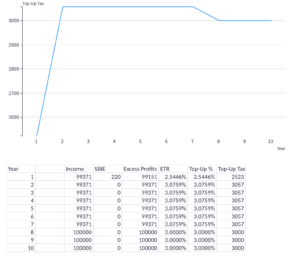

For the purposes of the Pillar Two Global Minimum Tax, when investments are made in tangible fixed assets there is an overlap between the deferred tax impact of any accelerated capital allowances and the reduction in the top-up tax obtained by the substance-based income exclusion.

The initial debit to the tax expense in the P&L on the creation of the deferred tax liability increases the Pillar Two effective tax rate (ETR). This can be a significant increase depending on the amount of the investment, the level of profits and the tax rate (recast to the 15% rate if this is lower).

The substance-based income exclusion doesn’t tie into the ETR calculation but does impact on the amount of top-up tax payable as it reduces the GloBE income (ie profits) that are subject to top-up tax.

In some cases, the deferred tax increase on the creation of the liability may push the ETR above 15% in any case, with no benefit being gained from the substance-based income exclusion.

Our modelling tool allows you to adjust the variables (including GloBE Income/Profits, the amount of tangible asset investment, the tax rate and the period over which the asset is depreciated) to model the consolidated impact of deferred tax and the substance-based income exclusion.

The tool is free for members.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |