Our OECD Pillar One & Two Modelling Tool is designed to provide an analysis of the high-level impact of Amount A of Pillar One.

Key features include:

The Pillar One and Two Modelling Tool is an online, software-based modelling tool.

The initial process is to select a jurisdiction and enter the basic financial details for that jurisdiction that are required for a high-level analysis of Pillar One.

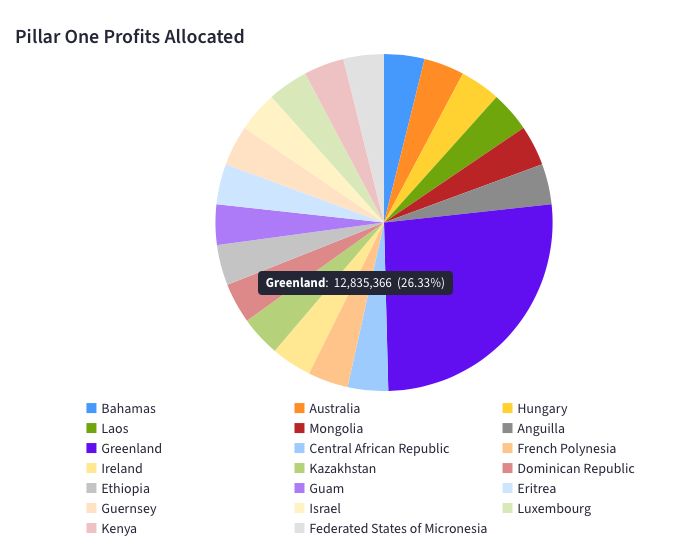

The modelling tool then calculates the estimated group profits reallocated to the chosen jurisdictions under Amount A of Pillar One.

By default, it supports an analysis of 20 jurisdictions. However, this can be increased to up to 150 jurisdictions.

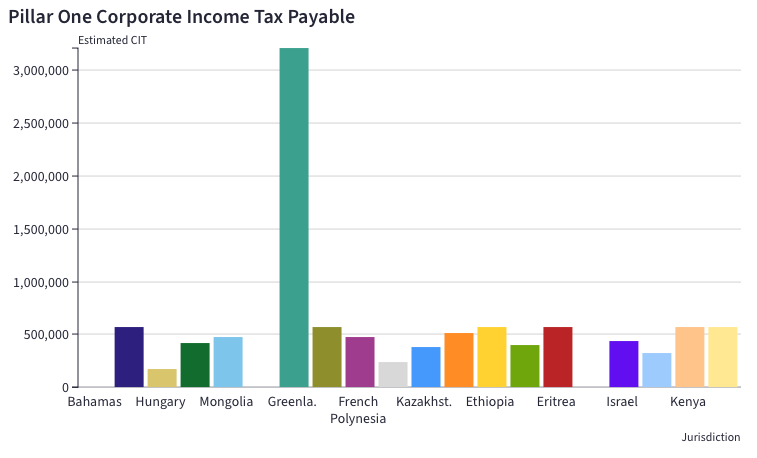

After calculating the estimated profit reallocation, the tool applies the main headline corporate income tax rate in the chosen jurisdiction to estimate the additional corporate income tax payable.

The calculation takes account of the key aspects of the Pillar One calculation, as outlined in the latest Progress Report on Amount A of Pillar One, including:

Calculating the estimated tax under Pillar One is only half the story, given Pillar One cannot be viewed in isolation.

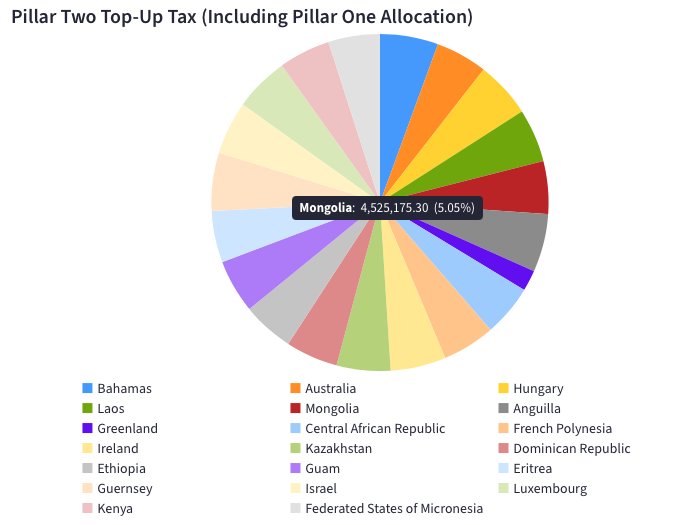

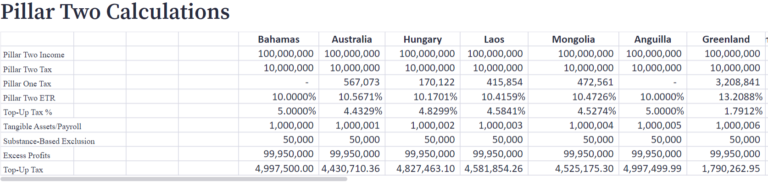

After calculating the Pillar One reallocation and estimated corporate income tax, the Pillar Two impact can also be considered, given Pillar One feeds directly into Pillar Two.

When both Pillar One and Pillar Two are implemented, Pillar One will apply before Pillar Two, and any Pillar One tax liability will be considered when calculating the effective tax rate for Pillar Two purposes. This will then impact on the top-up tax calculation for any low-taxed jurisdictions.

The modelling tool allows some additional jurisdictional financial details to be added in for Pillar Two purposes, and it then calculates the consolidated position taking account of both Pillar One and Pillar Two, to estimate the final top-up tax liability under Pillar Two.

The Modelling Tool is free for site members and is available from the membership portal.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |