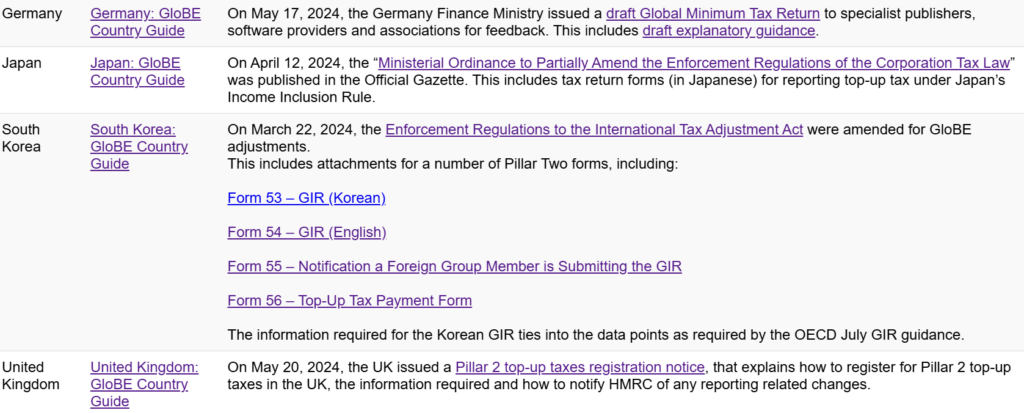

Links to all Domestic Pillar 2 Returns and Notifications.

The Pillar Two Global Minimum Tax includes a significant compliance burden for in-scope MNEs.

Not only is there a requirement to file GloBE Information Returns (GIRs) for each constituent entity in a jurisdiction (unless the filing requirement is met by a Designated Filing Entity, a Designated Local Entity or the Transitional Simplified Reporting Election applies), but jurisdictions also require other Pillar Two compliance forms.

This can include a requirement to register locally for Pillar Two purposes, domestic Pillar Two tax returns to impose the Pillar Two liability, payment forms as well as other related notification forms (eg a notification form to appoint a foreign group member to submit the GIR).

We keep track of all domestic Pillar Two forms issued to date, including links to domestic forms and notices for each relevant jurisdiction.

If you haven’t got a subscription you can join up below.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |