On December 20, 2022, the OECD issued the Safe Harbours and Penalty Relief: Global Anti-Base Erosion Rules (Pillar Two), which includes details of two safe harbours and penalty relief for the Pillar Two GloBE rules.

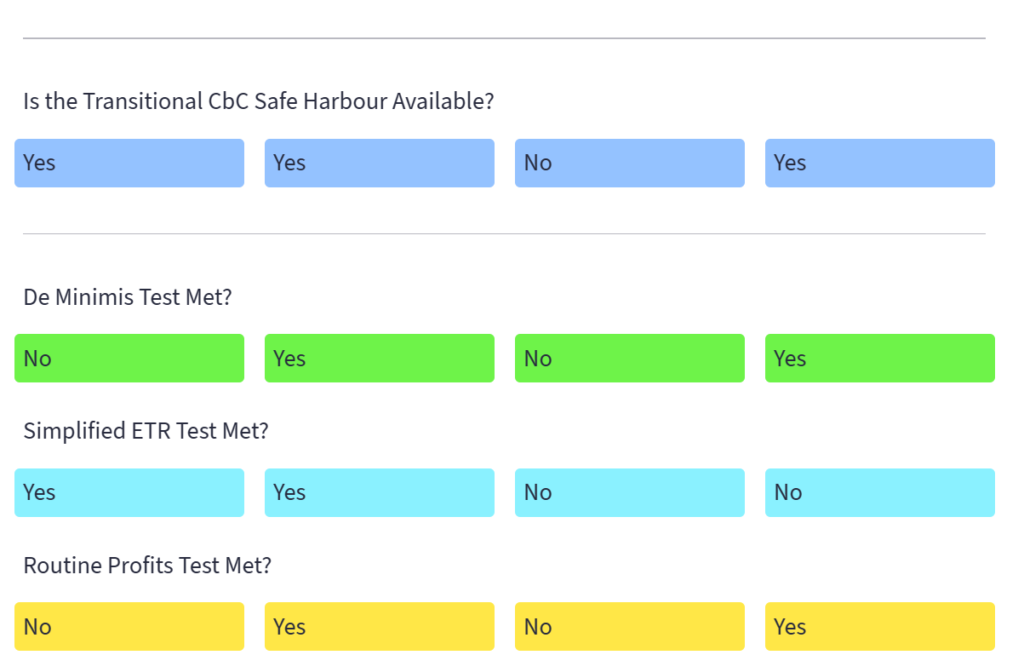

One of the key safe harbours is the Transitional CbCR Safe Harbour.

Our members-only modelling tool carries out the calculations based on the required inputted information to determine whether this safe harbour applies.

You can read more about the safe harbours at: OECD Releases the Safe Harbours for the Pillar Two GloBE Rules.

If you haven’t got a subscription you can join up below.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |