A Review of the UAE Consultation on the Introduction of the GloBE Rules

On March 15, 2024, the UAE launched a public consultation on the implementation of the GloBE rules in the UAE. The consultation is open until April 10, 2024.

On March 15, 2024, the UAE launched a public consultation on the implementation of the GloBE rules in the UAE. The consultation is open until April 10, 2024.

In this article we look at the impact of Pillar Two on tax stabilization agreements, and the benefits of renegotiating agreements.

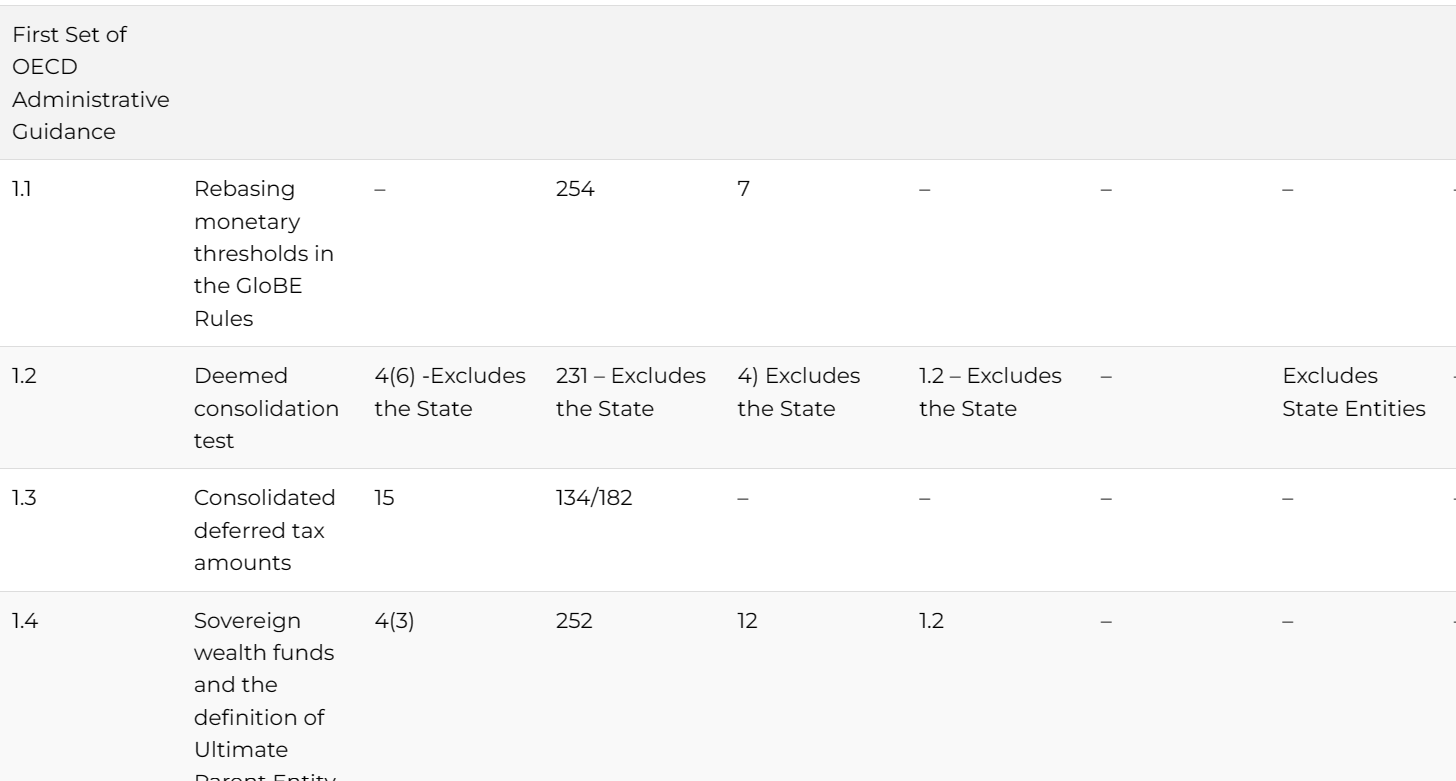

We have tracked the draft and enacted domestic laws issued to date to the OECD Model Rules. This will be constantly updated as new or amended legislation is issued.

Tax incentives for R&D are a common way for a jurisdiction to attract foreign direct investment (FDI).

In this article we look at the financial accounting, domestic tax and Pillar Two treatment of some of the key incentives offered including a deduction, capitalized treatment, a super deduction, tax credits and patent boxes or other similar arrangements.

The Transitional CbCR Safe Harbour is included in the OECD Safe Harbour and Penalty Relief Guidance and where it applies it deems the jurisdictional top-up tax to be zero. Read our detailed analysis.

Differences in Accounting Standards have a significant impact on the Pillar Two effective tax rate (ETR) and top-up tax calculation. Read this detailed report.

The requirements for a participation exemption under domestic law may not match the exemption requirements in the Pillar Two Rules. Read our analysis.

The QDMTT Safe Harbour excludes the application of the GloBE Rules in other jurisdictions by deeming the Top-up Tax payable under the GloBE Rules to be nil where top-up tax is levied under a QDMTT. In this article, we look at how it applies.

On July 17, 2023, the OECD issued the standardised GloBE Information Return (GIR) that must be submitted by MNE groups within the scope of the GloBE rules.

The Second Set of OECD Administrative Guidance includes a number of additions to the design features of a QDMTT. Read more in this article.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |