Menu

Trending Now

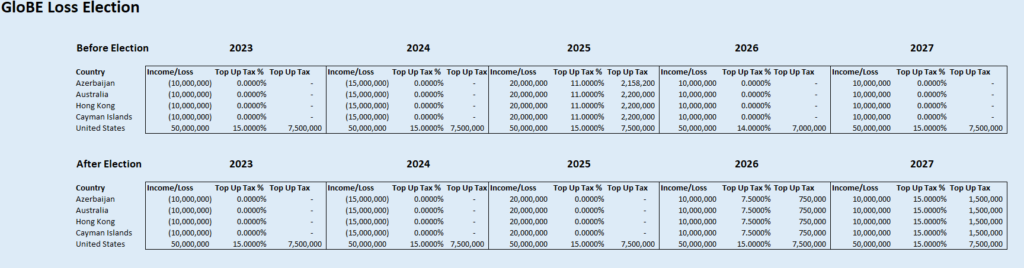

Our Pillar Two GloBE Loss Election Modelling Tool allows you to see the impact of making a GloBE Loss Election on your estimated top-up tax liability.

What is the GloBE Loss Election?

The GloBE Loss election effectively dispenses with deferred tax in the Pillar Two jurisdictional effective tax rate calculation and allows an MNE to establish a deemed deferred tax asset where this is a net Pillar Two GloBE loss for that jurisdiction.

The deferred tax asset for the loss is equal to the net Pillar Two loss in the jurisdiction for a fiscal year, multiplied by the 15% minimum rate.

This operates in a similar way to the standard loss treatment for deferred tax purposes, and any amount of loss utilized in future years is treated as an addition to covered taxes for that year.

To see more information on the Pillar Two GloBE Loss election, see GloBE Loss Election.

The key aspect of making this election is that deferred tax in the financial accounts and the Pillar Two deferred tax adjustments are no longer relevant.

This means that timing differences can impact the jurisdictional ETR, potentially leading to top-up tax under Pillar Two.

In addition, the election is made in the first Pillar Two information return for the jurisdiction. As such, it is an election that can only be made once.

Therefore, MNE’s need to model very carefully the impact of making an election on their estimated top-up tax under Pillar Two.

Pillar Two GloBE Modelling Tool

Our Modelling Tool does just that. It models the impact of making this election on the jurisdictional top-up tax payable.

Simply enter relevant financial details for relevant companies and then view the analysis which shows the effect of a GloBE Loss Election.

Access This Tool

If you’re a site member, you can access this tool for free at:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |