statement For Pillar 1 and STTR Implementation

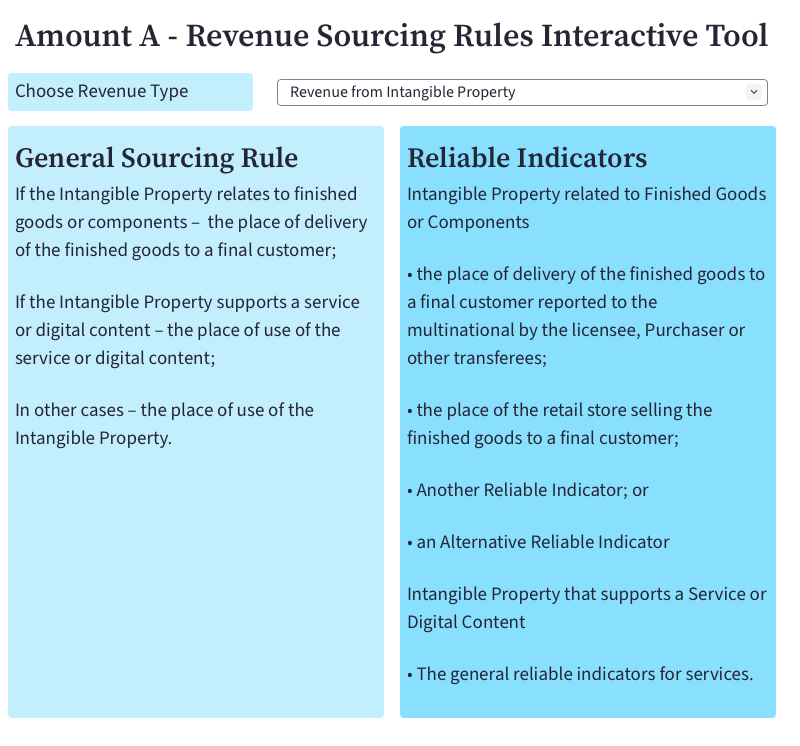

Yesterday, the OECD issued an Outcome Statement on Pillars 1 & 2 that gives an update on the status and timeline for implementation of Amount A and B of Pillar One, and the Subject-to-Tax Rule (STTR).