Malta Enacts EU Minimum Tax Directive With Art. 50 Postponement

On February 20, 2024, the Maltese Government issued Legal Notice 32 of 2024 which enacts the EU Minimum Tax Directive with the Article 50 postponement.

OECD Issues Final Rules for Amount B Under Pillar One

On February 19, 2024, the OECD published its final report on Pillar One Amount B, aimed at providing a simplified and streamlined approach to the application of the arm’s length principle to baseline marketing and distribution activities.

Renegotiating Tax Stabilization Agreements For Pillar Two

In this article we look at the impact of Pillar Two on tax stabilization agreements, and the benefits of renegotiating agreements.

GloBE Country Guide: Estonia

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Estonia. Updated for the Draft Law of February 8, 2024.

Estonia Issues Draft Pillar 2 Law Including Art. 50 Postponement

On February 8, 2024, the Government approved the ‘Act supplementing the Tax Information Exchange Act, the Tax Organisation Act and the Income Tax Act’ which includes provisions to implement Article 50 of the EU Minimum Tax Directive.

English Translation of Estonia’s Global Minimum Tax Law

English Translation of Finland’s Global Minimum Tax Law

GloBE Country Guide: Lithuania

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Lithuania. Updated for the Draft Law of October 27, 2023.

GloBE Country Guide: Latvia

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Latvia. Updated for the Draft Law of January 30, 2024

Latvia Issues Draft Pillar Two Law & Confirms Postponement

On January 30, 2024, a draft law to implement the EU Minimum Tax Directive (and delay the application of the GloBE rules until 2030) was approved by the Latvian Cabinet of Ministers.

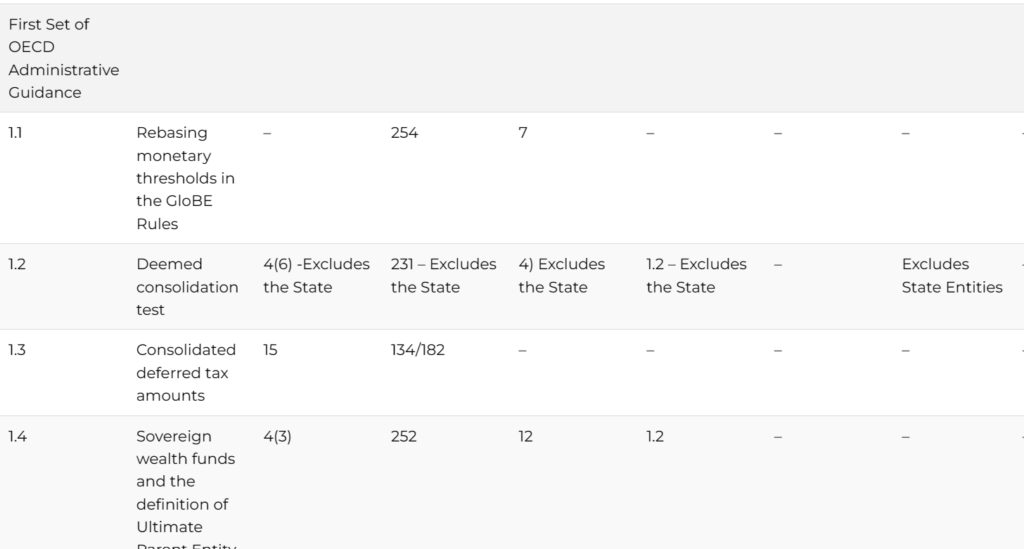

Domestic Pillar Two Laws: Mapping Matrix – Updated

We have tracked the draft and enacted domestic laws issued to date to the OECD Model Rules. This will be constantly updated as new or amended legislation is issued.