South Korea Enacts 2026 Tax Reform for QDMTT Implementation

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

Contents

General

The Spring Finance Bill 2023 (Finance (No. 2) Bill) was published yesterday (March 23, 2023), along with its Explanatory Notes. The Bill includes provisions to implement key aspects of the Pillar Two Global Minimum Tax for accounting periods beginning on or after 31 December 2023.

This follows the original draft legislation published on July 20, 2022.

The Undertaxed Profits/Payments Rule was not included in the Bill, however this is not unexpected as it was announced in the Autumn Statement that this will apply no earlier than accounting periods beginning on or after 31 December 2024.

The draft legislation is very comprehensive and, as expected, covers relevant aspects of the OECD Model Rules, Commentary and other Published Guidance.

In particular it, provides for an Income Inclusion Rule (named the Multinational Top-Up Tax) and a Domestic Top-Up Tax (which is likely to be a Qualified Domestic Minimum Top-Up Tax).

The UK Bill is the most comprehensive law we have seen to date to implement the Pillar Two Global Minimum Tax. It closely follows the OECD Model Rules and reflects the latest guidance, including aspects of the OECD Safe Harbours Guidance and the Administrative Guidance.

It is worth noting at the outset that Section 255 of the Bill specifically refers to the OECD Model GloBE Rules and Commentary (including the OECD Examples) and directly applies them in various aspects of the application of the Multinational Top-Up Tax.

In addition, it applies ‘any further commentaries or guidance published from time to time by the OECD that are relevant to the implementation of the Pillar Two model rules’.

This would, therefore, include the OECD Administrative Guidance that will itself be included in an updated version of the OECD Commentary.

Application

If you haven’t got a subscription you can sign up below

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Simplified ETR Safe Harbour from December 31, 2026 (December 31, 2025 in certain cases). We provide an excel overview and a sample calculator for the key elements of the Safe Harbour calculation.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Substance-based Tax Incentive Safe Harbour. This online tool shows how the new safe harbour operates.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This article looks at a number of the new elections that arise from this.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package.

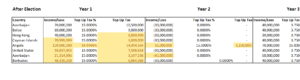

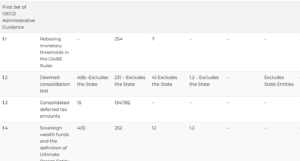

We have tracked the draft and enacted domestic laws issued to date back to both sets of OECD Administrative Guidance in this matrix for our members. This will be constantly updated as new or amended legislation is issued.

We track the implementation of key aspects of the Transitional CbCR Safe Harbour in draft and enacted domestic laws issued to date back to the OECD Safe Harbours Guidance and the OECD Administrative Guidance.

We keep track of all domestic Pillar Two forms issued to date, including links to domestic forms and notices for each relevant jurisdiction.

Track the development and application of QDMTTs as they are implemented globally. The OECD Administrative Guidance provides significant flexibility as to their design.

On December 23, 2025, Germany enacted a law to amend the Minimum Tax Act. This follows the two previous discussion drafts and now includes the January 2025 OECD Administrative Guidance and DAC9 amendments.

On December 23, 2025, Austria published the Tax Amendment Act 2025 in its Official Gazette. This includes amendments to aspects of the December 2023, June 2024 and January 2025 OECD Administrative Guidance, as well as DAC 9 implementation.

Part III of the Dutch Year-End Decree 2025 (published in the Official Gazette on December 23, 2025) amends the Minimum Tax Executive Decree 2024 for aspects of the December 2023, June 2024, and January 2025 OECD Administrative Guidance.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |