GloBE Country Guide: Estonia

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Estonia. Updated for the Draft Law of February 8, 2024.

Estonia Issues Draft Pillar 2 Law Including Art. 50 Postponement

On February 8, 2024, the Government approved the ‘Act supplementing the Tax Information Exchange Act, the Tax Organisation Act and the Income Tax Act’ which includes provisions to implement Article 50 of the EU Minimum Tax Directive.

English Translation of Estonia’s Global Minimum Tax Law

English Translation of Finland’s Global Minimum Tax Law

GloBE Country Guide: Lithuania

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Lithuania. Updated for the Draft Law of October 27, 2023.

GloBE Country Guide: Latvia

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Latvia. Updated for the Draft Law of January 30, 2024

Latvia Issues Draft Pillar Two Law & Confirms Postponement

On January 30, 2024, a draft law to implement the EU Minimum Tax Directive (and delay the application of the GloBE rules until 2030) was approved by the Latvian Cabinet of Ministers.

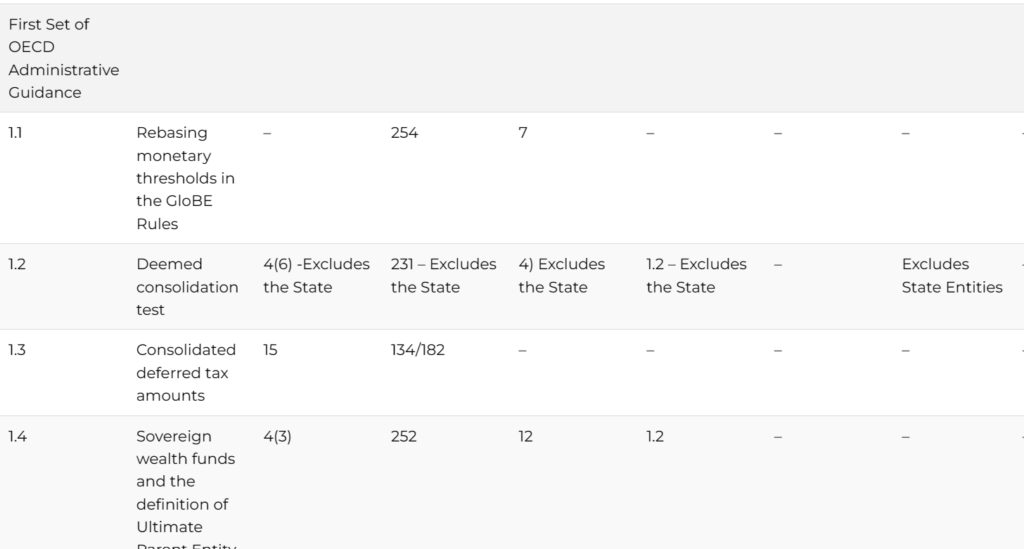

Domestic Pillar Two Laws: Mapping Matrix – Updated

We have tracked the draft and enacted domestic laws issued to date to the OECD Model Rules. This will be constantly updated as new or amended legislation is issued.

GloBE Country Guide: Austria

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Austria for accounting periods beginning on or after 31 December, 2023. Updated for the Minimum Taxation Reform Act published in Austrian Federal Law Gazette No. 187/2023 on December 30, 2023.

EU Commission Issues Infringement Decisions Against 9 Member States For Not Enacting Pillar 2

On January 25, 2024, the EU Commission announced infringement decisions against EU member states that have not enacted domestic law to implement Pillar 2.

GloBE Country Guide: Spain

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Spain for accounting periods beginning on or after 31 December, 2023.