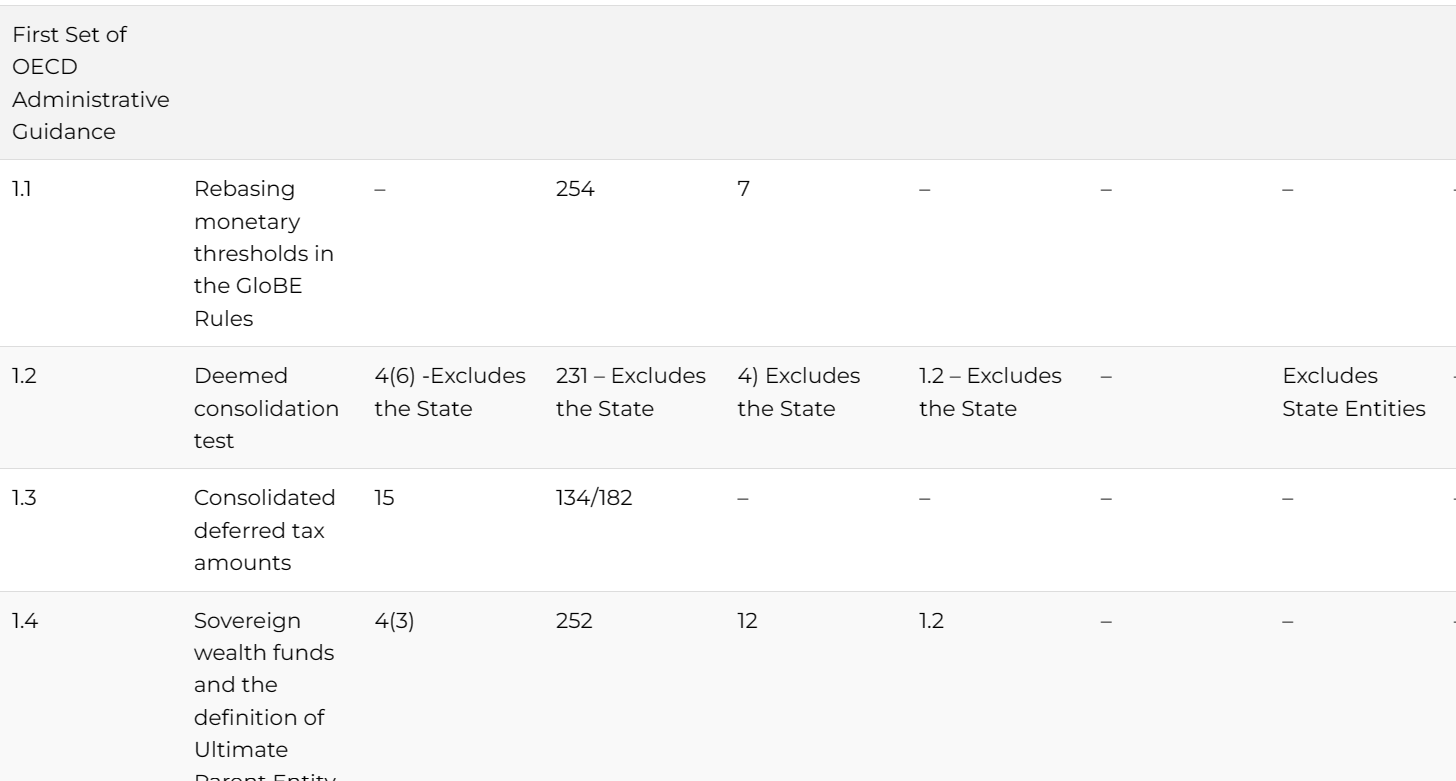

OECD Administrative Guidance: Domestic Implementation Matrix

We have tracked the draft and enacted domestic laws issued to date back to both sets of OECD Administrative Guidance in this matrix for our members. This will be constantly updated as new or amended legislation is issued.