Bermuda Issues a Consultation for CIT Administrative Rules

On August 8, 2024, the Bermuda Ministry of Finance issued a consultation on the administrative provisions for the new corporate income tax that is to apply from 2025

Turkey Enacts its Pillar Two Law

The “Law on the Amendment of Tax Laws and Certain Laws” was published in the Turkish Official Gazette on August 2, 2024. Articles 37 – 50 of the Law include provisions to implement the GloBE rules in domestic law from January 1, 2024. This includes the IIR, UTPR and a domestic minimum top-up tax.

South Korea’s 2024 Tax Law Amendment Bill Includes Pillar 2 Updates

On July 25, 2024, the Ministry of Economy and Finance issued the 2024 Tax Law Amendment Bill. This includes a number of amendments to the South Korean global minimum tax law to reflect aspects of the OECD Administrative Guidance.

UK Issues Draft Legislation for the Hybrid Arbitrage Anti-Avoidance Rule

On July 29, 2024, the UK government issued draft legislation for the implementation of the Pillar Two anti-avoidance rules targeting Hybrid Arbitrage Arrangements.

Israel to Apply a QDMTT from 2026

On July 29, 2024, the Israeli Ministry of Finance announced it will implement a QDMTT from January 1, 2026. The IIR and UTPR will not be introduced at that point and further consideration will be given to their implementation after a review of the effectiveness of the QDMTT.

Denmark GloBE Country Guide: Updated for June 2024 Amending Law

On June 11, 2024, Law No. 684 was published in the Danish Official Gazette. This implements additional aspects of the OECD Administrative Guidance.

English Translation of Turkey’s Global Minimum Tax Law

English Translation Turkey’s draft Global Minimum Tax Law

GloBE Country Guide: Turkey

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Turkey for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation submitted to the Turkish Parliament on July 16, 2024.

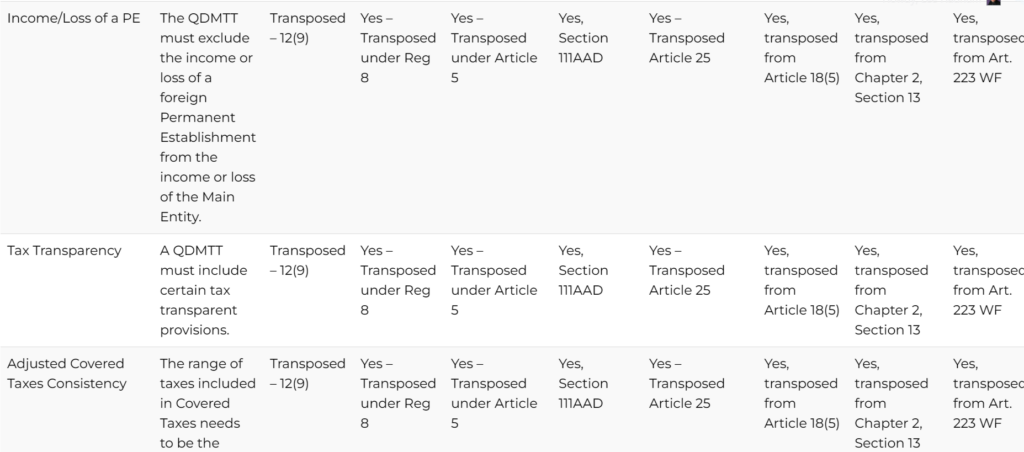

QDMTT Legislative Tracker: Updated to July 19, 2024

Updates to our QDMTT Legislative Tracker to include domestic QDMTT legislation released up to July 19, 2024.

GloBE Country Guide: Portugal

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Portugal for accounting periods beginning on or after January 1, 2024. Updated for the draft law issued on July 10, 2024.