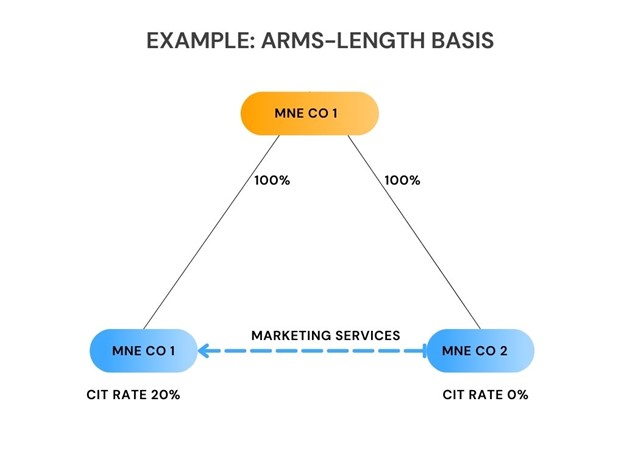

Pillar Two and Transfer Pricing

The Pillar Two Rules generally require transactions between entities located in different jurisdictions to be priced at an arms-length basis. However, special rules apply to unilateral transfer pricing adjustments given the risk of income either being taxed twice or not taxed at all.

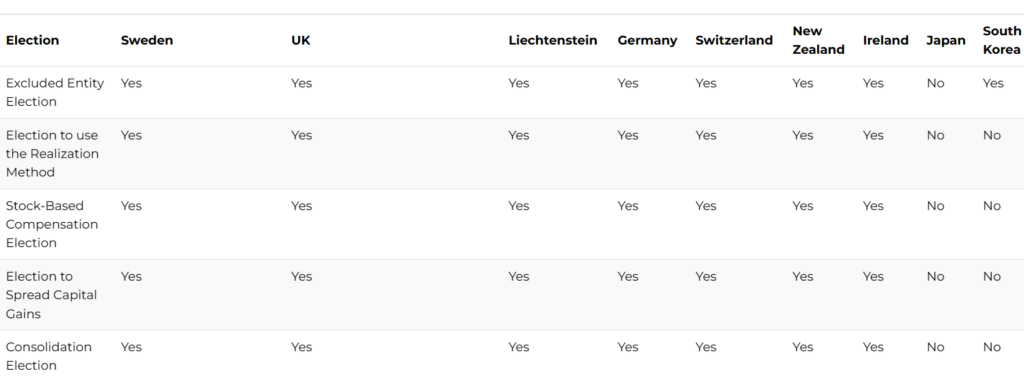

Pillar Two Elections: Jurisdictional Matrix

Use our jurisdictional matrix to track the domestic implementation of Pillar Two elections in the current domestic draft or enacted law.

Norway Issues Consultation and Draft Law For Pillar 2 Rules

Yesterday, the Norwegian Ministry of Finance launched a consultation (including draft legislation) on the implementation of the Pillar Two GloBE Rules in Norway.

IMF Recommends Extension of Kuwait’s CIT For GloBE Implementation

In yesterdays concluding statement of the IMF 2023 Article IV mission to Kuwait, the IMF recommended that the 15 percent corporate income tax should be expanded to cover domestic firms, to bring Kuwait into line with the GloBE rules.

IASB Proposing Amendments to IFRS For SME’s For Pillar 2 Rules

On June 1, 2023, the International Accounting Standards Board issued an Exposure Draft for Proposed Amendments to the IFRS for SMEs Standard to take account of the Pillar Two Rules.

The Netherlands Sends GloBE Minimum Tax Bill to Parliament

The Netherlands presented the Minimum Tax Bill, 2024 to Parliament yesterday. It implements an Income Inclusion Rule and a Qualified Domestic Minimum Top-Up Tax for financial years commencing on or after December 31, 2023. An Under-Taxed Profits Rule applies for financial years commencing on or after December 31, 2024.

Vietnam Planning Overhaul of Tax Incentive Regime for Pillar 2

It was reported last week that the Vietnamese Ministry of Planning and Investment is working on designing tax incentives to take account of the upcoming application of Pillar Two.

The Bahamas Issues a Policy Paper on a New CIT System, Including a QDMTT

Last week the Bahamian government released a Green Paper asking for feedback on four proposed strategies for the introduction of corporate income tax in the Bahamas, including a QDMTT.

Switzerland Issues Second Consultation on the GloBE Rules

Yesterday, Switzerland issued an updated Draft Decree for the Pillar Two Global Minimum Tax. This follows the previous Draft Decree that was subject to a public consultation.

Direct Transposition of the GloBE Rules: Different Approaches By Switzerland & New Zealand

Whilst both jurisdictions are opting for direct transposition of the OECD Model Rules, there is a key difference in how they are drafted.