Bulgaria Gazettes its 2025 Budget Law which Includes Numerous Changes to the Global Minimum Tax Regime

On March 27, 2025, Bulgaria’s 2025 State Budget Law (the ‘2025 Budget Law’) was published in the Official Gazette. This includes a number of changes to the Corporate Income Tax Law to amend the Global Minimum Tax provisions from January 1, 2024.

Insurance Investment Entities and Pillar Two

Insurance Investment Entities are subject to special treatment under the Pillar Two GloBE Rules. Read our analysis of the key provisions.

Italy Issues Decree for Double Filing Relief Notification Under the Pillar 2 Rules

On March 6, 2025 a Decree of the Italian Ministry of Finance on Notification Requirements for Global Minimum Tax purposes was published in the Official Gazette. This provides more details on the double filing relief notification under Article 51(4) of Legislative Decree December 27, 2023, no. 209 (the Global Minimum Tax Law).

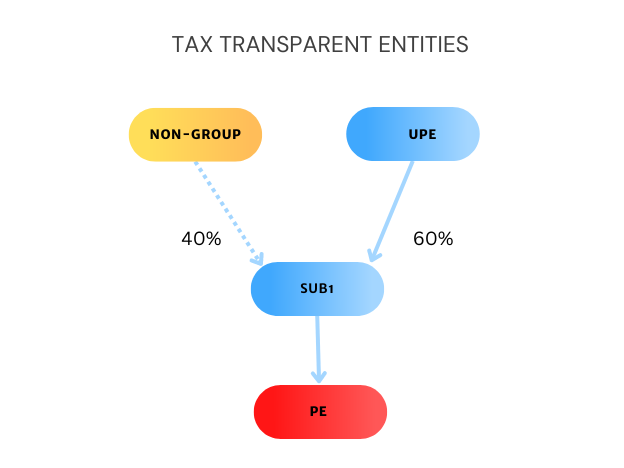

The Treatment of Tax Transparent Entities Under Pillar Two

The Pillar Two Rules include specific provisions for tax transparent entities to avoid artificially low effective tax rates and significant top-up tax, particularly for tax transparent UPEs.

The Impact of Pillar 2 on Group HR/Payroll Companies

Centralized HR/payroll companies are frequently used by MNE groups but raise specific issues in relation to the Pillar Two GloBE Rules. In particular, the impact of using a centralized function and the nature of recharges could have an impact on the substance-based income exclusion of group entities.

Territorial Tax Systems and Pillar Two

Jurisdictions that apply a territorial basis do not tax foreign source income. This raises some interesting issues in the application of the Pillar 2 rules.

Gibraltar Issues Simplification Measure for MNEs to Simplify Global Minimum Tax Compliance

On February 20, 2025, Gibraltar issued the Income Tax (Allowances, Deductions, and Exemptions) (Amendment) Rules 2025 to allow in-scope MNEs to just be taxed under the Global Minimum Tax Act, and not the Income Tax Act.

Interaction Between Bonus Depreciation and the Substance-Based Income Exclusion

In this article we look at the interaction between deferred tax on bonus depreciation and the substance-based income exclusion on investments in tangible assets.

French 2025 Finance Act Includes Pillar 2 Changes for OECD Administrative Guidance

On February 15, 2025, Law 2025-127 of February 15, 2025 (the 2025 Finance Act) was published in the French Official Gazette. This includes a number of amendments to the Pillar 2 regime from December 31, 2024.

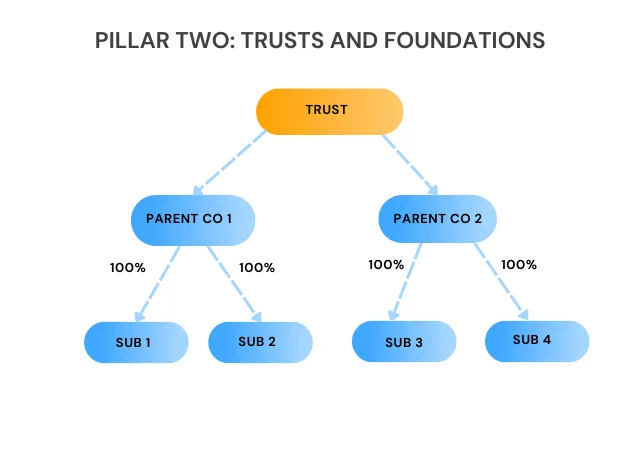

Pillar Two: Trusts & Foundations

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’. This means that the Pillar Two GloBE rules can apply to both trusts and foundations.