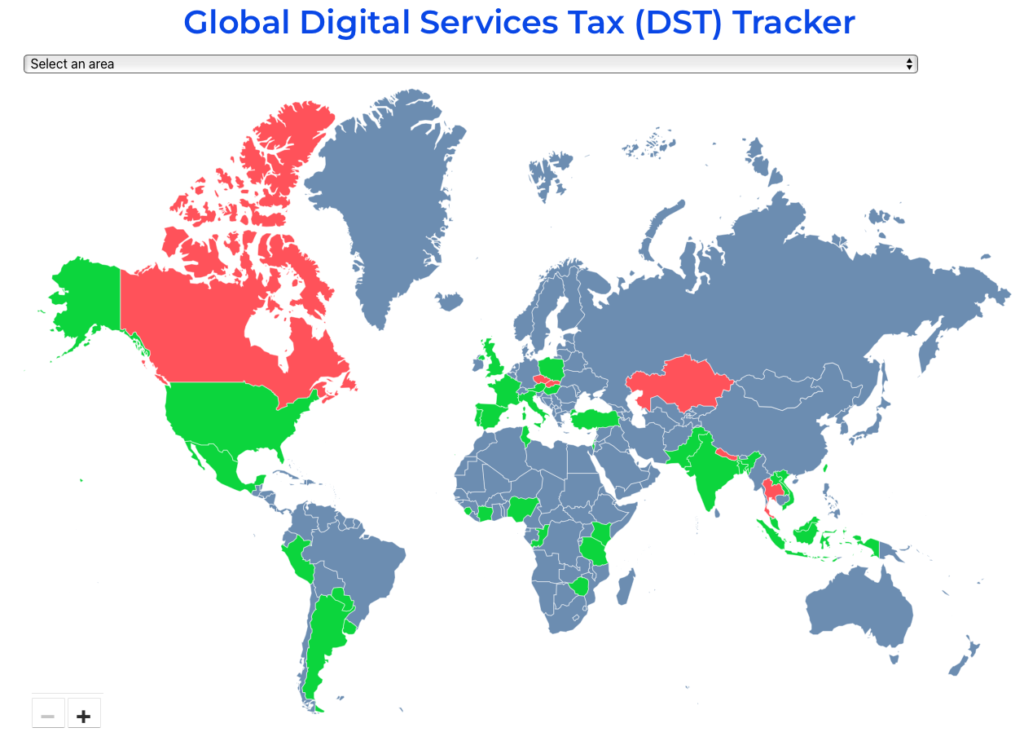

Global Digital Services Tax Tracker: Updated

Our Global Digital Services Tax Tracker has been updated to January 23, 2023.

The Philippines Tax Regime and the Pillar Two GloBE Rules

In this article, we look at the potential impact of the Pillar Two GloBE Rules for MNEs operating in the Philippines.

Indonesian Regulation Signals Global Minimum Tax Implementation

On December 20, 2022, Indonesia issued Government Regulation No. 55/2022 on the Adjustment of Regulations in the Field of Income Tax. This included reference to the implementation of a global minimum tax in Indonesia as well a a desire to implement Pillar One.

Summary of Todays OECD Two-Pillar Economic Assessment Webinar

Today’s OECD webinar on Tax challenges of digitalisation: Economic impact assessment of the Two-Pillar Solution reported that revenue gains from both Pillar One and Pillar Two is expected to increase from the previous economic impact assessment.

When a Low Statutory Corporate Tax Rate Doesn’t Create Pillar 2 Top-Up Tax

Just because the statutory rate of corporate income tax is significantly below 15% does not necessarily mean that top-up tax would apply under the Pillar Two global minimum tax rules. We look at why in this article.

The South Korean PE Risk Under Pillar Two

With the enactment of the Pillar Two GloBE Rules in South Korea from January 1, 2024, the costs of an unintentional permanent establishment (PE) in South Korea may be significantly greater.

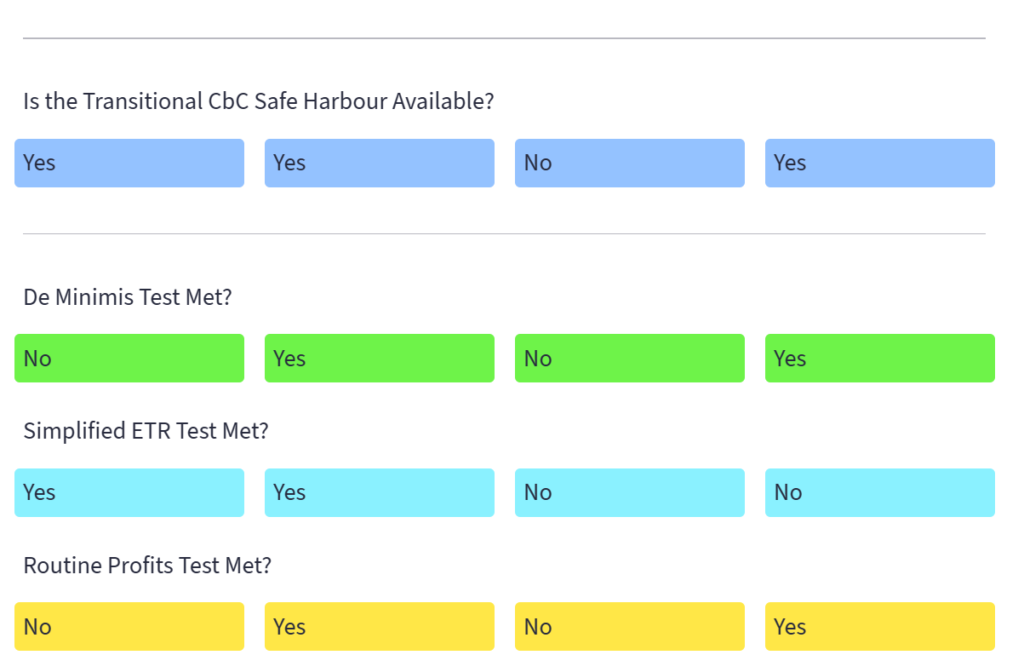

Pillar Two Transitional CbCR Safe Harbour Modelling Tool

Our members-only modelling tool carries out the calculations based on the required inputted information to determine whether the Transitional CbCR Safe Harbour applies.

Data Points for Pillar Two Corporate Structures

The GloBE Information Return will require information on an MNEs corporate structure in so far as it impacts the application of the Pillar Two GloBE rules. In this article we look at the data points that are required to comply with this.

English Translation of the South Korean Pillar Two Law

As a members only resource, we include an unofficial English translation of the South Korean Global Minimum Tax Law (Law 19191 of December 31, 2022).

IASB Issues Pillar Two Exposure Draft For Deferred Tax

Today, the International Accounting Standards Board (IASB) issued an Exposure Draft for proposed amendments to IAS 12 to take account of the Pillar Two Model Rules.