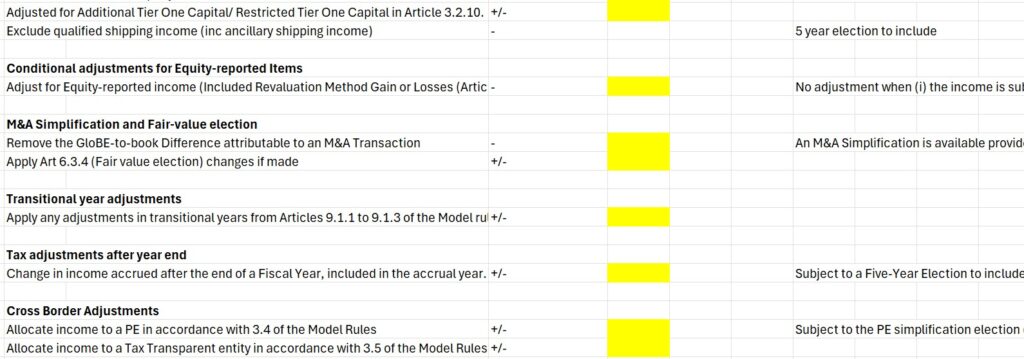

Sample Excel File for the Simplified ETR Safe Harbour

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Simplified ETR Safe Harbour from December 31, 2026 (December 31, 2025 in certain cases). We provide an excel overview for the key elements of the Safe Harbour calculation.

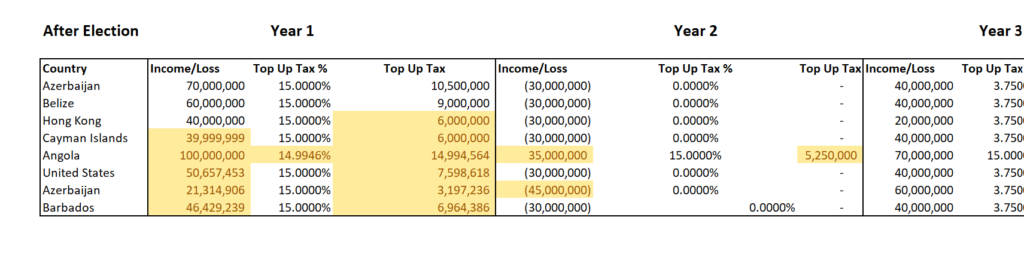

Sample Calculator for the New Substance-based Tax Incentive Safe Harbour

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Substance-based Tax Incentive Safe Harbour. This online tool shows how the new safe harbour operates.

New Elections in the OECD Side-by-Side Package

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This article looks at a number of the new elections that arise from this.

OECD Releases Guidance on the Side-by-Side Package

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package.

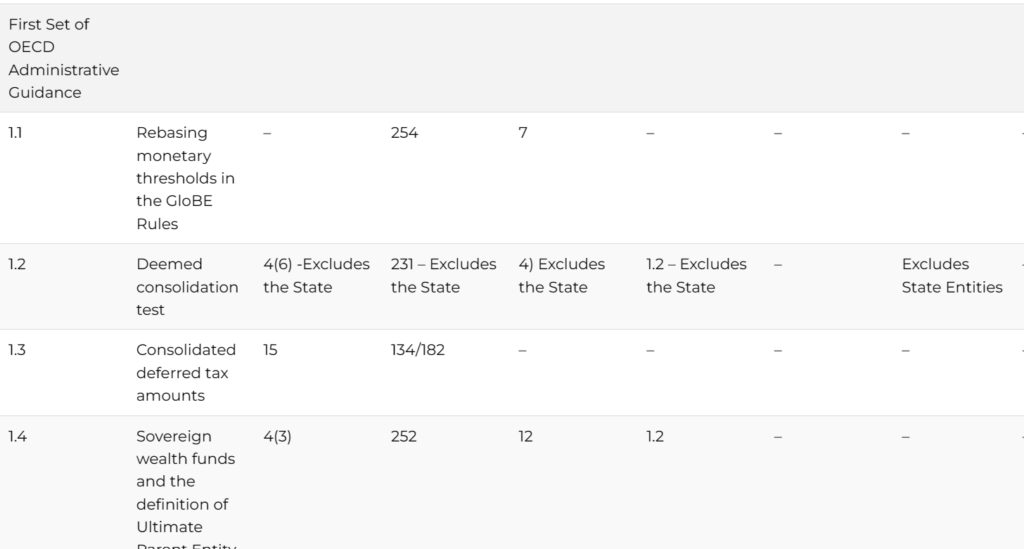

OECD Administrative Guidance: Domestic Implementation Matrix

We have tracked the draft and enacted domestic laws issued to date back to both sets of OECD Administrative Guidance in this matrix for our members. This will be constantly updated as new or amended legislation is issued.

Transitional CbCR Safe Harbour: Domestic Implementation Tracker

We track the implementation of key aspects of the Transitional CbCR Safe Harbour in draft and enacted domestic laws issued to date back to the OECD Safe Harbours Guidance and the OECD Administrative Guidance.

Pillar Two: GMT Compliance Forms

We keep track of all domestic Pillar Two forms issued to date, including links to domestic forms and notices for each relevant jurisdiction.

QDMTT: Legislative Tracker

Track the development and application of QDMTTs as they are implemented globally. The OECD Administrative Guidance provides significant flexibility as to their design.

Germany Enacts a Law to Amend its GMT Law for June 2024 and January 2025 OECD Guidance

On December 23, 2025, Germany enacted a law to amend the Minimum Tax Act. This follows the two previous discussion drafts and now includes the January 2025 OECD Administrative Guidance and DAC9 amendments.

Austria Issues 2025 Tax Amendment Act to Include OECD Administrative Guidance Updates

On December 23, 2025, Austria published the Tax Amendment Act 2025 in its Official Gazette. This includes amendments to aspects of the December 2023, June 2024 and January 2025 OECD Administrative Guidance, as well as DAC 9 implementation.