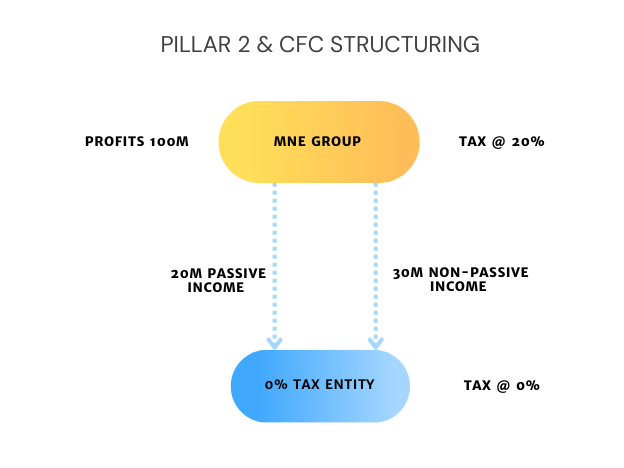

Blended CFC Regimes and Avoiding Unrelievable CFC Taxes

Top-up taxes under a QDMTT are added to covered taxes of a CFC but only for the purposes of calculating the allocation of Blended CFC Taxes. The way the rules operate is aimed at minimising unrelievable CFC taxes under Blended CFC Regimes. Read more.