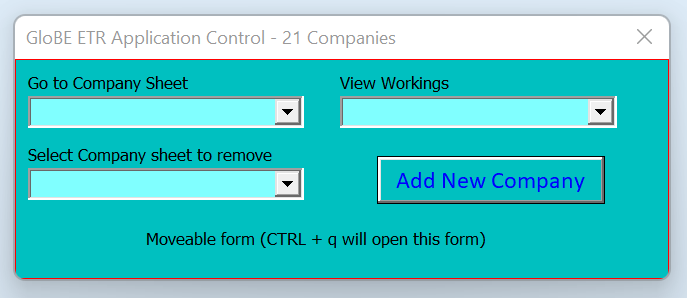

GloBE Top-Up Tax Modelling Tool – Unlimited Companies

Calculate estimated GloBE top-up tax. Add unlimited companies and jurisdictions via an easy to use control panel to view potential jurisdictional liabilities.

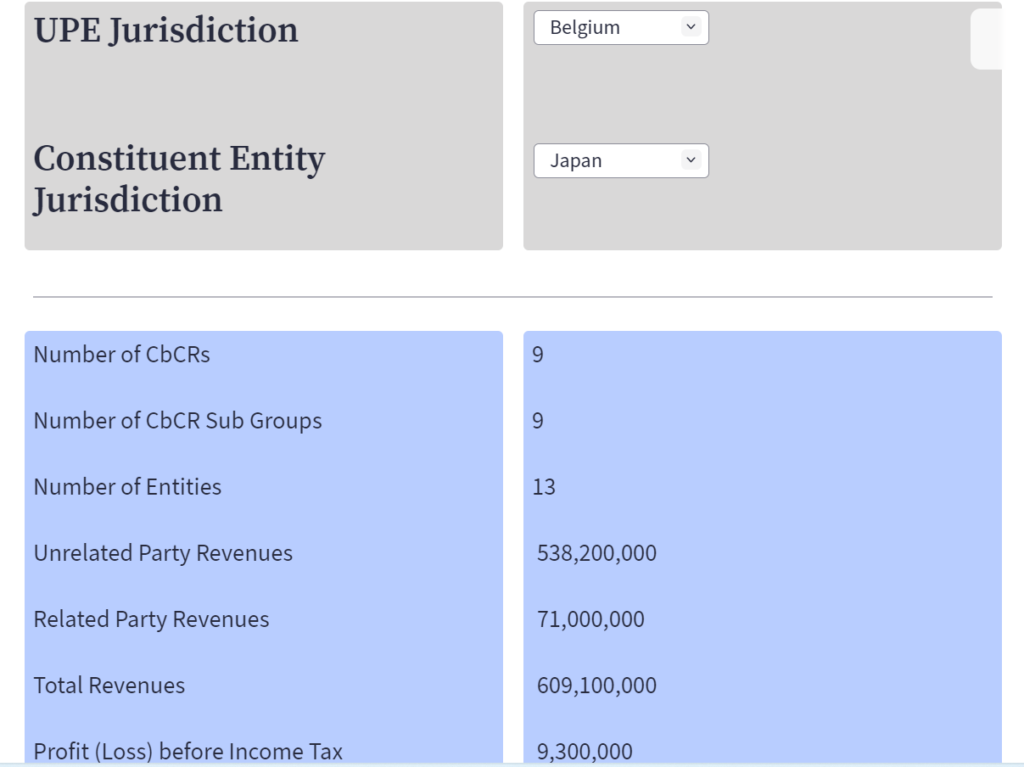

Updated Pillar 2 Modelling Tool – OECD CbC Data

Our Modelling Tool takes the underlying source data from the OECD aggregated CbC source data and subjects it to a data manipulation process to provide a drill down into some of the key metrics and data sources that are relevant for Pillar Two on a jurisdictional basis.

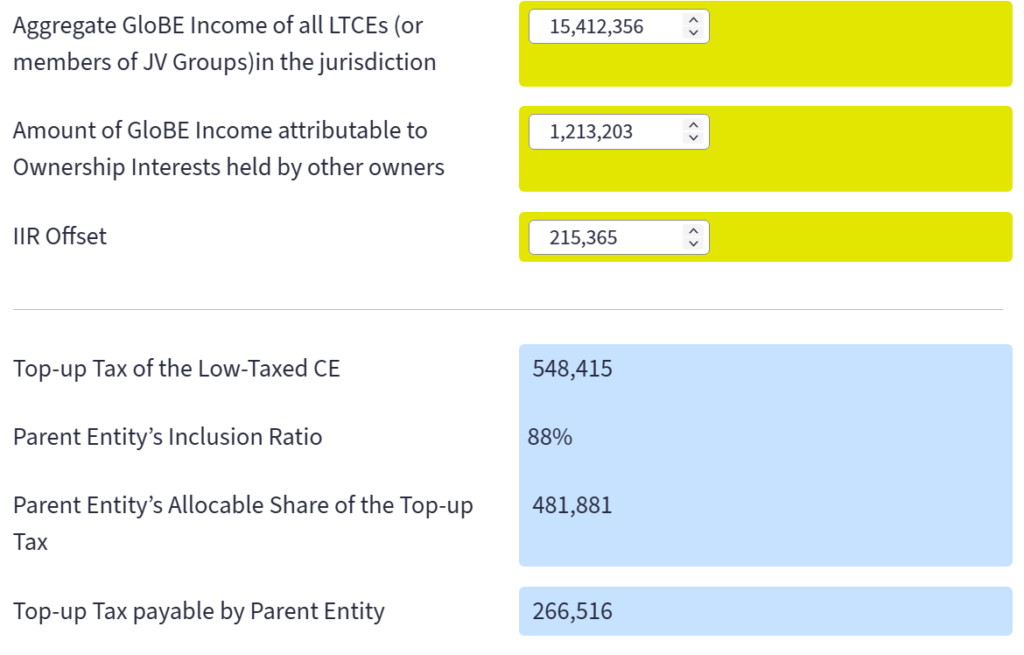

Income Inclusion Rule Calculator

Use our members Income Inclusion Rule Calculator to see how the IIR applies. Enter details of the low-taxed entity including jurisdictional GloBE income and other relevant information to determine top-up tax payable by the parent company.

Liechtenstein to Consult on Pillar Two Global Minimum Tax

Liechtenstein has announced it is to issue a consultation on a Pillar Two Global Minimum Tax in March 2023.

Comprehensive Data Points for the Substance-Based Income Exclusion

In this article we take a comprehensive look at how the substance-based income exclusion applies including the various adjustments for permanent establishments and flow-through entities and the data points required.

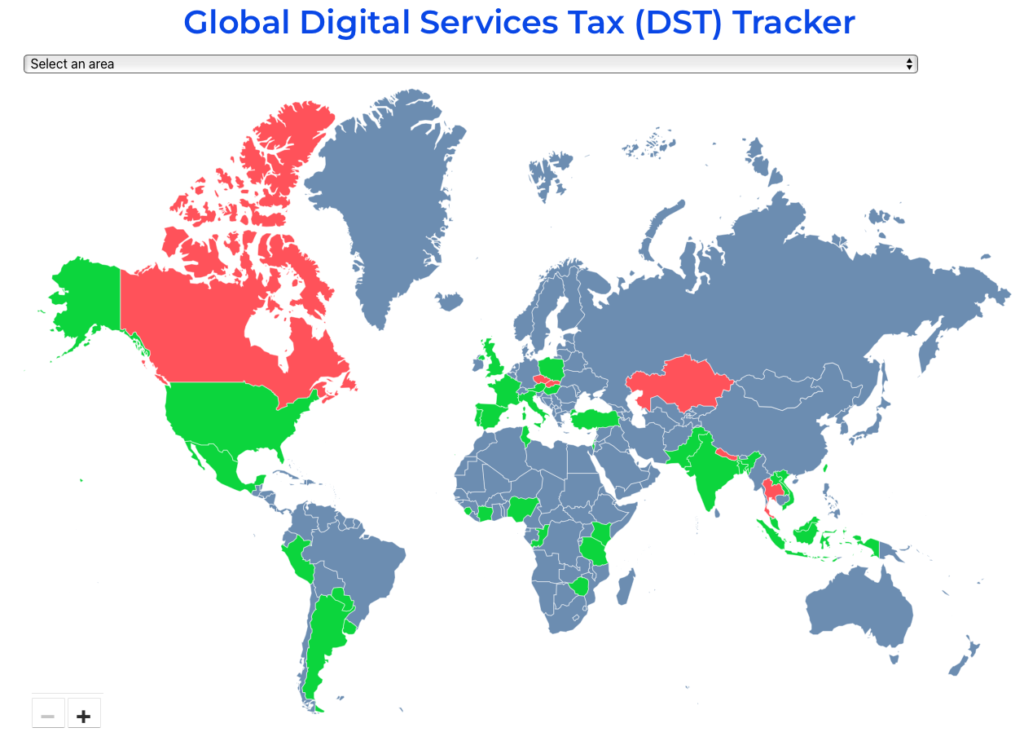

Global Digital Services Tax Tracker: Updated

Our Global Digital Services Tax Tracker has been updated to January 23, 2023.

The Philippines Tax Regime and the Pillar Two GloBE Rules

In this article, we look at the potential impact of the Pillar Two GloBE Rules for MNEs operating in the Philippines.

Indonesian Regulation Signals Global Minimum Tax Implementation

On December 20, 2022, Indonesia issued Government Regulation No. 55/2022 on the Adjustment of Regulations in the Field of Income Tax. This included reference to the implementation of a global minimum tax in Indonesia as well a a desire to implement Pillar One.

Summary of Todays OECD Two-Pillar Economic Assessment Webinar

Today’s OECD webinar on Tax challenges of digitalisation: Economic impact assessment of the Two-Pillar Solution reported that revenue gains from both Pillar One and Pillar Two is expected to increase from the previous economic impact assessment.

When a Low Statutory Corporate Tax Rate Doesn’t Create Pillar 2 Top-Up Tax

Just because the statutory rate of corporate income tax is significantly below 15% does not necessarily mean that top-up tax would apply under the Pillar Two global minimum tax rules. We look at why in this article.