Our OECD Pillar Two Tracker covers the latest developments at the OECD, EU and in domestic jurisdictions to keep you up-to-date with the implementation of Pillar Two.

Updated daily and with links to our more detailed analysis on the approach and impact of domestic implementation.

Either use the list view to select a jurisdiction from the drop down list or use the ‘point and click’ functionality on the interactive map to view jurisdictional information.

Alternatively, you can view developments by date.

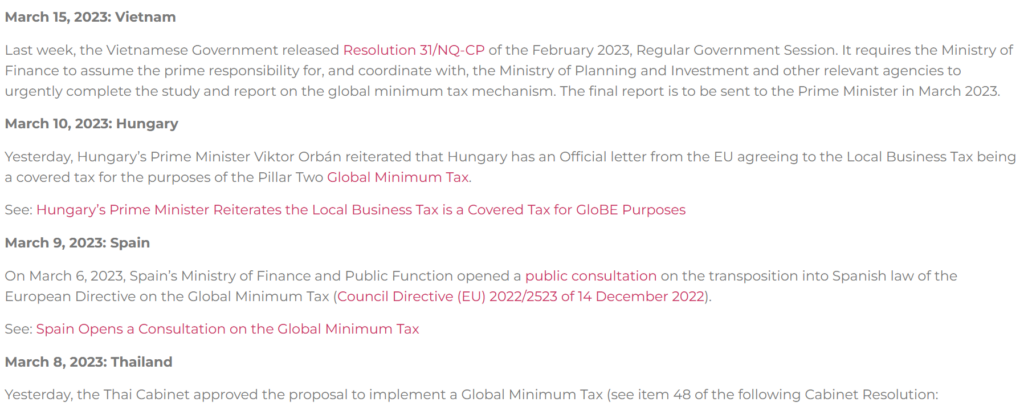

Members can access the latest 2025 Pillar 2 jurisdictional developments in our Pillar 2 Tracker. Earlier jurisdictional developments can be viewed at:

If you haven’t got a subscription you can join up below.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |