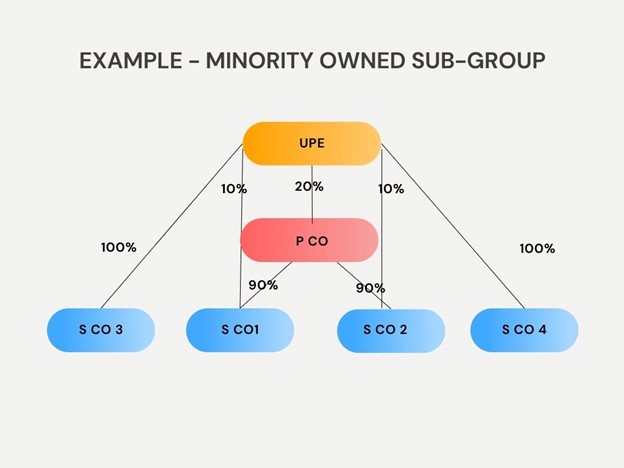

Minority owned sub-groups (defined as a minority owned parent entity and its minority owned subsidiaries) are treated as a separate MNE group. Therefore, the adjusted covered taxes and GloBE income of the minority owned sub-group are excluded from the jurisdictional GloBE ETR calculation for the rest of the MNE group and any top up tax is calculated separately.

A minority owned entity is an entity where the UPE owns 30% or less of the ownership interest but the UPE holds the controlling interest. The 30% ownership test takes account of both direct and indirect ownership.

This can result in an MNE group having to calculate more than one ETR in a jurisdiction.

Example

UPE is the ultimate parent entity of an MNE group within the scope of the Pillar Two GloBE rules. It has a group structure of:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |