R&D is a common tax incentive provided by jurisdictions. The question for the purposes of Pillar Two is to what extent it will lead to a reduction in the GloBE effective tax rate, and potentially lead to additional top-up tax.

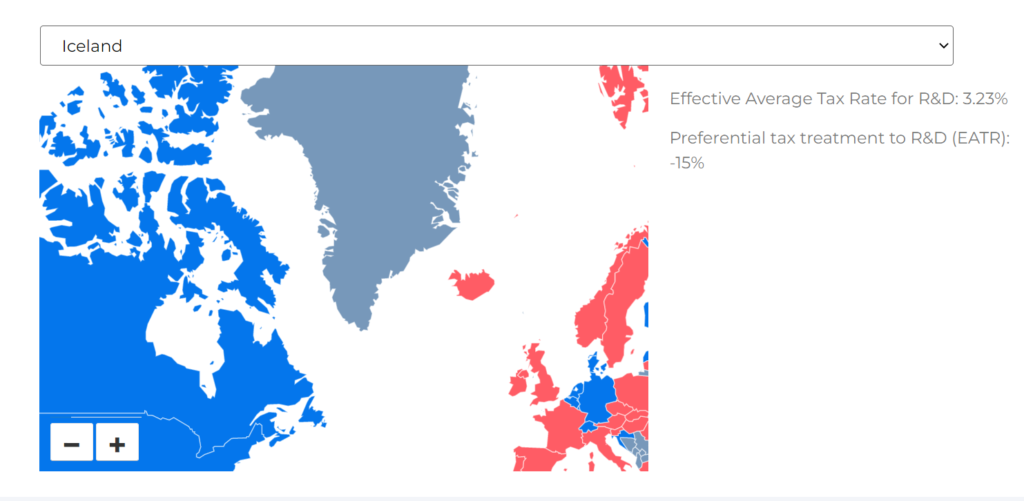

Our Global R&D Effective Tax Rate Map highlights two metrics on a jurisdictional basis:

Firstly, the Effective Average Tax Rate for R&D; and

Secondly, the Preferential Tax Treatment Rate for R&D. This aims to determine by how much R&D tax incentives reduce the tax payable on R&D investments.

If you haven’t got a subscription you can join up below.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |