Iceland Issues a Draft Bill for IIR and Domestic Top-Up Tax From January 1, 2026

On June 5, 2025, Iceland issued a Draft Minimum Tax Bill for consultation. The Draft Bill includes an Income Inclusion Rule (IIR) and a domestic minimum tax from January 1, 2026.

GloBE Country Guide: Iceland

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Iceland for accounting periods beginning after 31 December, 2025. Updated for the Draft Minimum Tax Bill opened for consultation June 5, 2025.

Hong Kong Enacts Law for IIR and Domestic Top-Up Tax From January 1, 2025

On June 6, 2025, the Inland Revenue (Amendment) (Minimum Tax for Multinational Enterprise Groups) Ordinance 2025 was published in the Official Gazette. The Bill includes an Income Inclusion Rule (IIR) and a domestic minimum tax from January 1, 2025.

Denmark Passes Law to Implement June 2024 and January 2025 OECD Administrative Guidance

On June 3, 2025, the Danish Parliament passed Bill 2024/1 LSV 194 A to amend the Danish Minimum Tax Act for the June 2024 and January 2025 OECD Administrative Guidance.

The Pillar Two GloBE Rules & Insurance Companies

The GloBE rules include a number of insurance specific adjustments. In this article we look at the nature of these provisions as well as the impact of the GloBE rules on insurance companies generally. Updated for OECD Administrative Guidance.

Investment Property & The GloBE Rules

Whilst the treatment of investment property for financial accounting purposes is important when determining the GloBE treatment, of even more importance are any differences between the financial accounting treatment and the domestic tax treatment.

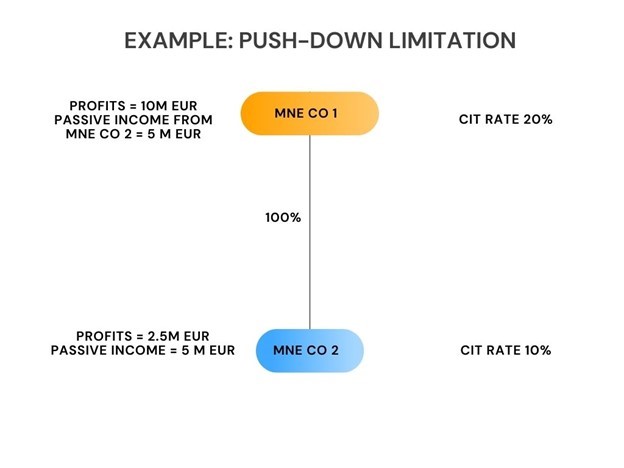

Blended CFC Regimes and Avoiding Unrelievable CFC Taxes

Top-up taxes under a QDMTT are added to covered taxes of a CFC but only for the purposes of calculating the allocation of Blended CFC Taxes. The way the rules operate is aimed at minimising unrelievable CFC taxes under Blended CFC Regimes. Read more.

The 4 Different Jurisdictional Effective Tax Rates Under the GloBE Rules

The clarifications and additions to the Commentary to the Pillar Two GloBE Rules provided by the OECDs Administrative and Safe Harbours Guidance, means that there are now up to four jurisdictional effective tax rates (ETRs) that may need to be calculated to determine the impact of the GloBE Rules.

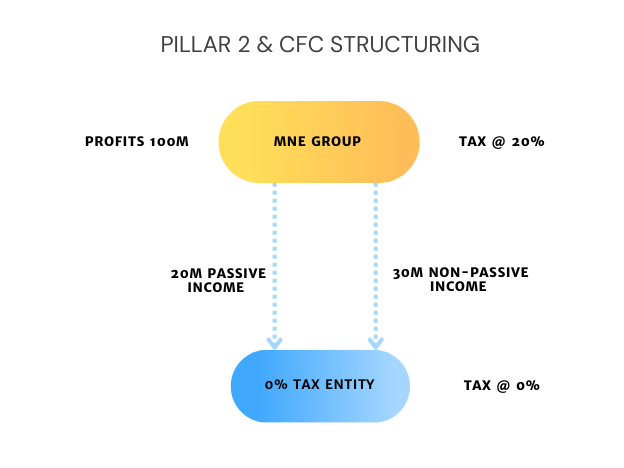

Differences Between Domestic CFC Regimes and the GloBE Rules That Allow Cross-Jurisdictional Blending

The definition of CFC taxes that are restricted in the GloBE rules is much narrower than under many domestic CFC regimes. In this article we look at this issue.

Group Financing Companies and Pillar Two

MNE groups should pay careful attention to any group financing companies in light of the Pillar Two Rules. In this analysis we look at the impact of Pillar Two for both general GloBE and QDMTT purposes.