Menu

Trending Now

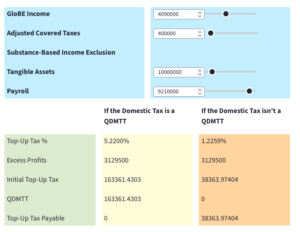

Of key importance is that a domestic top-up tax that doesn’t qualify as a QDMTT would simply be treated as another covered tax.

This makes the tax less attractive and would mean an increased tax rate compared to if it was a QDMTT in order to fully eliminate any GloBE top-up tax after the substance-based income exclusion has been taken into account.

This is because the substance-based income exclusion is taken into account in the formula when

calculating excess profits.

To see an example of how this applies, see Qualified Domestic Minimum Top-Up Tax.

Our interactive tool allows you to simulate the impact on the top-up tax liability depending on whether a domestic minimum tax is a QDMTT or not.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |