Key Takeaways From the Dutch Draft Pillar Two Legislation

On October 24, 2022, the Dutch Government released a consultation, including draft legislation, on the Pillar Two GloBE rules. See the key takeaways.

Global R&D Interactive Map

Our Interactive Global R&D Map analyses key international R&D tax regimes to consider their treatment for Pillar Two purposes.

Pillar Two Developments Tracker

Our OECD Pillar Two Tracker covers the latest developments at the OECD, EU and in domestic jurisdictions to keep you up-to-date with the implementation of Pillar Two.

The Use of Corporate Income Tax Incentives to Attract FDI After Pillar Two

In this analysis we look at the key corporate tax incentives and assess their potential FDI impact taking into account the Pillar Two GloBE Rules.

The Use of Corporate Income Tax Incentives to Attract FDI After Pillar Two

In this analysis we look at the key corporate tax incentives and assess their potential FDI impact taking into account the Pillar Two GloBE Rules.

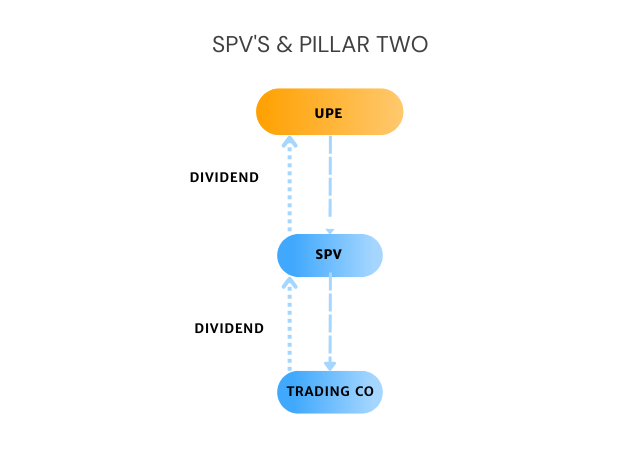

Why MNEs Should Reassess SPVs in Light of Pillar Two

The nature of the Pillar Two GloBE Rules means that in some cases, SPVs can lead to top-up tax that would not occur if a subsidiary was directly held.

A Review of China’s Tax Law From a Pillar Two Perspective

In this analysis we look at the key features of China’s tax law that would need to be taken into account by MNEs with Chinese subsidiaries for Pillar 2 purposes.

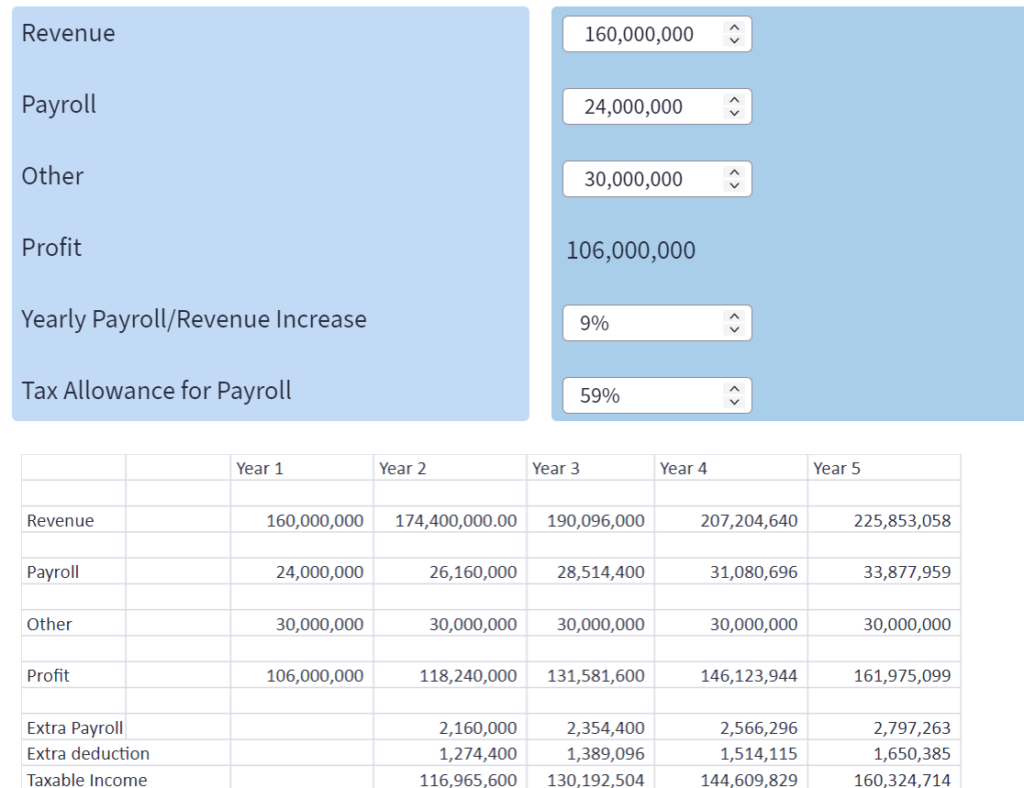

Payroll Tax Incentives – Pillar Two Modelling Tool

This Modelling Tool accompanies our analysis Modelling the Impact of Payroll Tax Incentives Post Pillar 2. Members use this tool to adjust key variables.

Modelling the Impact of Payroll Tax Incentives Post Pillar 2

In a post Pillar Two environment, the nature of tax incentives needs to be carefully considered to ensure that both MNEs and tax authorities derive benefits. In this analysis we model the impact of payroll tax incentives.

India’s Tax Regime after Pillar Two: Key Risks and Opportunities

In this article we look at India’s corporate income tax regime and assess the impact of the Pillar Two GloBE Rules on MNE’s with operations in India.