The South Korean PE Risk Under Pillar Two

With the enactment of the Pillar Two GloBE Rules in South Korea from January 1, 2024, the costs of an unintentional permanent establishment (PE) in South Korea may be significantly greater.

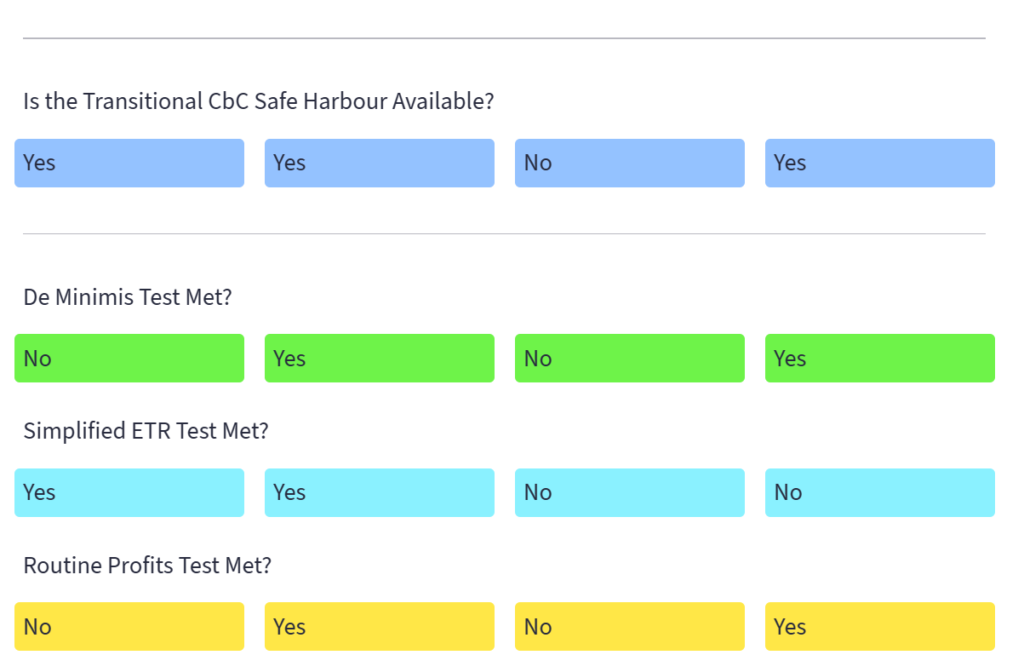

Pillar Two Transitional CbCR Safe Harbour Modelling Tool

Our members-only modelling tool carries out the calculations based on the required inputted information to determine whether the Transitional CbCR Safe Harbour applies.

Data Points for Pillar Two Corporate Structures

The GloBE Information Return will require information on an MNEs corporate structure in so far as it impacts the application of the Pillar Two GloBE rules. In this article we look at the data points that are required to comply with this.

English Translation of the South Korean Pillar Two Law

As a members only resource, we include an unofficial English translation of the South Korean Global Minimum Tax Law (Law 19191 of December 31, 2022).

IASB Issues Pillar Two Exposure Draft For Deferred Tax

Today, the International Accounting Standards Board (IASB) issued an Exposure Draft for proposed amendments to IAS 12 to take account of the Pillar Two Model Rules.

First Domestic Pillar Two Global Minimum Tax Law Enacted

On December 31, 2022 the first domestic law was enacted to give effect to the Pillar Two GloBE rules from January 1, 2024. Read more.

First Domestic Pillar Two Global Minimum Tax Law Enacted

On December 31, 2022 the first domestic law was enacted to give effect to the Pillar Two GloBE rules from January 1, 2024. Read more.

UPE Data Points for the GloBE Information Return

In this first of a series of articles that will break down all of the data points for the purposes of the Pillar Two GloBE rules (and in particular the expected reporting in the GloBE information return), we look at the UPE data points in the corporate structure.

IASB to Publish Pillar 2 Exposure Draft on January 9, 2023

The International Accounting Standards Board (IASB) has stated it expects to publish its Exposure Draft on the Pillar Two Model Rules on January 9, 2023. Read more.

ATAF Releases Draft Domestic Minimum Tax Legislation

The African Tax Administration Forum (ATAF) has released a Suggested Approach to Drafting Domestic Minimum Top-Up Tax Legislation under the Pillar Two GloBE Rules.