OECD Pillar One & Two Modelling Tool

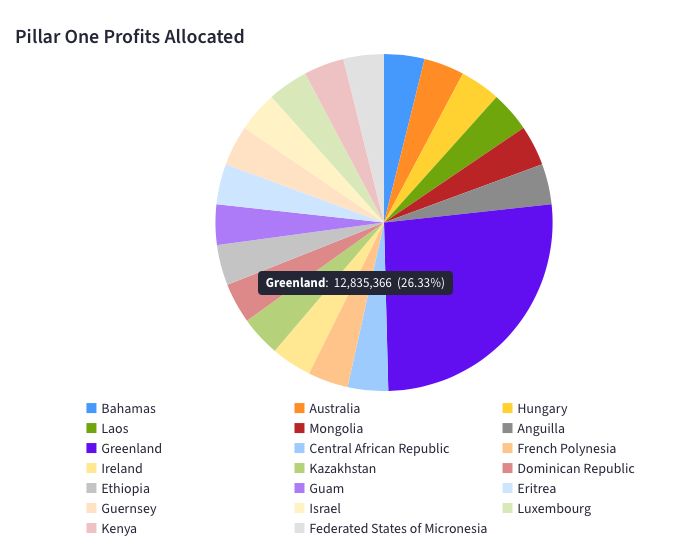

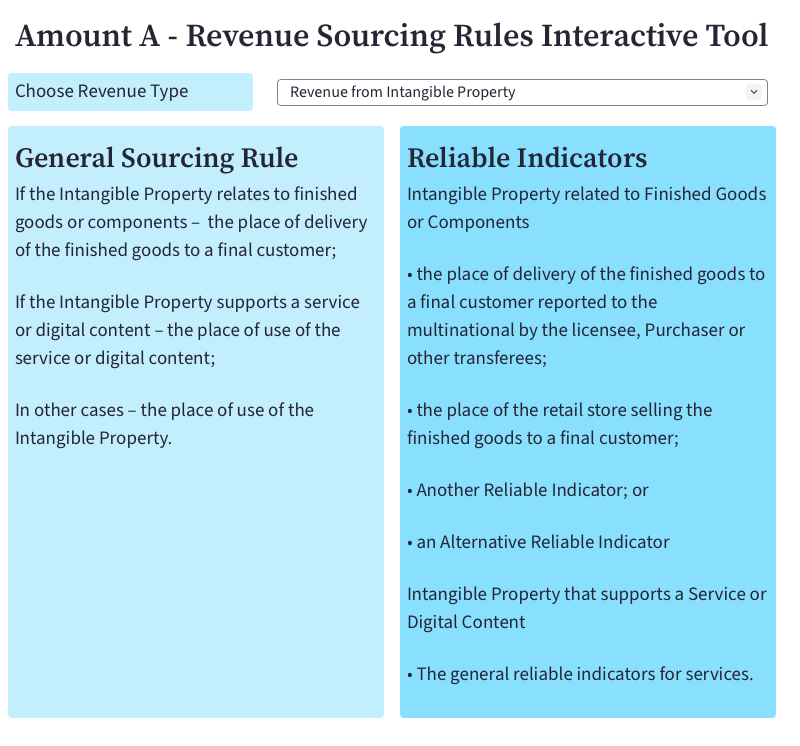

Our OECD Pillar One & Two Modelling Tool is designed to provide an analysis of the high-level impact of Amount A of Pillar One. Key

Our OECD Pillar One & Two Modelling Tool is designed to provide an analysis of the high-level impact of Amount A of Pillar One. Key

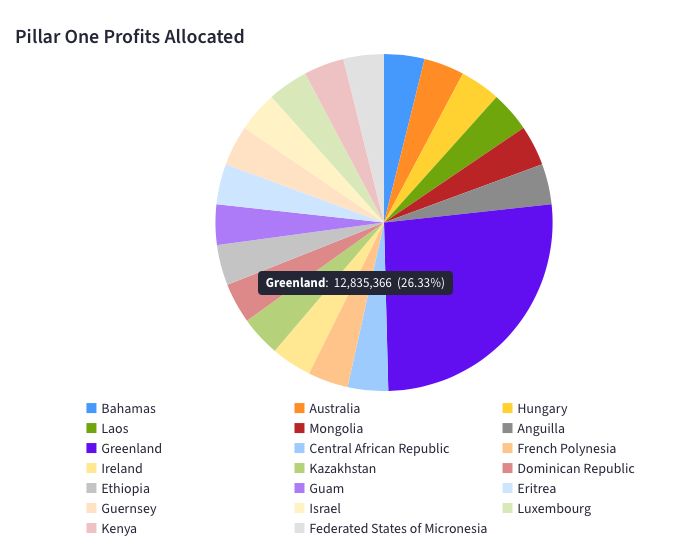

Our Investment Companies Top-Up Tax Calculator models the impact of Pillar Two in a jurisdiction where there are a mix of investment and non-investment companies.

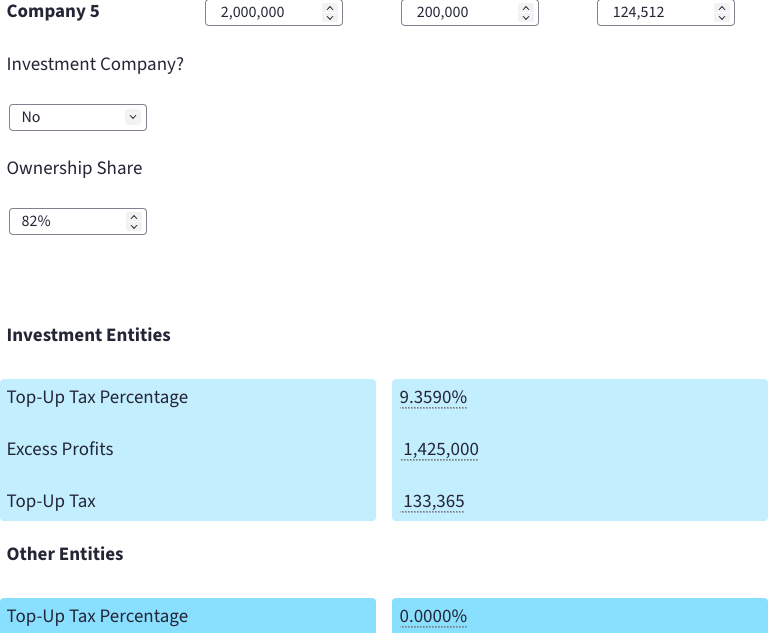

The Revenue Sourcing Rules for Amount A are used to determine where an in-scope multinational group derives its revenues. This is then used in the profit reallocation calculation.

Use our interactive tool to quickly determine the relevant sourcing rule for each revenue type.

Our GloBE Loss Election interactive tool allows you simulate the impact on your top-up tax liability depending on whether a GloBE Loss Election is made or not.

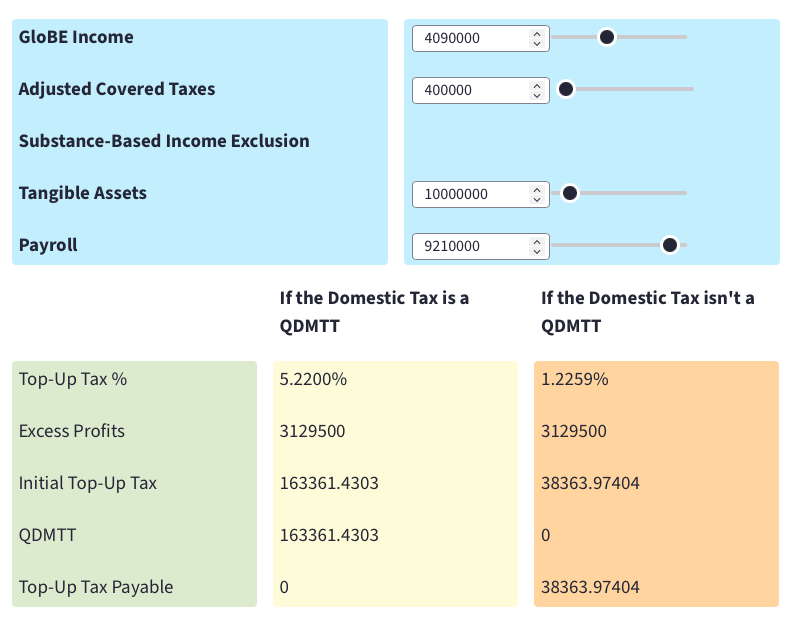

Our Qualified Domestic Minimum Top-Up Tax (QDMTT) interactive tool allows you simulate the impact on your top-up tax liability depending on whether the domestic top-up tax is a QDMTT or is non-qualifying.

The UK published draft legislation on July 20, 2022, to implement a ‘multinational top-up tax’ in line with Pillar Two of the OECDs Two-Pillar Solution. We have produced a calculator to illustrate the key aspects to the calculation of the multinational top-up tax.

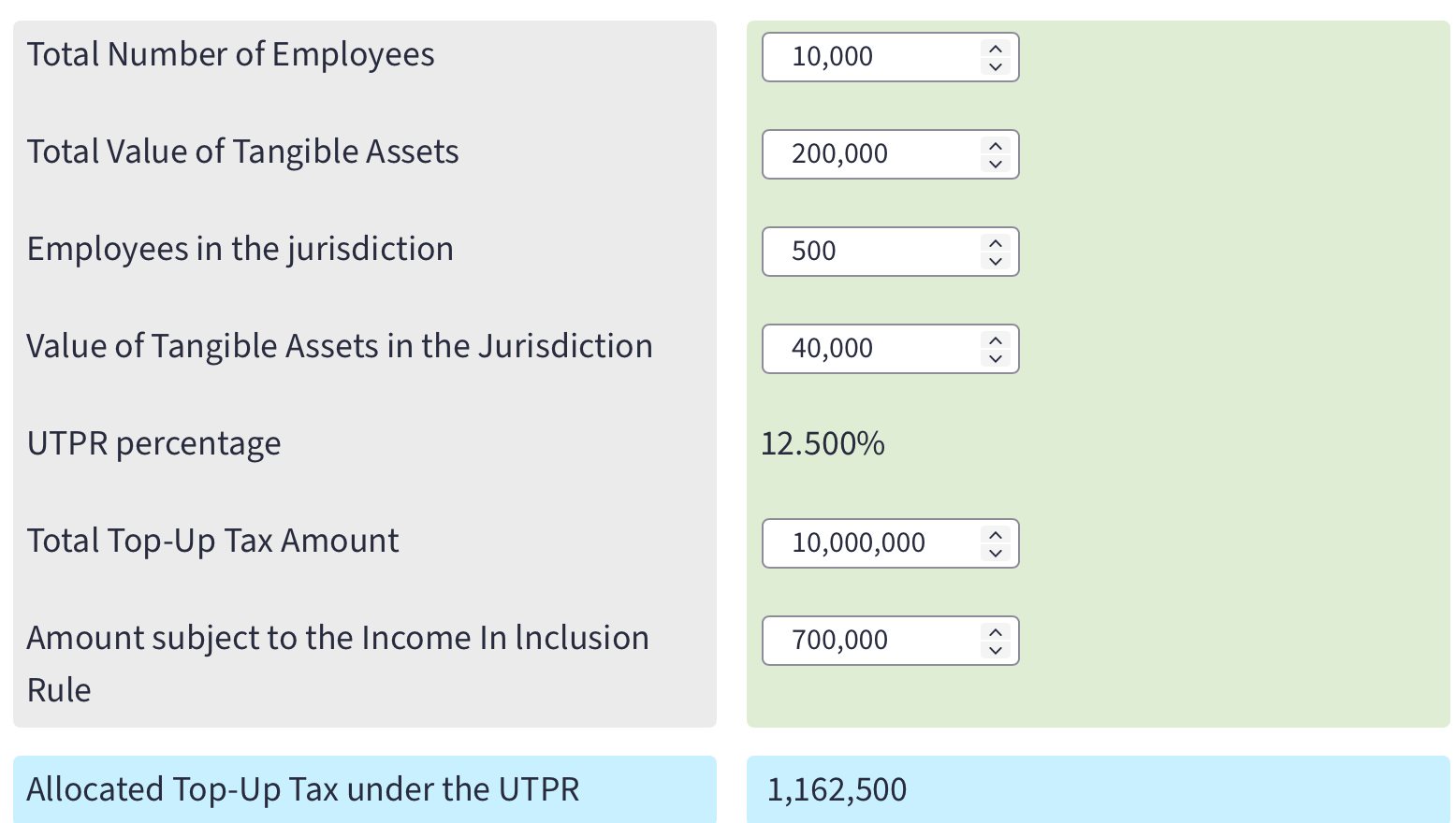

This Pillar Two under-taxed payments rule (UTPR) calculator gives an indication of the broad operation of how the top-up tax is allocated to UTPR jurisdictions.

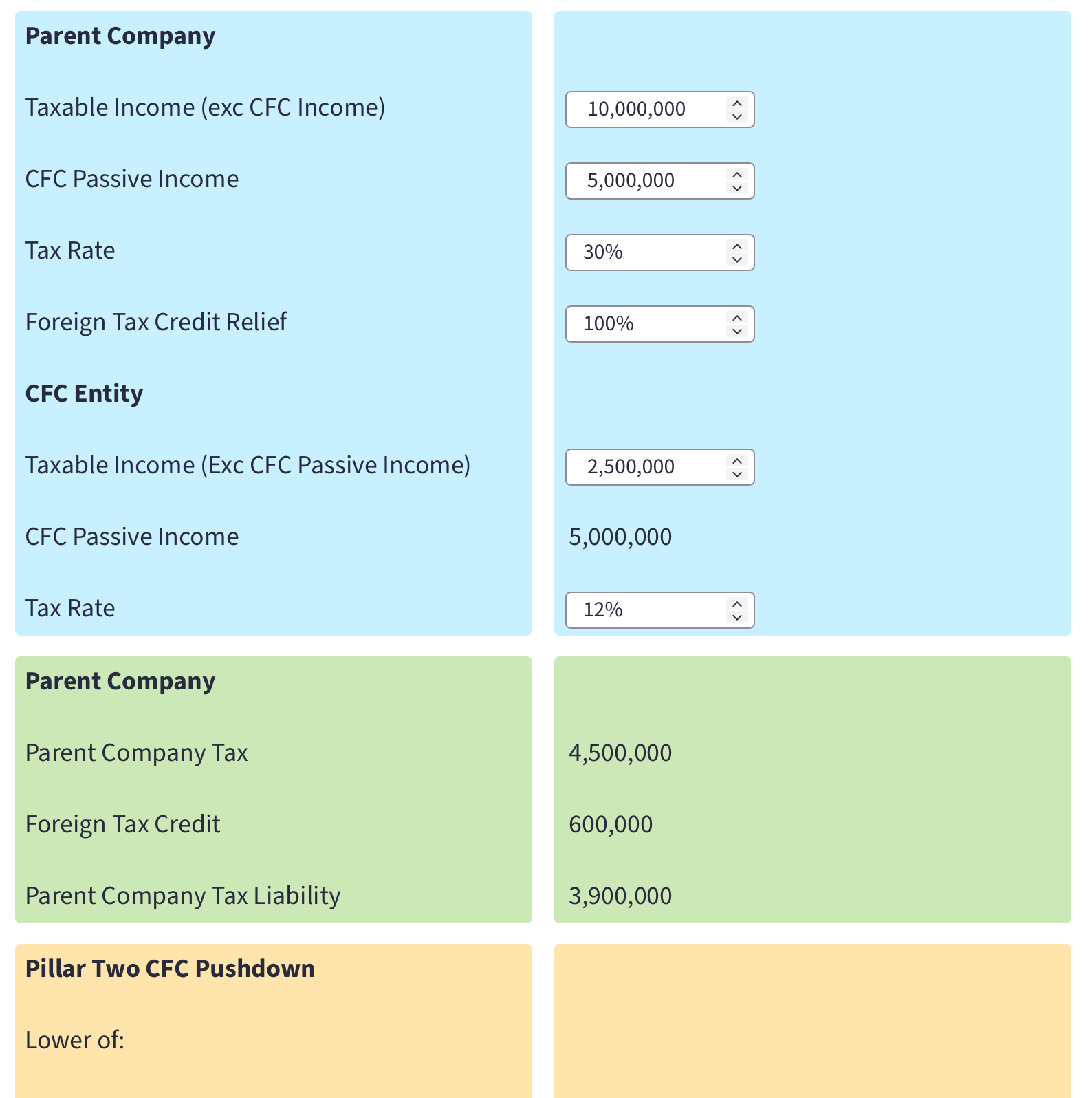

When allocating taxes to group entities for the purpose of the Pillar Two rules, tax paid by a parent entity under a controlled foreign company (CFC) regime is usually allocated to the CFC entity. However, under Pillar Two, this is subject to a limitation. Use our interactive tool to see the impact of the CFC pushdown limitation.

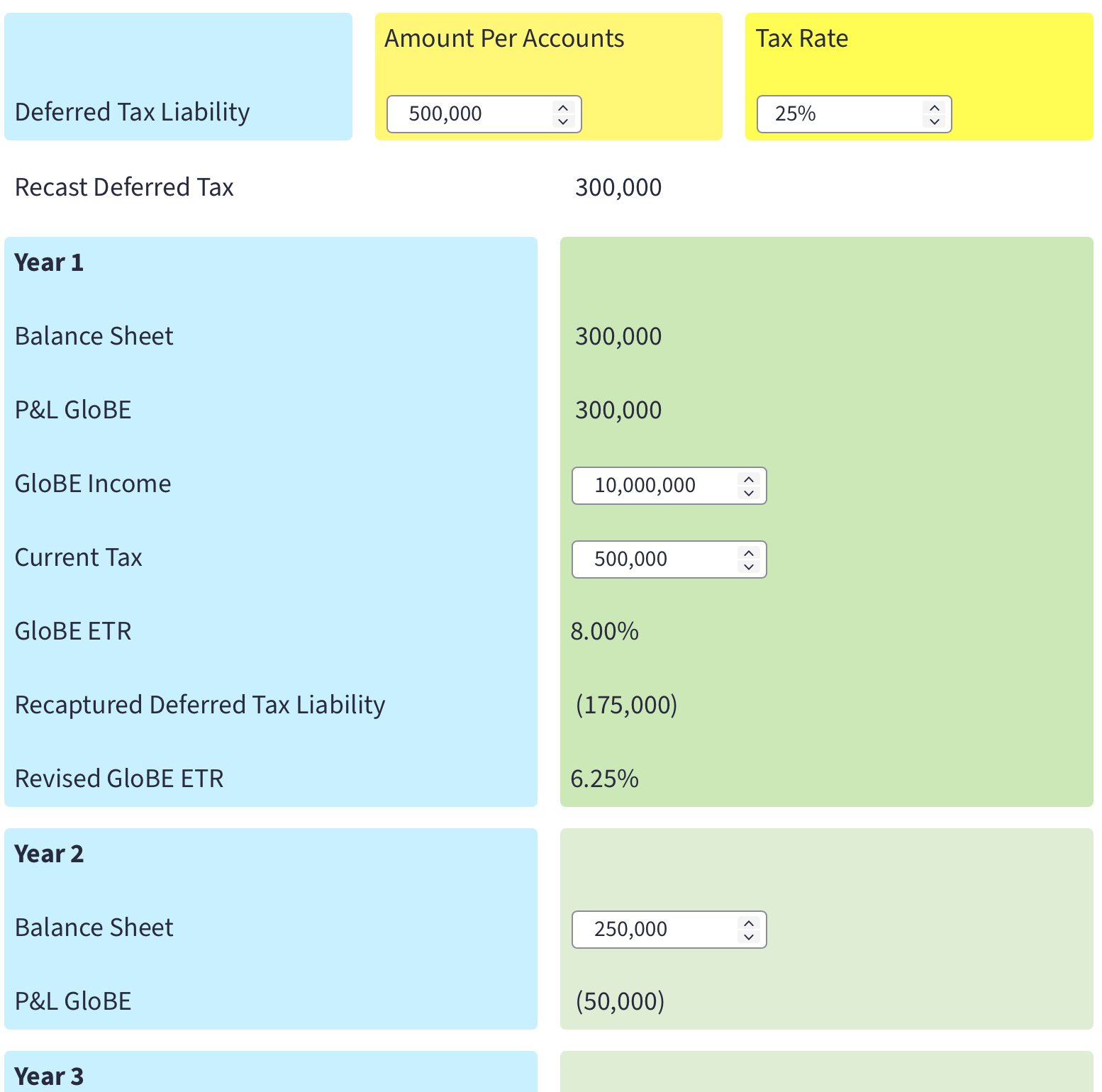

Our deferred tax recapture tool simulates the impact of the Pillar Two rule that recaptures deferred tax liabilities that are not paid within five years.

Deferred Tax has a significant impact on the Pillar Two effective tax rate (ETR) and therefore on any top-up tax that may be levied. Use our Pillar Two Deferred Tax Liability Calculator to model the impact on the Pillar Two top-up tax.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |