In scope-MNEs or groups that could potentially come within the scope of Pillar Two now have an additional ‘layer’ of tax law to consider.

Not only will they need to consider the domestic corporate income tax treatment of the income flows for their group entities and the impact of double tax treaties and other similar agreements, but they also need to consider the Pillar Two impact.

Pillar Two effectively represents an entire new sub-set of tax rules that apply to calculate GloBE income and adjusted covered taxes, the jurisdictional ETR calculation and the top-up tax calculation.

These rules do not tie into the domestic corporate income tax rules, hence why the favoured approach from the legislation we’ve seen to date, is for the Pillar Two rules to be included in separate legislation.

As such, going forward, Pillar Two considerations will become an integral part of the analysis of the international tax implications of global structuring for MNE groups.

For instance, avoiding excess ETR capacity in one jurisdiction whilst having a sub 15% ETR in another would be highly attractive.

The ETR is driven not just by the tax payable but by the Pillar Two definition of income (GloBE income). Therefore, minimising GloBE income by ensuring that any reliefs provided in the Pillar Two Rules (as enacted in domestic legislation) will avoid the ETR being unnecessarily pushed down.

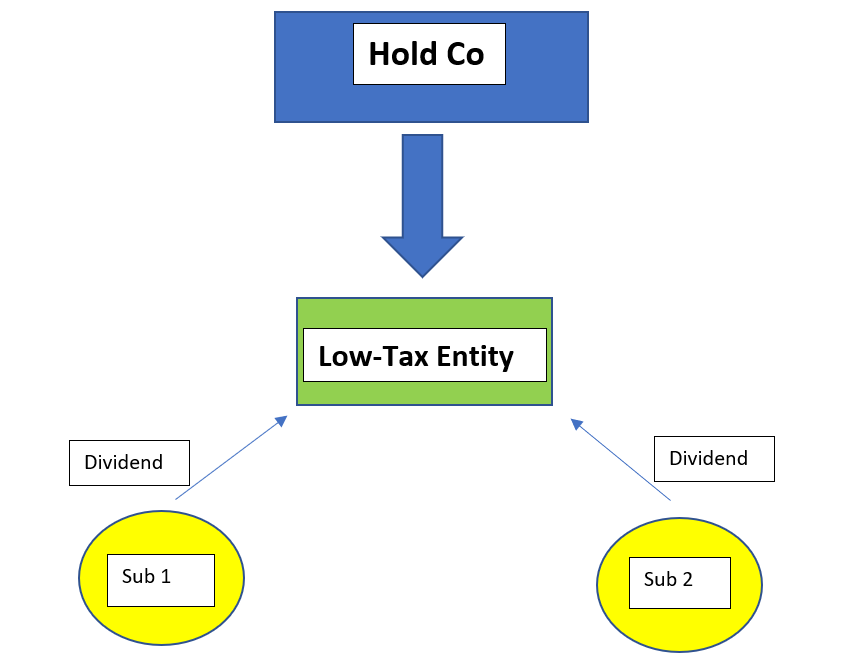

The specific treatment of dividends and other distributions under the Pillar Two GloBE Rules raises some interesting issues and opportunities in blending such payments between otherwise low-taxed entities and holding companies to reduce any potential top-up tax liability.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |