Menu

Trending Now

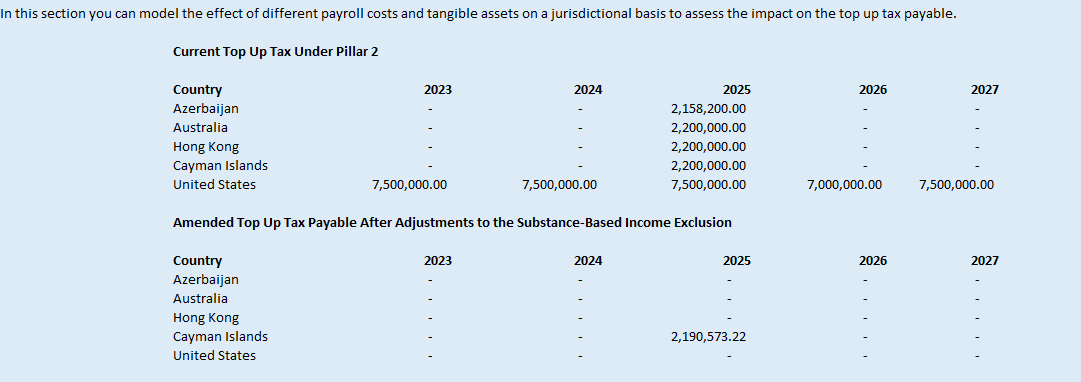

An essential element of the Pillar Two GloBE rules is the substance-based income exclusion.

It provides a degree of tax relief for MNE groups in the form of carve-outs based on the amount of qualifying payroll and tangible fixed asset costs in a jurisdiction.

Relief is to be given at 5% of the amount of qualifying costs (subject to transitional rules). This is deducted from Pillar Two net GloBE income, before calculating top-up tax. Therefore, it directly feeds into the amount of top-up tax payable.

Our Modelling Tool allows you to adjust jurisdictional payroll and fixed asset costs to instantly see the impact this has on your top-up tax liability.

How to Access

If you’re a site member, this tool is free to use and can be accessed at:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |