Cross-Border Deals After Pillar Two

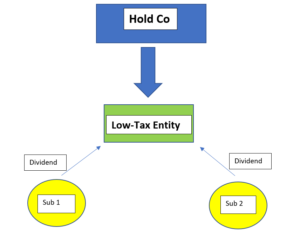

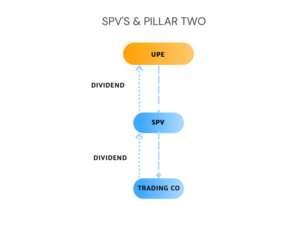

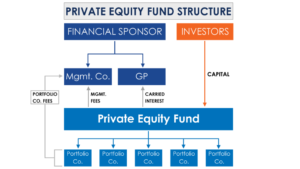

In this article we look at some of the most significant issues to consider including the determination of when and how deals can bring groups within the scope of Pillar Two, specific considerations for private equity funds, differences in GloBE and domestic tax treatment and potential restrictions on post-acquisition transfers.