Japan’s Accounting Standards Board Publishes Deferred Tax Guidance For Global Minimum Tax

Today, the Accounting Standards Board of Japan (ASBJ) issued the Practical Response Report on the ‘Treatment of Deferred Tax in Relation to the Revision of the Corporation Tax Act Corresponding to Global Minimum Taxation’.

The Practical Response Report is applicable from today and until it is repealed by the ASBJ.

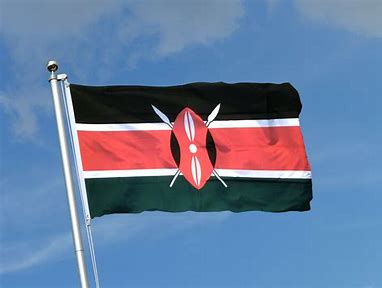

Kenya to Implement OECD Two Pillar Solution

It’s been reported that Kenya is to sign up to the Two Pillar Solution. It was not a signatory to the original October 2021 Statement as it was not prepared to remove its digital service tax as required for Pillar One.

Japan’s Global Minimum Tax Law is Gazetted Today

The “Act for the Partial Revision of the Income Tax Act” was promulgated in Special Issue No. 25 of the Official Gazette on Friday, March 31, as Act No. 3/2023.

Liechtenstein Publishes Draft Global Minimum Tax Law

On March 29, 2023, Liechtenstein published draft legislation for the implementation of the Pillar Two Globe Rules.

Canada’s 2023 Budget Confirms Global Minimum Tax Implementation

In yesterday’s 2023 Canadian Budget, the government confirmed that it will introduce legislation implementing the Income Inclusion Rule (IIR) and a domestic minimum top-up tax (QDMTT) applicable to Canadian entities of MNEs with effect for fiscal years of MNEs that begin on or after December 31, 2023.

Japan’s Global Minimum Tax Law Is Enacted

On March 28, 2023, Japan enacted the second domestic law to give effect to the Pillar Two GloBE rules from April 1, 2024.

Differing Commencement Dates For Pillar Two Internationally

The wording for Pillar 2 implementation can vary from ‘ On or after December 31, 2023’, ‘From December 31, 2023’ or ‘After December 30, 2023’ to ‘From January 1, 2024’ or ‘From April 1, 2024’. We look at why.

GloBE Country Guide: The United Kingdom

Analysis of the implementation of the Pillar Two Global Minimum Tax rules in the UK on or after 31 December 2023. Updated for the 2024 Finance Act.

Review of the UK Global Minimum Tax in Yesterday’s 2023 Spring Finance Bill

The Spring Finance Bill 2023 (Finance (No. 2) Bill) was published yesterday (March 23, 2023). The Bill includes provisions to implement key aspects of the Pillar Two Global Minimum Tax for accounting periods beginning on or after 31 December 2023.

GloBE Country Guides: Summary

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules.