New Zealands Approach to Pillar Two

There are features of the NZ regime that raise issues from a Pillar Two perspective. Some of these were addressed in a Pillar Two consultation document issued earlier this year. In this article we look at some of the key issues in the implementation of Pillar Two for New Zealand.

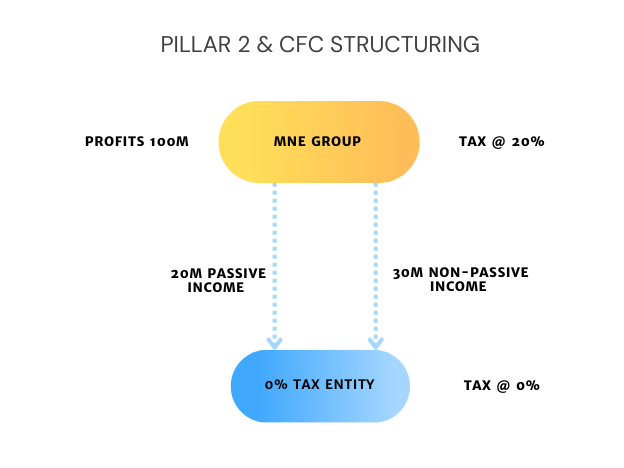

Profit Shifting to CFCs to Reduce Pillar 2 Top-Up Tax

Article 4.3.2(c) of the OECD Model Rules allocates tax paid on CFC income to the CFC entity (subject to a pushdown limitation). However, this leads to a situation where an MNE can reduce potential top-up tax by allocating more income to a CFC entity.

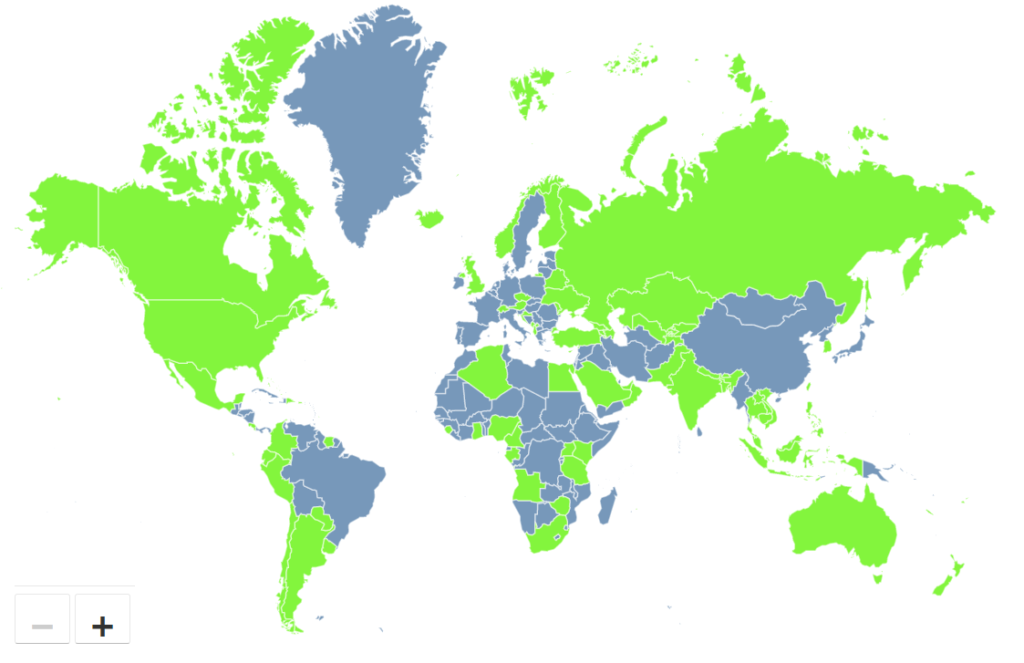

VAT on Digital Services Tracker: Updated

Our Global VAT on Digital Services Tracker has been updated and now covers over 80 jurisdictions.

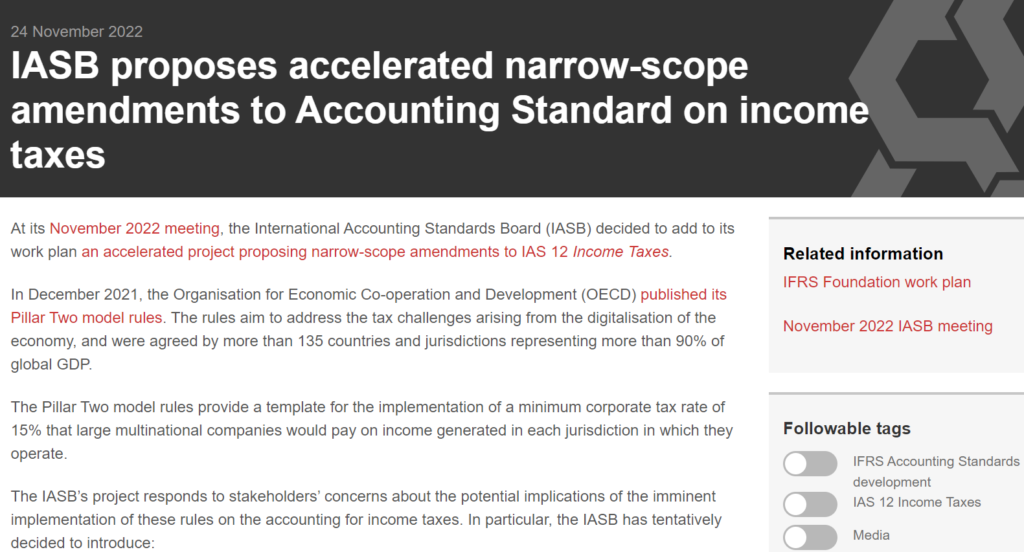

IASB Agrees to Amendments for Pillar Two Accounting

Whilst a number of the measures follow the proposals in the November Staff Paper, the prospect of certain other additional disclosures not previously suggested, has been put forward. In this article we review the IASB’s announcement and proposed changes.

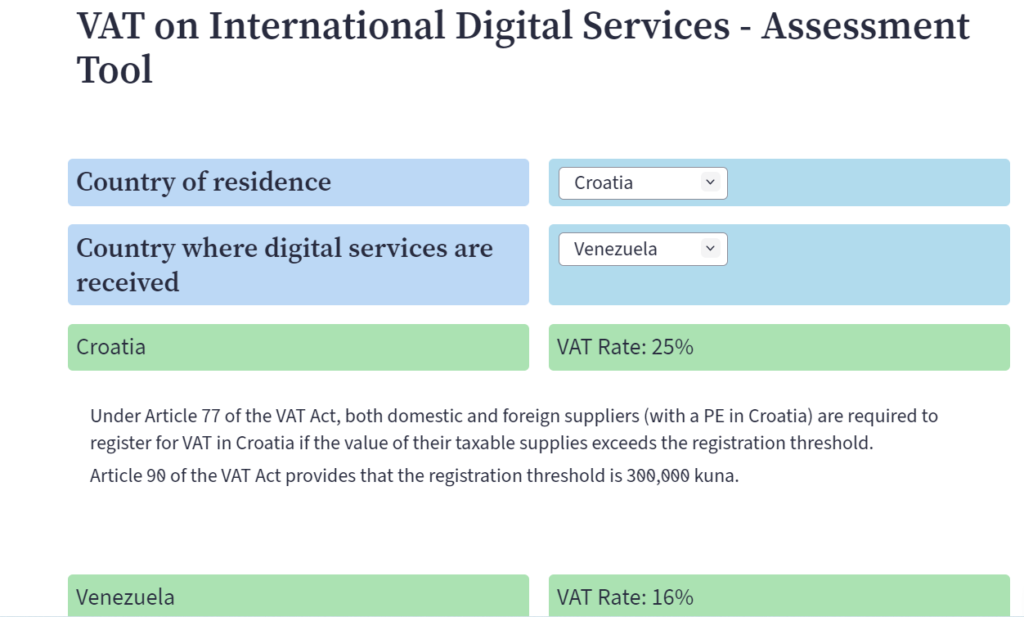

VAT on Digital Services: Global Assessment Tool

Use our global assessment tool to determine the VAT position on the provision of international digital services. The tool is fully cited to the relevant domestic law.

Luxembourg Private Debt Funds and Pillar Two

Luxembourg is home to the second largest funds industry in the world and the largest in Europe. In this article we look at the Pillar 2 impact on Luxembourg private debt funds.

Global R&D Effective Tax Rate Map

Use our Global map to determine the effective tax rate for R&D expenditure globally. Including the average R&D ETR per jurisdiction and the impact of incentives.

UK Pushes Forward With Pillar Two Implementation

Following draft legislation issued in July 2022, the UK government confirmed in this week’s Autumn Statement that they will legislate to implement Pillar Two from 2024 including the UTPR and a QDMTT.

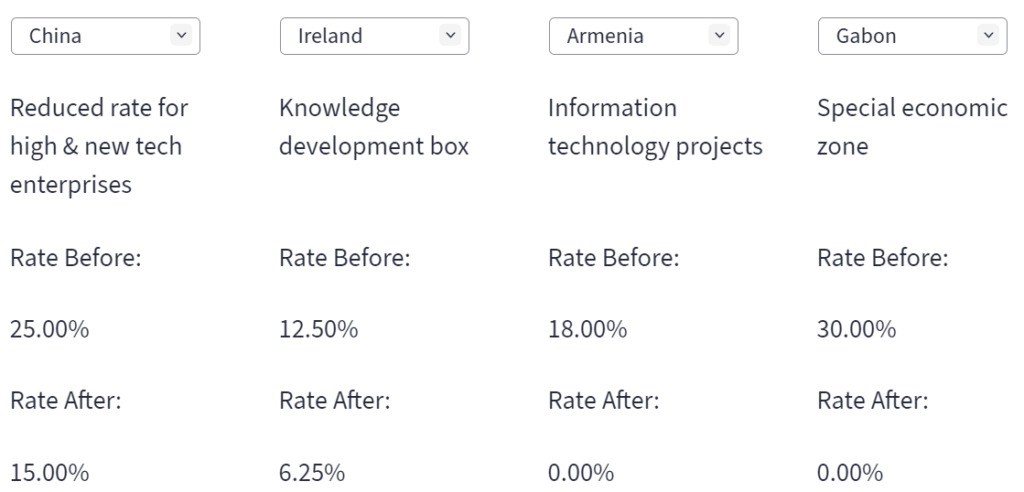

Global IP Tax Incentives Tool

Global intellectual property (IP) incentives have grown in recent years. Use our tool to compare different regimes.

Pillar 2 Insights From Yesterday’s OECD Corporate Tax Statistics Report

The OECD issued the Fourth Edition of its Corporate Tax Statistics report yesterday. The Press Release that accompanied the report stated that the report supported the need to press forward with the OECD Two-Pillar Solution to address base erosion issues. In this article we look at some of the key insights and highlights from the report.