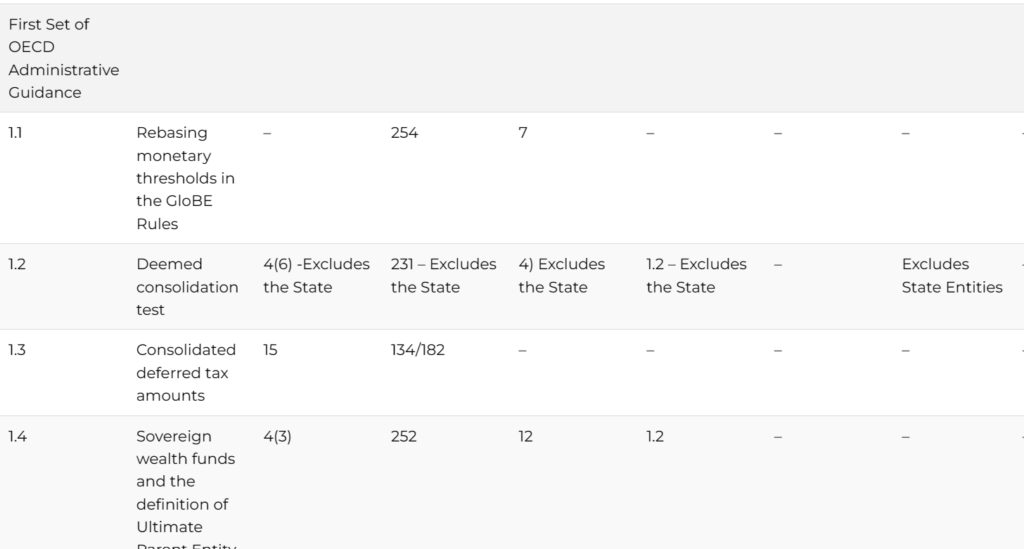

Tracking of local enactment of the OECD Administrative Guidance.

A key aspect of Pillar Two is that the GloBE Rules are implemented uniformly by domestic jurisdictions.

From the legislation (both draft and enacted) released to date, whereas there are few and relatively minor differences from the OECD Model Rules, there are significant differences in the extent to which the OECD Administrative Guidance is reflected.

This is to be expected. Jurisdictions have had a number of years to implement the OECD Model Rules, but the lead time from the Administrative Guidance is much shorter.

| First Set of OECD Administrative Guidance | |

|---|---|

| 1.1 | Rebasing monetary thresholds in the GloBE Rules |

| 1.2 | Deemed consolidation test |

| 1.3 | Consolidated deferred tax amounts |

| 1.4 | Sovereign wealth funds and the definition of Ultimate Parent Entity |

| 1.5 | Clarifying the definition of ‘Excluded Entity’ |

| 1.6 | Meaning of “ancillary” for Non-Profit Organisations |

| 2.1 | Intra-group transactions accounted at cost |

| 2.2 | Excluded Equity Gains or Loss and hedges of investments in foreign operations |

| 2.3 | Excluded Dividends – Asymmetric treatment of dividends and distributions |

| 2.4 | Debt release Election |

| 2.5 | Accrued Pension Expenses |

| 2.6 | Covered Taxes on deemed distributions |

| 2.7 | Excess Negative Tax Carry-forward guidance |

| 2.8 | Substitute Loss carry forwards |

| 2.9 | Equity Gain or loss inclusion election |

| 2.1 | Allocation of taxes arising under a Blended CFC Tax Regimes |

| 3..1 | Application of Taxable Distribution Method Election to Insurance Investment Entities |

| 3.2 | Exclusion of Insurance Investment Entities from the definition of Intermediate Parent Entity and Partially-Owned Parent Entity |

| 3.3 | Restricted Tier One Capital |

| 3.4 | Liabilities related to Excluded Dividends and Excluded Equity Gain or Loss from securities held on behalf of policyholders |

| 3.5 | Simplification for Short-term Portfolio Shareholdings |

| 3.6 | Application of Tax transparency election to mutual insurance companies |

| 4.1 | Deferred tax assets and tax credits under Transitional Rules |

| 4.2 | Applicability of Transitional Rules to transactions similar to asset transfers |

| 4.3 | Asset carrying value and deferred taxes under Transitional Rules |

| Second Set of OECD Administrative Guidance | |

| 1 | Currency Conversion Rules |

| 2 | Tax Credits Guidance (MTTCs) |

| 3 | SBIE Rules |

| – Foreign rules | |

| – Stock-based compensation election |

|

| – Lease |

|

| – Impairment losses inc in tangible asset value |

|

| 4.1 | QDMTT Safe Harbour |

| 4.2 | UTPR Safe Harbour |

| Third Set of OECD Administrative Guidance | |

| 1 | Transitional CbCR – Purchase Accounting Adjustments (consistent reporting condition, goodwill impairment adjustment) |

| 2.2.1 | Transitional CbCR – JVs |

| 2.3.1 | Transitional CbCR – Same Financial Statements/Local Financial Statements for Statutory Reporting |

| 2.3.2 | Transitional CbCR – Using different accounting standards |

| 2.3.3 | Transitional CbCR – Adjustments to Qualified Financial Statements/Dividend Misatches |

| 2.3.4 | Transitional CbCR – MNEs not required to file CbC Reports |

| 2.3.5 | Transitional CbCR – Qualified Financial Statements for PEs |

| 2.4.2 | Transitional CbCR – Treatment of Taxes on income of PEs, CFCs, and Hybrid Entities |

| 2.6 | Transitional CbCR – Treatment of hybrid arbitrage arrangements |

| 3.1 | Identifying Consolidated Revenue |

| 3.2 | Mismatch between Fiscal Years of the UPE and another Constituent Entity |

| 3.3 | Mismatch between Fiscal Year and Tax Year of Constituent Entity |

| 4.2.1 | Blended CFCs – multiple GloBE Jurisdictional ETRs |

| 4.2.2 | Blended CFCs – not required to calculate an ETR |

| 4.2.3 | Blended CFCs – income of non-GloBE Entities |

| 5.3 | 30 June 2026 filing deadline |

| 6 | NMCE Simplified Calculations |

| Fourth Set of OECD Administrative Guidance | |

| 1.2.1 | Aggregate DTL Category basis |

| 1.2.1 | Exclusion of certain types of GL accounts and separate tracking |

| 1.2.1 | Exclusion of GL accounts that generate standalone DTAs |

| 1.2.1 | Exclusion of swinging accounts and separate tracking |

| 1.2.2 | FIFO/LIFO basis |

| 1.2.2 | Aggregation of Short-term DTLs |

| 1.2.2 | Reversal of DTLs that accrued before the Transition Year |

| 1.2.2 | 5-year unclaimed accrual election |

| 2.1.2 | Recalculated deferred tax where GloBE carrying value differs from accounting carrying value |

| 2.1.2 | GloBE and accounting carrying values and the Transition Rules |

| 2.1.2 | Additional provisions for Intragroup transactions accounted for at cost |

| 2.1.2 | Exclusion of GloBE carrying value from SBIE |

| 3.1.3 | General rules for allocating cross-border, current taxes under a cross-crediting corporate tax system: 4 Steps |

| 3.1.3 | Specific rules for foreign PEs/CFCs, Hybrids/rev hybrids with domestic source income |

| 3.1.3 | Cross-crediting between Permanent Establishments and distributions from foreign subsidiaries |

| 4.1 | Extension of the Substitute Loss Carry-forward DTA to PEs, Hybrids and Rev Hybrids |

| 4.2 | Allocation of deferred tax expenses and benefits from a Parent Entity to a CFC, PE Hybrid or Rev Hybrid: 5 step process |

| 4.2.2 | Five-Year Election to exclude the allocation of all deferred tax expenses and benefits to CFCs, PEs, Hybrids and Rev Hybrids |

| 4.2.3 | Exclusion of Blended CFC Tax Regime deferred tax assets or liabilities from transition rules |

| 5.2.2 | Determining GloBE status when a Flow-through Entity is held directly by another Flow-through Entity |

| 5.3.2 | Non-group owners: Partially owned Flow-through Entities |

| 5.3.5 | Non-group owners: Indirect minority ownership |

| 5.4.2 | Taxes allocated to a flow through entity |

| 5.5.2 | Hybrid entities – Taxes pushed down include indirect owners |

| 5.5.4 | Hybrid entities – Entities located in jurisdictions without a Corporate Income Tax system |

| 5.6.2 | Extension of taxes pushed down to include Reverse Hybrids |

| 6.1.4 | Option to exclude a Securitization Entity from scope of QDMTT |

| 6.1.4 | Option to not impose top-up tax liabilities on SPVs used in securitization transactions |

| 6.1.4 | Amendments to the Switch-Off Rule |

| 6.1.4 | New definition: Securitization Entity |

| 6.1.4 | New definition: Securitization Arrangement |

| January 2025 OECD Administrative Guidance | |

| 1 | Application of the Article 9.1 transitional rules, primarily in relation to deferred tax assets (DTAs) arising from tax benefits provided by General Government after November 30, 2021 |

| January 2025 OECD Administrative Guidance | |

| 1 | Administrative Guidance on the data that MNE Groups will rely on to complete the GIR (Articles 8.1.4 and 8.1.5 of the OECD Model Rules) |

| January 2025 OECD Administrative Guidance | |

| 1 | Central Record of Legislation with Transitional Qualified Status |

| January 2026 of OECD Administrative Guidance | |

| Simplified ETR Safe Harbour | |

| 2 | Default Accounting Standard |

| 2 | Local Accounting Standard Rule |

| 2 | LFAS Carve out election for another Authorised Financial Accounting Standard |

| 2 | Election available for investment entities located in the same jursidiction as CEs (exc MOCEs) |

| Simplified Income | |

| 3.1 | Jurisdictional profit (or loss) before tax (FANIL + income tax expense) |

| Basic Adjustments | |

| 3.2 | Excluded dividends |

| 3.2 | Excluded entity gains or losses |

| 3.2 | Bribes/illegal payments |

| 3.2 | Penalties >250,000Euros |

| Industry Adjustments | |

| 3.3.1 | Excludes insurance company income in Article 3.2.9 + Election |

| 3.3.1 | Adjusted for Additional Tier One Capital/ Restricted Tier One Capital in Article 3.2.10. |

| 3.3.2 | Exclude qualified shipping income (inc ancillary shipping income) + Election |

| Conditional adjustments for Equity-reported Items | |

| 3.4.1 | Adjust for Equity-reported income (Included Revaluation Method Gain or Losses (Article 3.2.1(d)); and Prior Period Errors and Changes in Accounting Principle (Article 3.2.1(h)). |

| M&A Simplification and Fair-value election | |

| 3.4.2 | Remove the GloBE-to-book Difference attributable to an M&A Transaction |

| 3.4.2 | Apply Art 6.3.4 (Fair value election) changes if made |

| Optional Adjustment Elections | |

| 3.5.1 | GloBE elections made |

| 3.5.1 | Non-Material Constituent Entities Simplified Calculation |

| Optional exclusions + Elections | |

| 3.5.2 | Include adjustment for Asymmetric Foreign Exchange Currency Gain or Loss (Article 3.2.1(f)); |

| 3.5.2 | Include accrued Pension Expense (Article 3.2.1(i) |

| Simplified Taxes | |

| 4 | Total jurisdictional income tax expense (current and deferred tax) |

| Policy Based Adjustments | |

| 4 | Current or deferred tax expense attributable to a tax that is not a Covered Tax |

| 4 | Tax refunds and credits under Article 4.1.3 (b) and (c)) |

| Correlation adjustments | |

| 4 | Reduced by any tax expense associated with income not included in Simplified Income |

| Uncertain taxes/taxes not paid | |

| 4 | Accruals and payments of uncertain tax positions under Articles 4.1.2(c) and 4.1.3(d) |

| 4 | Reduced by current tax expenses not expected to be paid within 3 years under Article 4.1.3(e) |

| 4 | Adjusted for accrual or reversal of uncertain tax positions and taxes on distributions (Article 4.4.6) |

| Deferred Tax adjustments | |

| 4 | Recast deferred tax to 15% |

| 4 | Exclude valuation allowances, or accounting recognition adjustments |

| 4 | Adjust for for changes in the income tax rate, under Article 4.4.1(d) |

| 4 | Exclude the DTL recapture rules |

| Optional Adjustment Elections | |

| GloBE elections made | |

| Non-Material Constituent Entities Simplified Calculation + Election | |

| 4.4 | Include any Covered Taxes accrued as an expense but not included in income tax expense in the accounts + Election |

| 4.4 | Covered Taxes related to an Equity-reported Item of income that is included in Simplified Income or Loss + Election |

| 4.4 | Inclusion of QRTCs or MTTCs + Election |

| 4.4 | Substance-based Tax Incentive Safe Harbour + Election |

| 4.4 | GloBE Loss election |

| Transitional year adjustments | |

| 4.5 | Apply any adjustments in transitional years from Articles 9.1.1 to 9.1.3 of the Model rules |

| 4.6 | Tax adjustments after year end |

| 4.6 | Change in Covered Tax liability accrued after the end of a Fiscal Year, included in the accrual year + Election |

| 4.3 | Simplified Adjustment for Negative Taxes in Simplified Loss year + Election |

| Cross Border Adjustments | |

| 5.1 | Allocate covered taxes of a flow though entity in accordance with Article 4.3.2(b) of the Model rules |

| 5.1 | Exclude covered taxes allocable from a Main Entity to a PE or from a Constituent Entity-owner to a subsidiary Constituent Entity (ie CFCs, Hybrids, reverse hybrids and WHT – aside from domestic WHT) under Article 4.3.2(a), (c), (d), or (e) |

| 5.1 | PE Simplification election |

| 5.1 | Election to include allocated taxes under 4.3.2 (a),(c), (d) or (e) |

| Transfer Pricing Adjustments | |

| 5.2 | Adjust simplified taxes for a change in taxes relating to a TP taxable income adjustment in the Fiscal Year in which it accrued |

| 5.2 | Election to include TP taxable income adjustments |

| Tax Neutral UPEs | |

| 6.1 | Adjust simplified taxes in accrodance with Art 7.1 of the Model rules (flow-through UPE) |

| 6.1 | Adjust simplified taxes in accrodance with Art 7.3 of the Model rules (UPE subject to a deductible dividend regime) |

| 6.2 | Tax Transparent Entities |

| 6.3 | Investment Entity Tax Transparency Election |

| 7.1 | Exclusions (Stateless, certain investment entities and where a Eligible Distribution Tax System election is in place and there is an outstanding balance of the Deemed Distribution Tax Recapture Account. |

| 7.2 | Entry and Re-entry criteria |

| 7.3 | Integrity Rules |

| 7.4 | Commencement Date ( 31/12/2026 but 31/12/2025 in certain cases) |

| Extension of Transitional CbCR Safe harbour | |

| Substance-based Tax Incentive Safe Harbour | |

| General application (difference in Top-up tax) | |

| QTI definition | |

| Increase in adjusted covered taxes | |

| Amount of QTI used | |

| Substance cap | |

| Commencement (01/01/2026) | |

| Side-by-Side Safe Harbour | |

| General appliction | |

| Commencement (01/01/2026) | |

| UPE Safe Harbour | |

| General appliction | |

| Commencement (01/01/2026) |

If you haven’t got a subscription you can join up below.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |