Pillar Two Elections Updated For OECD Administrative Guidance

The OECD Administrative Guidance included a number of new elections available to MNEs to simplify or minimise some of the adverse impacts of the GloBE Rules. We have updated our Pillar Two Elections product to include all GloBE Elections.

Vietnam Needs to Act Fast After The South Korean Pillar Two Law

One of the tools to attract FDI to Vietnam is tax incentives. However, from the beginning of 2024, applying the Global Minimum Tax Rule at 15% will reduce Vietnam’s competitiveness. Although corporate income tax is currently at 20%, Vietnam applies a number of tax incentives.

The Equity Investment Inclusion Election

Article 2.9 of the OECD Administrative Guidance provides for an Equity Investment Inclusion Election. This relates, in part, to the interaction of Articles 3.2.1(c) and 4.1.3(a) of the OECD Model Rules.

Germany Confirms Pillar Two Law to be Gazetted in 2023

German Finance Minister Christian Lindner (FDP) has announced the presentation of a “tax fairness law” and a tax “growth package” for 2023. It was also confirmed the Law to implement the Pillar Two GloBE Rules will be gazetted in 2023.

Pillar 2 Navigator Update: Additional Top-Up Tax & Excess Negative Tax Expense Carry-Forwards

As an alternative to incurring additional top-up tax when a domestic tax loss exceeds the GloBE loss, Article 2.7 of the OECD Administrative Guidance provides that an MNE can elect for the Excess Negative Tax Expense administrative procedure.

Pillar 2 Navigator Update: Deferred Tax & Substitute Loss Carry Forwards

Article 2.8 of the OECD Administrative Guidance provides for the inclusion of deferred tax in the GloBE deferred tax adjustment amount for ‘Substitute Loss Carry Forwards’.

Japan Submits Draft Pillar Two Law to Parliament

On February 3 and 6, 2023, the Ministry of Finance published the “Bill for Partial Revision of the Income Tax Act” This includes the proposed implementation of the Pillar Two GloBE rules from April 2024.

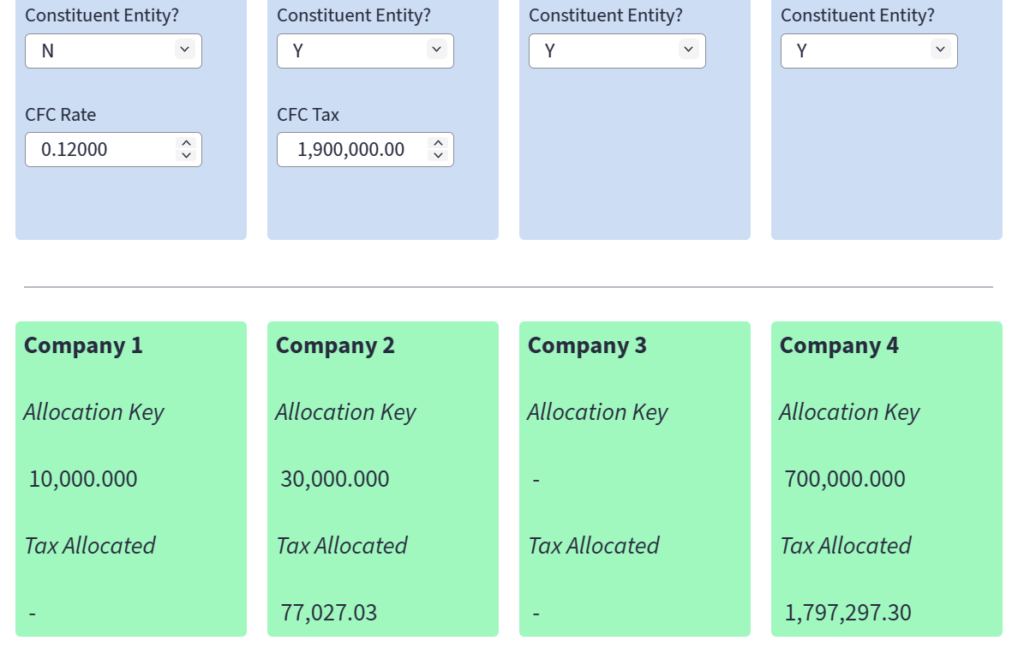

Blended CFC Calculator

For fiscal years that begin on or before 31 December 2025 but not ending after 30 June 2027, the OECD Administrative Guidance includes a simplified formula to allocate CFC taxes in blended CFC regime. Use our simple calculator.

Qatar: First Arab State to Introduce 15% Minimum Tax

Qatar is the first Arab state to introduce a 15% minimum tax in Law 11 of 2022, issued on February 2, 2023.

Designing a Qualified Domestic Minimum Top-Up Tax (QDMTT)

The OECD Administrative Guidance provides details on which aspects of the GloBE Rules need to be reflected in the QDMTT regime and which aspects don’t.