The Thorny Issue of Pillar Two in Vietnam

Vietnam’s broad income-based tax incentives could impact on investment into Vietnam in a post Pillar Two environment. We look at the issues and policy options.

Highlights of the OECD Progress Report on the Administration of Amount A

On October 6, 2022, the OECD issued the Progress Report on the Administration and Tax Certainty Aspects of Amount A of Pillar One (the ‘Progress Report’), which includes draft Model Rules on the administration of Amount A.

Global Developments with Pillars 1 & 2 Last Week

In this members article we look at key developments last week, including Ireland, Vietnam, Belgium and the OECD.

Malaysia to Implement Global Minimum Tax & QDMTT in 2024

In today’s 2023 Budget Speech, the Malaysian government joined the growing number of countries that will implement the 15% global minimum tax under Pillar 2.

Takeaways from Yesterday’s OECD Report on Tax Incentives & Pillar 2

The OECD issued a report yesterday on tax incentives after Pillar 2. We look at the key takeaways including which tax incentives have the largest impact.

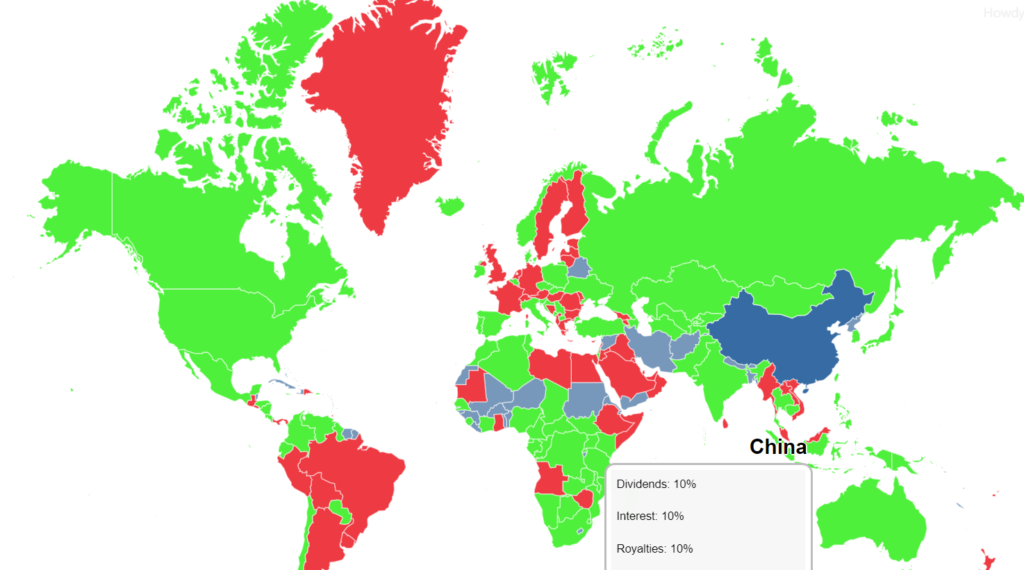

Subject-to-Tax Rule: Global Withholding Tax Map

The Subject-to-Tax Rule is a key component of Pillar Two, and unlike the GloBE Rules focuses on source jurisdictions. Our members-only global map highlights domestic withholding taxes at less than the 9% rate under the Subject-to-Tax Rule.

Australia’s Consultation on Pillar Two

On October 4, 2022, Australia issued a consultation paper on Pillar Two of the OECD Two-Pillar Solution. We look at the key aspects of the consultation.

The Impact of Nigeria’s Rejection of Both Pillar 1 and 2

Nigeria has rejected Pillar 1 and 2 on the basis that the thresholds would result in a loss of tax revenue. We look at the changes to domestic law to tax MNEs.

The Subject-to-Tax Rule: What You Need to Know

The Subject-to-Tax Rule is a key element of Pillar Two, and allows source jurisdictions to levy additional tax on certain payments. Read what you need to know.

The Netherlands and its Approach to Pillar Two

The Netherlands has issued Parliamentary Paper 22112 (3278) in which it provides comments on the EU’s proposed directive for the implementation of Pillar Two.