Spain Gazettes a Law to Amend the Basque Economic Agreement for Global Minimum Tax Provisions

Law 3/2025, of 29 April, was published in the Spanish Official State Gazette on April 30, 2025. This amends the Economic Agreement with the Basque Country and includes a new Article 20bis for the application of the Pillar 2 Global Minimum Tax.

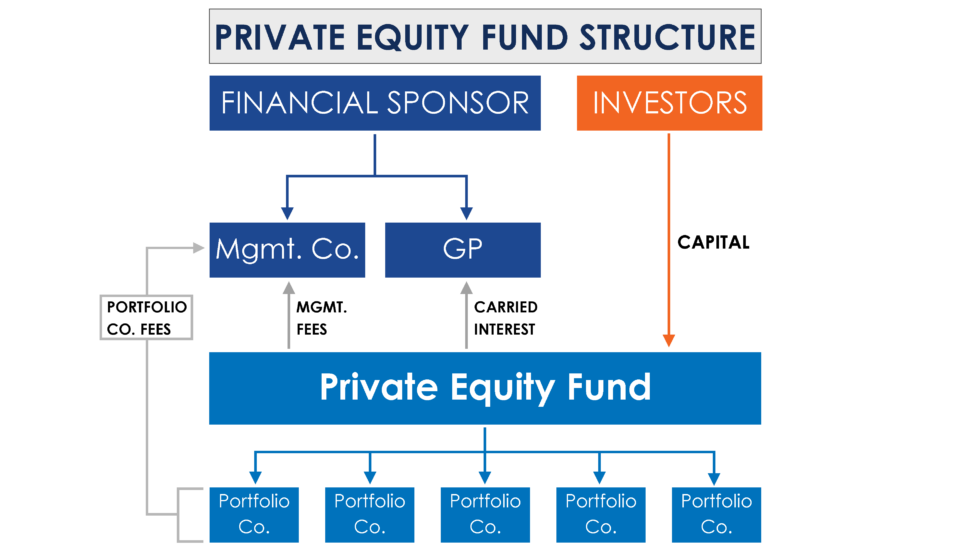

Cross-Border Deals After Pillar Two

In this article we look at some of the most significant issues to consider including the determination of when and how deals can bring groups within the scope of Pillar Two, specific considerations for private equity funds, differences in GloBE and domestic tax treatment and potential restrictions on post-acquisition transfers.

Corporate Investments and Pillar Two

The Pillar Two GloBE treatment of corporate investments will depend to a large extent on the nature of the activities, the accounting treatment and the ownership interest.

Japan Issues Regulations for its QDMTT from April 1, 2026

On March 31, 2025, Japan enacted Cabinet Order No. 121 of 2025 and Ministry of Finance Ordinance No. 19 of 2025 to provide further details on the application of Japan’s QDMTT from April 1, 2026.

Hong Kong Updates Global Minimum Tax Bill for OECD Administrative Guidance and Other Updates

In April 2025, the Hong Kong Government proposed a number of Committee Stage Amendments to the Inland Revenue (Amendment) (Minimum Tax for Multinational Enterprise Groups) Bill 2024. This includes amendments for the January 2025 and June 2024 OECD Administrative Guidance.

South Korea’s updated Enforcement Regulation and Enforcement Decree provides for OECD Administrative Guidance Updates

South Korea’s amendment to the Enforcement Decree No. 35348 of February 28, 2025 and the Decree of the Ministry of Economy and Finance No. 1114 of March 21, 2025 provide for further aspects of the June 2024 OECD Administrative Guidance as well as additional top-up tax forms.

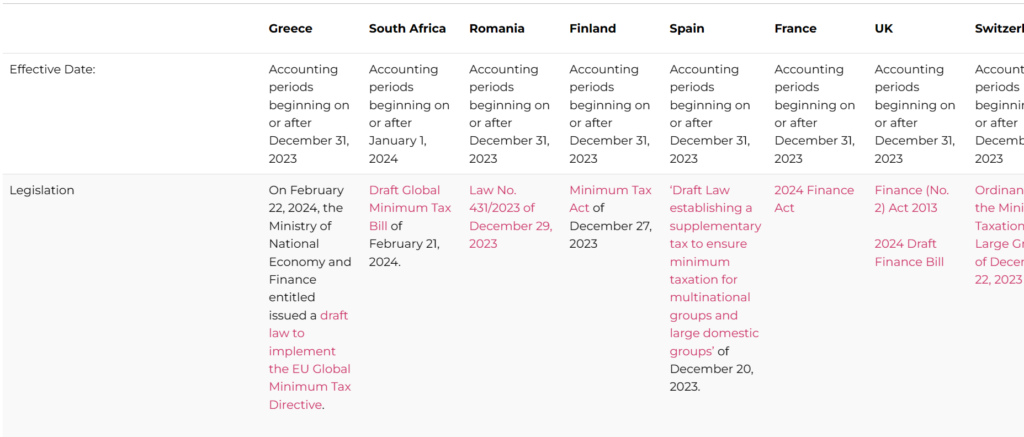

OECD Administrative Guidance Matrix: Updated to April 23, 2025

Updates to our ‘OECD Administrative Guidance: Domestic Implementation Matrix’ to reflect the latest April 2025 Pillar 2 updates for the UAE and Poland.

Poland to Issue a Draft Bill to Implement Aspects of the OECD Administrative Guidance

On April 7, 2025, the Polish Ministry of Finance released details for a draft bill to amend the Minimum Tax Act. The amendments are primarily to implement the June 2024 and January 2025 OECD Administrative Guidance.

UAE Issues Ministerial Decision to Implement the OECD Administrative Guidance

On April 16, 2025, the Ministry of Finance issued Ministerial Decision No. (88) of 2025 to provide for the application of the OECD Administrative Guidance from January 1, 2025.

Domestic Approaches to Including the Initial Phase of International Activity Exemption for QDMTT Purposes

The UTPR exclusion for MNEs in their initial phase of international activity does not need to be included in a QDMTT, however, it can be included. In this article we look at the different jurisdictional approaches.