Jersey to implement an IIR and QDMTT from January 1, 2025

On May 22, 2024, Jersey announced it will be implementing an Income Inclusion Rule (IIR) and a new standalone multinational corporate income tax for accounting periods beginning on or after January 1, 2025.

Denmark GloBE Guide Updated for the Draft Law of April 30, 2024

On April 30, 2024, a Draft Law to amend the Danish Minimum Taxation Act was submitted to the Danish Parliament. This implements additional aspects of the OECD Administrative Guidance.

Isle of Man Announces QDMTT From 2025

On May 20, 2024, the Isle of Man Government issued a press release stating it intends to introduce a Qualified Domestic Minimum Top-Up Tax (QDMTT) with effect from January 1, 2025.

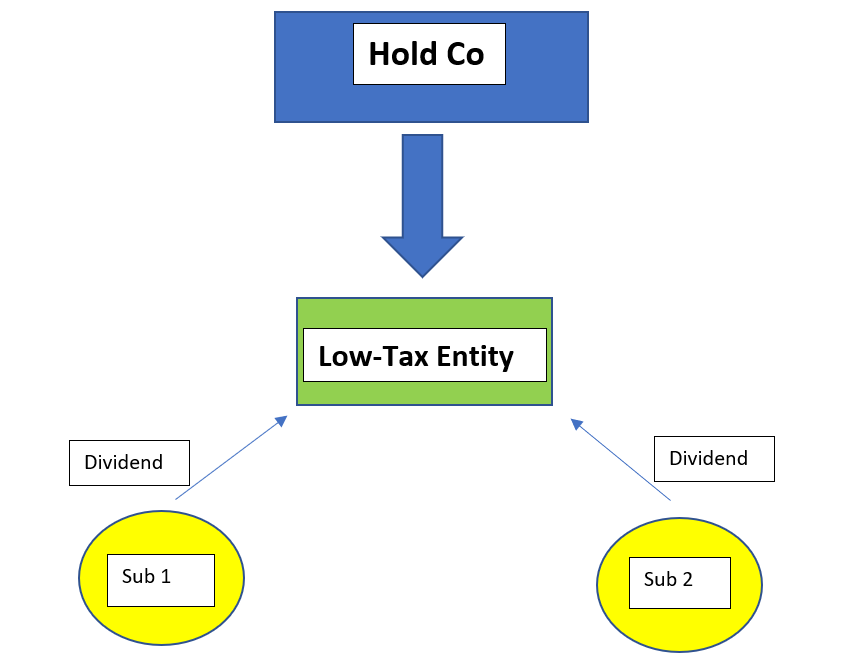

Reviewing MNE Group Structures for Profit Extraction after Pillar Two

The specific treatment of dividends and other distributions under the Pillar Two GloBE Rules raises some interesting issues and opportunities in blending such payments between otherwise low-taxed entities and holding companies to reduce any potential top-up tax liability.

Kenya Includes a Domestic Minimum Tax in its 2024 Finance Bill

On May 13, 2024, the Finance Bill, 2024 was sent to the Kenyan Parliament. It includes provisions to introduce a 15% domestic minimum top-up tax from January 1, 2025.

Data Points For the Transitional CbCR Safe Harbour

The Transitional CbCR Safe Harbour is a short-term measure that will allow an MNE to avoid undertaking detailed GloBE calculations for a jurisdiction if certain requirements are met. Data will need to be extracted from the CbC Report, financial statements and ERP and EPM systems. Group structure information will also be required.

Estonia’s Pillar Two Law Enacted: Updated GloBE Guide

On May 2, 2024, the Estonian Official Gazette enacted the ‘Act supplementing the Tax Information Exchange Act, the Tax Administration Act and the Income Tax Act’ to implement Article 50 of the EU Minimum Tax Directive.

Updated GloBE Guide: Canada

Analysis of the implementation of the Pillar Two GloBE rules for Canada, updated for the Budget Implementation Bill, 2024, No. 1, issued on April 30, 2024.

Why Decentralized Data Management is required for Pillar Two

Whether multinationals adopt a centralized or decentralized approach to Pillar Two will be one of the key factors in correctly establishing the systems and architecture to collect, manage, analyse and store source data for the Pillar Two effective tax rate and top-up tax calculation.

GloBE Country Guide: Poland

On April 25, 2024, the Polish Ministry of Finance issued a draft law to implement the EU Minimum Tax Directive into domestic law. Read our review of the draft law.