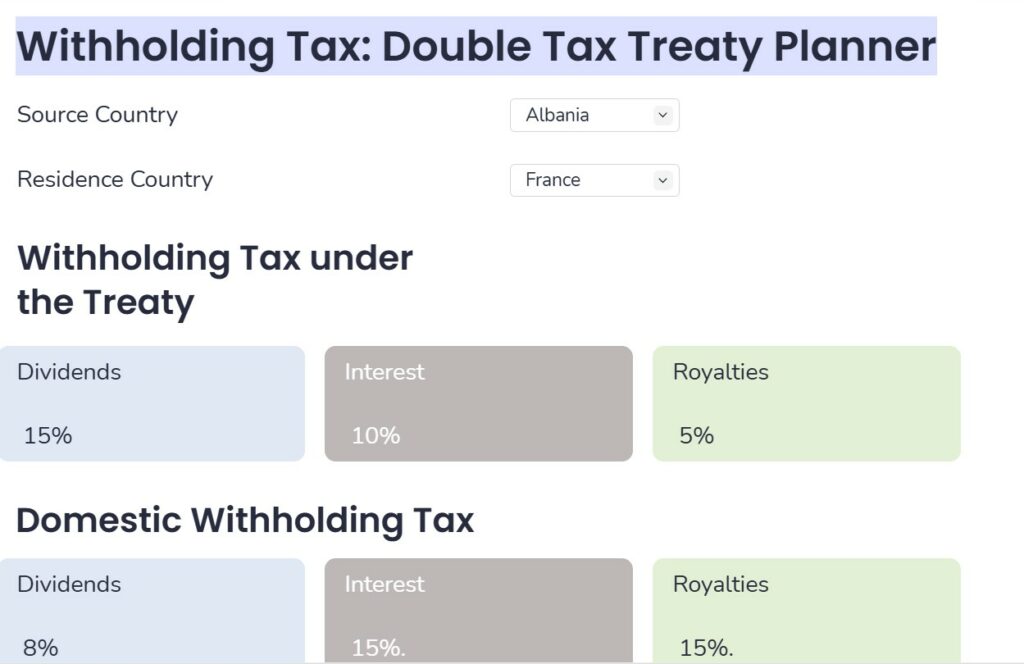

Withholding Tax: Double Tax Treaty Planner

A tax modelling tool that calculates the withholding tax rates for interest, dividends and royalties under both domestic law and relevant double tax treaties.

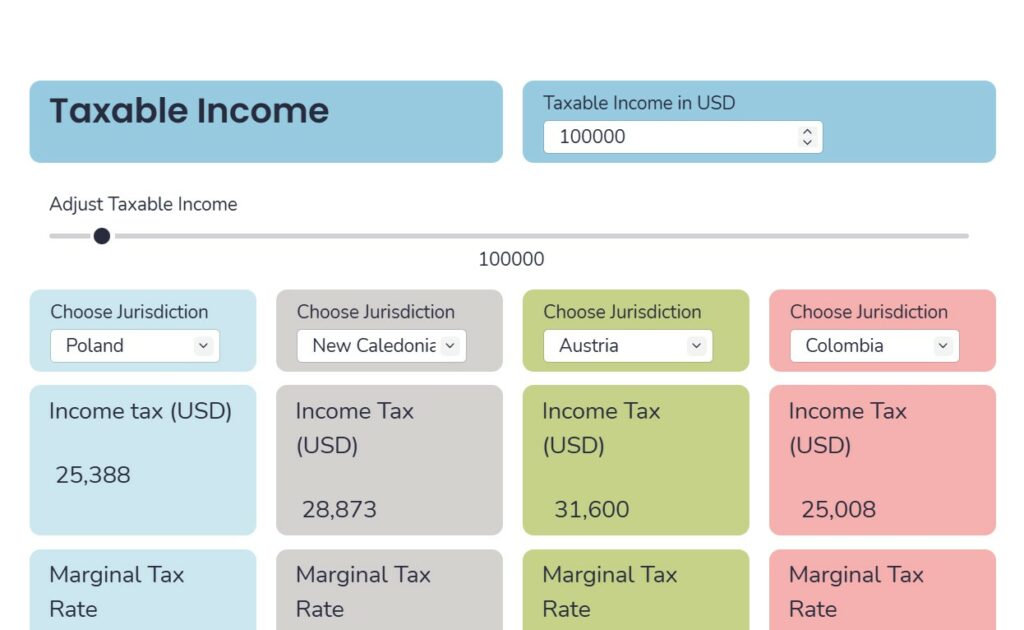

Global Personal Income Tax Modelling Tool

A tax modelling tool that calculates the high-level income tax payable and effective tax rate for different countries.

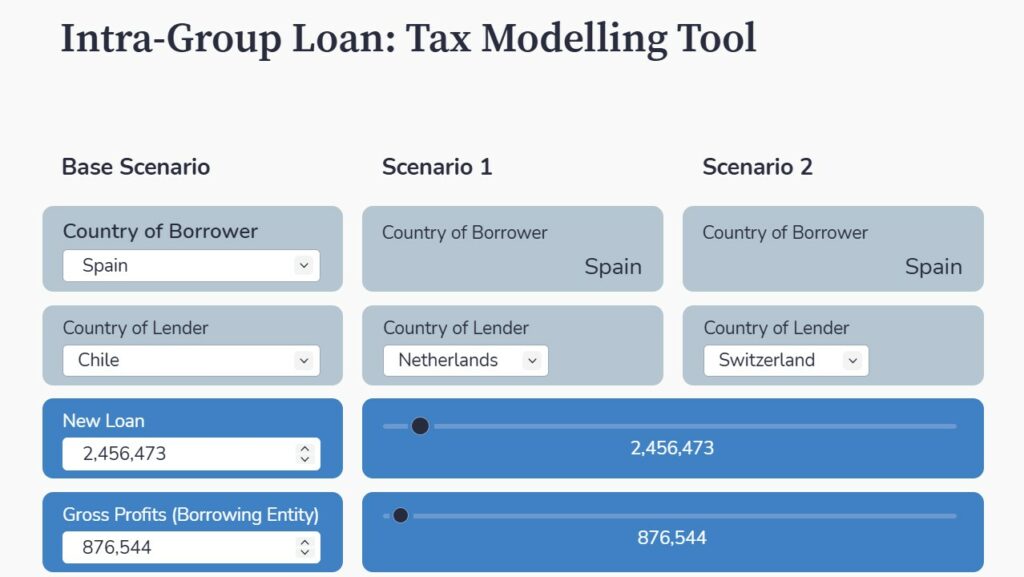

Intra-Group Loan: Tax Modelling Tool

A tax modelling tool that calculates the effective tax rate for different scenarios in various countries, allowing users to compare the tax implications of different loan structures and jurisdictions

Japan’s Pillar 2 Filing Portal is Open

Japan has launched its Multinational Enterprise Information Reporting Portal for filing Pillar 2 returns.

Nigeria Enacts High-Level GloBE Minimum Tax Rules

On 6 September 2025, Nigeria’s Tax Act 2025 was published in the Official Gazette. This includes a DMTT (without any of the detailed GloBE adjustments yet applying).

Poland Issues Draft Pillar 2 Notifications and Top-Up Tax Returns

On September 11, 2025, the Polish Ministry of Finance issued the draft Pillar 2 notifications and top-up tax returns for consultation.

Vietnam Issues its Pillar 2 Decree

On August 29, 2025, Vietnam issued its Decree for the detailed implementation of the Pillar 2 rules from January 1, 2024.

Czech Republic Gazettes Act No. 316/2025 to Amend its Minimum Tax Act

On September 2, 2025, Act No. 316/2025 Coll was published in the Official Gazette to amend the Minimum Tax Act for various aspects of the OECD Administrative Guidance as well as filing dates, QDMTT amendments and amending the Safe Harbour rules.

Uruguay Budget Bill Includes a Pillar 2 Domestic Minimum Tax

On August 31, 2025, the Ministry of Economy and Finance sent the Draft Budget Law for the period 2025–2029 to Parliament. This includes a domestic minimum tax (intended to be a QDMTT).

GloBE Country Guide: Uruguay

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Uruguay for accounting periods beginning on or after January 1, 2026. Updated for the 2025-2029 Draft Budget Bill.