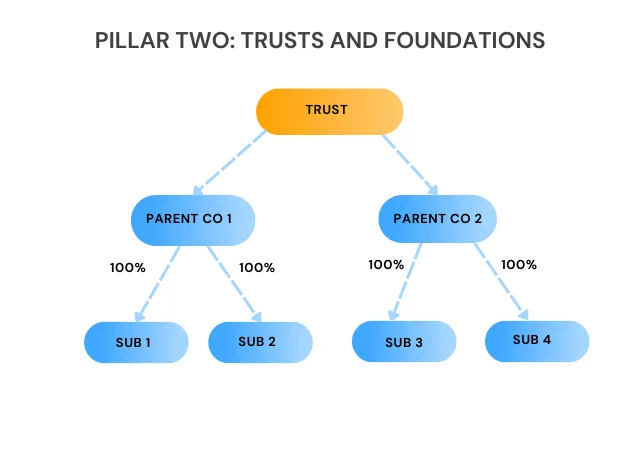

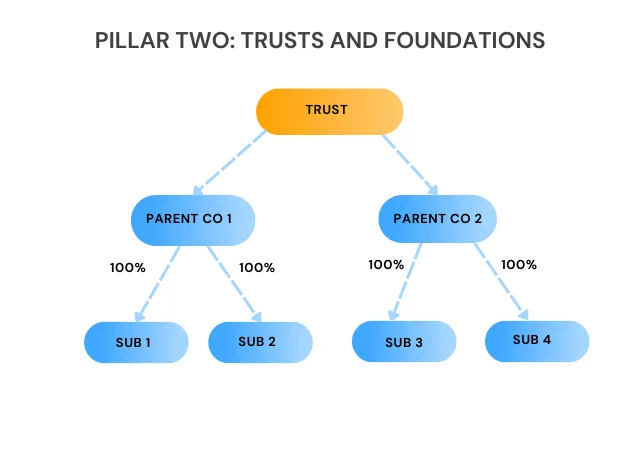

Pillar Two: Trusts & Foundations

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’. This means that the Pillar Two GloBE rules can apply to both trusts and foundations.

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’. This means that the Pillar Two GloBE rules can apply to both trusts and foundations.

Pension funds are subject to a number of specific provisions under the Pillar Two rules. In this article we look at some of the key aspects of Pillar Two that impact on Pension Funds.

In January 2025, the OECD provided some much-needed guidance on the operation of the Pillar 2 GloBE rules. This Orbitax article provides an analysis of the impact of the guidance on Pillar 2 compliance.

On November 7, 2024, the Finance Bill 2024-2025 was introduced to Parliament. This includes provisions to enact the UTPR (and associated rules such as the Transitional UTPR Safe Harbour and Initial Phase of International Activity Exemption), and other Pillar 2 amendments.

We keep track of the domestic implementation of the Subject-to-Tax Rule (STTR) internationally including links to relevant effected double tax treaties.

The substance-based income exclusion favours capital intensive and certain low profit margin companies. These companies stand to benefit the most.

On July 3, 2024, the Italian Ministry of Economy & Finance issued a Decree which contains the procedures for the implementation of the Qualified Domestic Minimum Top-up Tax (QDMTT).

Our QDMTT Legislative Tracker has been updated for the amendments to the design of QDMTTs, as provided in the June 2024 OECD Administrative Guidance.

The Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) includes guidance on the treatment of Securitization Entities.

Section 5 of the Fourth Set of OECD Administrative Guidance (published on June 17, 2024) provides clarifications on the allocation of both profits and taxes of Flow-through Entities (including both hybrid entities and reverse hybrid entities). Most of these changes are to ensure the consistent matching of income and taxes in the same entity.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |