Germany Releases its Group Parent Notification Form for German Minimum Tax Groups

On October 17, 2024, Germany released its Group Parent notification form for German minimum tax groups. Section 3 of the German GMT law provides that the Group Parent of the German minimum tax group is required to register with the Federal Tax Authority within 2 months of the end of the relevant fiscal period (ie February 28, 2025 for the 2024 fiscal year).

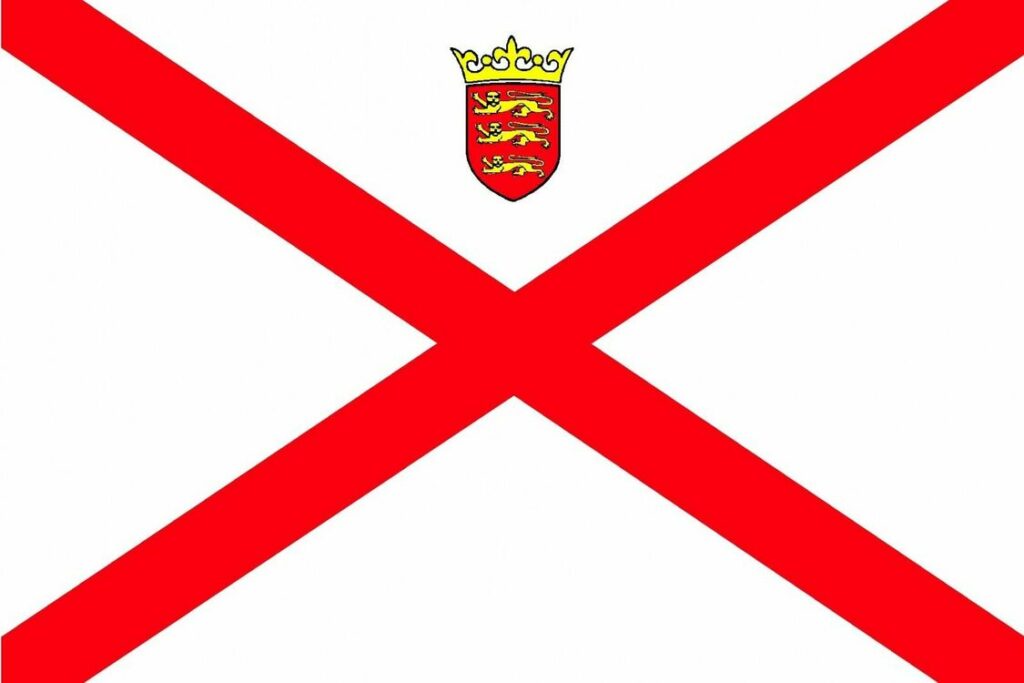

Jersey Enacts Law for the IIR and the MCIT

On October 22, 2024, Jersey enacted the Multinational Corporate Income Tax (Jersey) Law 202 and the Multinational Taxation (Global Anti-Base Erosion – IIR Tax) (Jersey) Law 202 to provide for the IIR and MCIT from January 1, 2025.

Lithuania GloBE Country Guide Updated for Latest Draft Law

On September 19, 2024, the Lithuanian government launched a public consultation on a draft law to fully implement the OECD’s Pillar Two Model Rules. Read our updated GloBE Country Guide.

France GloBE Country Guide Updated for the 2025 Finance Bill

On 10 October 2024, the French Government presented the draft Finance Bill for 2025 to Parliament. This includes amendments to its General Tax Code to reflect the OECD Administrative Guidance. Read our updated GloBE Country Guide.

Belgium Issues a Draft 7 Page QDMTT Return for Consultation

On October 18, 2024, Belgium issued a draft 7-page QDMTT Return for consultation. The consultation lasts until November 8, 2024.

Ireland GloBE Country Guide Updated for the 2024 Finance Bill

On October 10, 2024, Ireland published its 2024 Finance Bill. In the Bill, a number of amendments are made to the Global Minimum Tax provisions. Our Ireland GloBE Country Guide has been updated for relevant changes.

Portugal Approves Pillar 2 Law, Bahamas and Cyprus Table Legislation in Parliament

On October 18, 2024, the Portuguese Parliament approved a law to introduce the EU Minimum Tax Directive into domestic legislation, whilst on October 16, 2024 and October 18, 2024 (respectively), the Bahamas and Cyprus tabled legislation in Parliament to implement Pillar Two.

The Impact of the Different ETR Calculation for Investment Funds

The Pillar Two effective tax rate (ETR) calculation for investment entities is similar to the standard ETR calculation, however, there is an important twist in that the top-up tax is adjusted for minority interests. There is no adjustment for minority interests under the standard ETR calculation. In this article we look at the impact of this.

Ireland Includes GMT Amendments in its 2024 Finance Bill

On October 10, 2024, Ireland published its 2024 Finance Bill. In the Bill, a number of amendments are made to the Global Minimum Tax provisions.

Singapore Issues Draft Legislation for OECD Safe Harbours

On October 4, 2024, Singapore issued a Consultation document on the GloBE Safe Harbours (Transitional Country-by-Country Reporting (“CbCR”) Safe Harbour, QDMTT Safe Harbour and the Simplified Calculations Safe Harbour), as well as other aspects of the OECD Administrative Guidance.