Latvia Issues Draft Pillar Two Law & Confirms Postponement

On January 30, 2024, a draft law to implement the EU Minimum Tax Directive (and delay the application of the GloBE rules until 2030) was approved by the Latvian Cabinet of Ministers.

On January 30, 2024, a draft law to implement the EU Minimum Tax Directive (and delay the application of the GloBE rules until 2030) was approved by the Latvian Cabinet of Ministers.

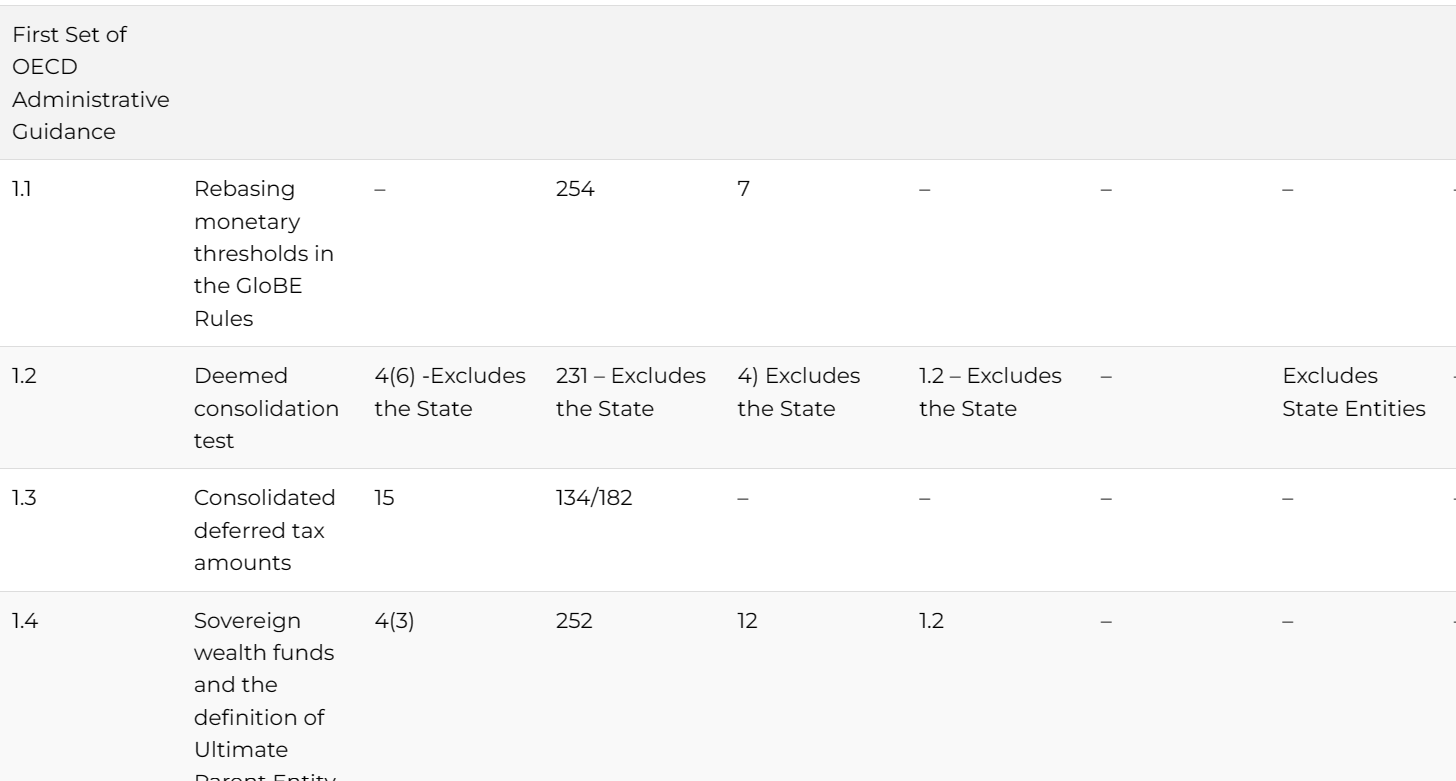

We have tracked the draft and enacted domestic laws issued to date to the OECD Model Rules. This will be constantly updated as new or amended legislation is issued.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Austria for accounting periods beginning on or after 31 December, 2023. Updated for the Minimum Taxation Reform Act published in Austrian Federal Law Gazette No. 187/2023 on December 30, 2023.

On January 25, 2024, the EU Commission announced infringement decisions against EU member states that have not enacted domestic law to implement Pillar 2.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Spain for accounting periods beginning on or after 31 December, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Slovakia for accounting periods beginning on or after 31 December, 2023. Updated for Act No. 507/2023 of December 23, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Czech Republic for accounting periods beginning on or after 31 December, 2023. Updated for Law 416/2023 published in the Official Gazette on December 29, 2023.

Tax incentives for R&D are a common way for a jurisdiction to attract foreign direct investment (FDI).

In this article we look at the financial accounting, domestic tax and Pillar Two treatment of some of the key incentives offered including a deduction, capitalized treatment, a super deduction, tax credits and patent boxes or other similar arrangements.

The Polish Ministry of Finance has stated that Poland will begin the legislative process to implement Pillar 2 in the first quarter of 2024, with the rules to be effective from January 1, 2025.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Croatia for accounting periods beginning on or after 31 December, 2023. Updated for Law No 155/23, of December 22, 2023.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |